Why Coinbase Global (COIN) Is Down 11.1% After Unveiling Its “Everything Exchange” Strategy And Texas Move

- Coinbase Global has completed its reincorporation from Delaware to Texas and unveiled a sweeping expansion into stock trading, prediction markets, tokenization, white-label stablecoins, and an AI-powered investment advisor, while keeping its core business model and management unchanged.

- This push to become an “everything exchange” links traditional equities, event contracts, and on-chain assets in one app, allowing users to move seamlessly between crypto balances, USDC, and new financial products without leaving the Coinbase ecosystem.

- We’ll now examine how Coinbase’s move into stock trading and prediction markets may reshape the company’s broader investment narrative.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Coinbase Global Investment Narrative Recap

To own Coinbase today, you need to believe it can evolve from a mainly crypto trading platform into a broader, resilient fintech infrastructure player, less dependent on spot volumes. The Texas reincorporation itself looks immaterial to that story near term, while the key catalyst remains whether new products like stock trading and prediction markets can offset pressure from softer trading activity and rising compliance and cybersecurity costs, which still loom as the biggest immediate risk.

Among the recent announcements, the launch of stock trading and prediction markets inside the existing Coinbase app is most relevant here, because it directly targets the revenue diversification challenge. By letting users shift between crypto, USDC and equities or event contracts in one place, Coinbase is testing whether it can deepen engagement and broaden fee pools without relying so heavily on cyclical crypto spot volumes.

Yet against that promise, investors should be aware of how ongoing cybersecurity and data breach risks could still...

Read the full narrative on Coinbase Global (it's free!)

Coinbase Global’s narrative projects $8.5 billion revenue and $2.1 billion earnings by 2028. This requires 8.3% yearly revenue growth and an earnings decrease of $0.8 billion from $2.9 billion today.

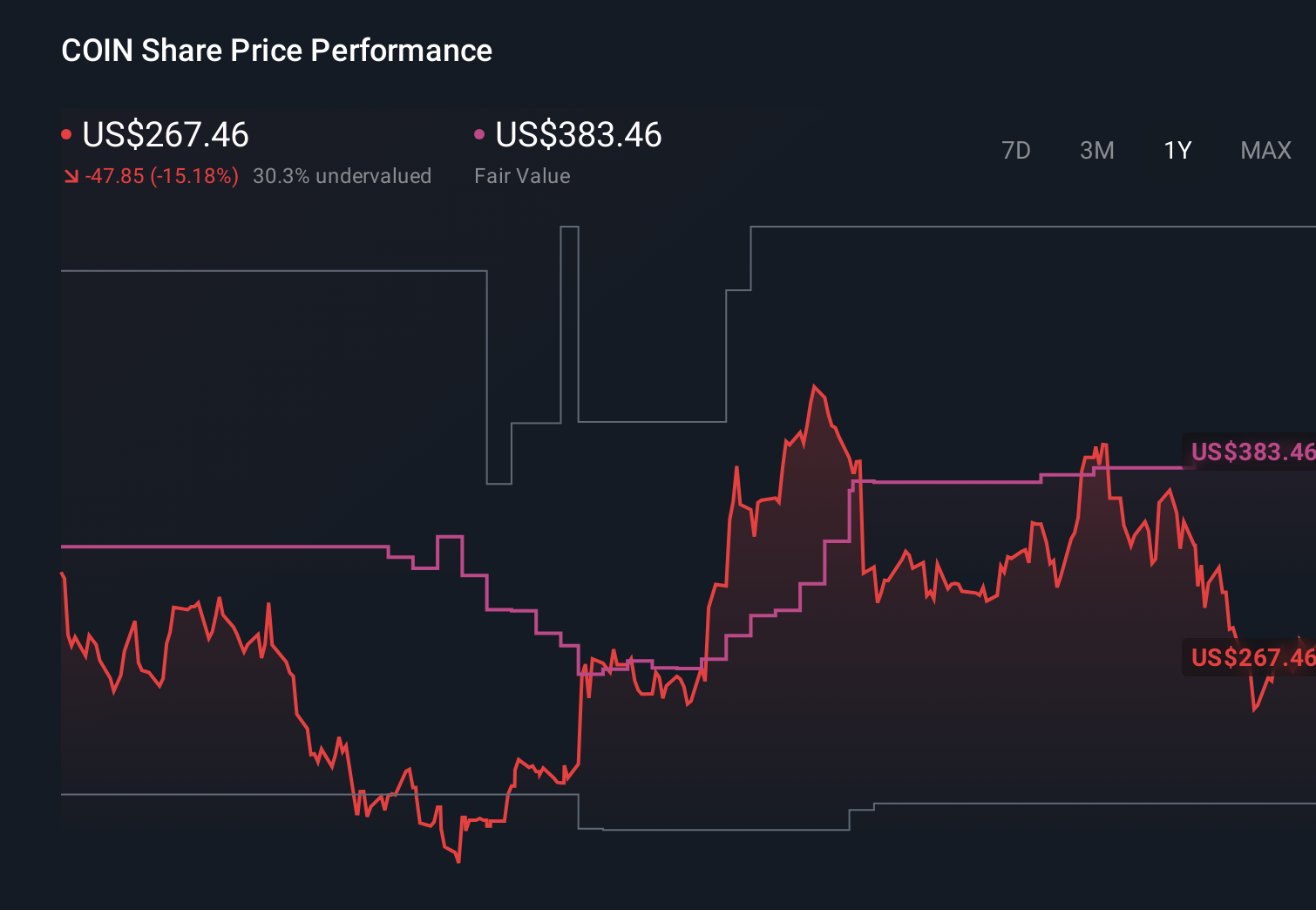

Uncover how Coinbase Global's forecasts yield a $383.46 fair value, a 60% upside to its current price.

Exploring Other Perspectives

Twenty nine Simply Wall St Community fair value estimates for Coinbase span roughly US$128 to US$510, reflecting very different expectations about its future. As you weigh those views, consider how much confidence you have that Coinbase’s push into stock trading and prediction markets can genuinely reduce its reliance on volatile spot trading volumes over time.

Explore 29 other fair value estimates on Coinbase Global - why the stock might be worth over 2x more than the current price!

Build Your Own Coinbase Global Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coinbase Global research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Coinbase Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coinbase Global's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報