Neogen Corporation (NASDAQ:NEOG) Shares Fly 34% But Investors Aren't Buying For Growth

The Neogen Corporation (NASDAQ:NEOG) share price has done very well over the last month, posting an excellent gain of 34%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 38% in the last twelve months.

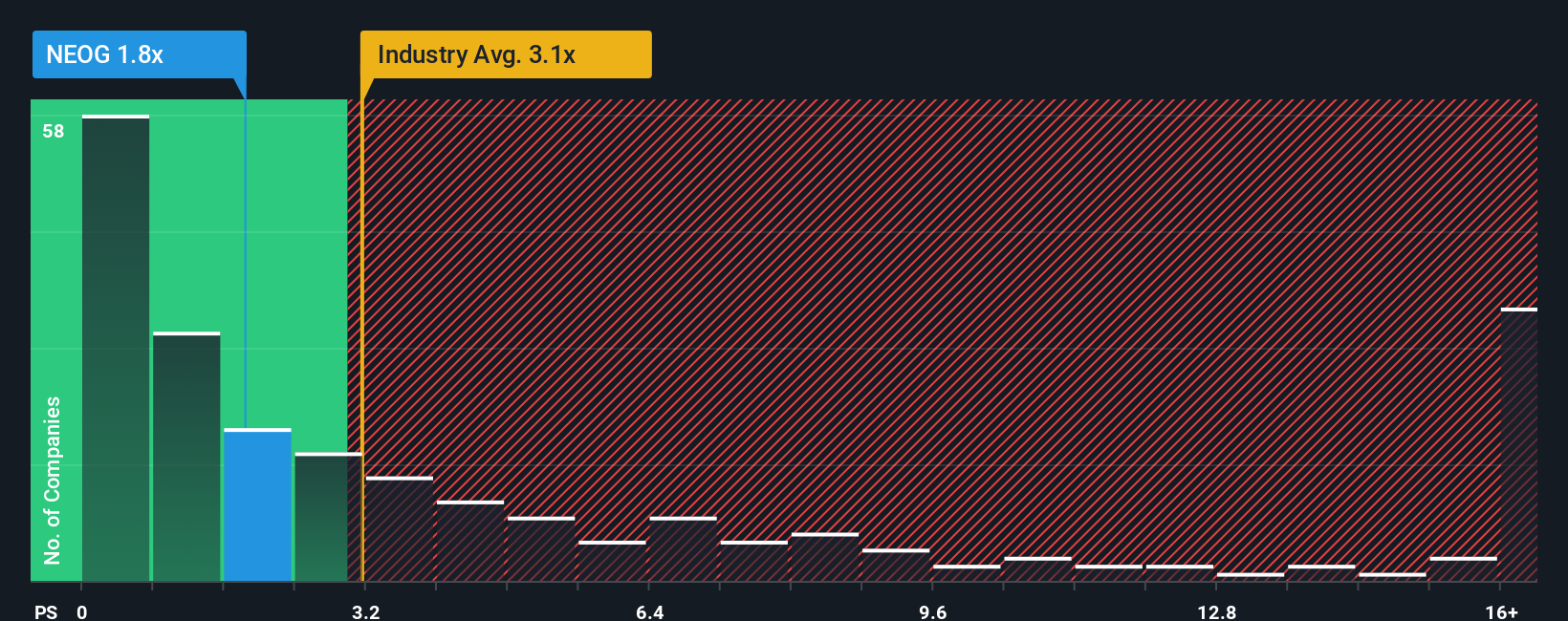

Although its price has surged higher, Neogen may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.8x, considering almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3.1x and even P/S higher than 9x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Neogen

How Neogen Has Been Performing

While the industry has experienced revenue growth lately, Neogen's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Neogen.How Is Neogen's Revenue Growth Trending?

In order to justify its P/S ratio, Neogen would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 2.8% decrease to the company's top line. Still, the latest three year period has seen an excellent 67% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 0.5% per year during the coming three years according to the four analysts following the company. That's not great when the rest of the industry is expected to grow by 121% each year.

With this in consideration, we find it intriguing that Neogen's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Neogen's P/S

The latest share price surge wasn't enough to lift Neogen's P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Neogen's P/S is on the lower end of the spectrum. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Neogen you should know about.

If you're unsure about the strength of Neogen's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報