LandBridge (LB) valuation after new Samsung C&T battery storage partnership on Texas land

LandBridge (LB) just took a clear step into energy storage, signing agreements that give Samsung C&T Renewables exclusive rights to develop two large scale battery projects on its Texas acreage.

See our latest analysis for LandBridge.

The stock reaction has been cautious so far, with a 1 month share price return of minus 18.63 percent leaving LandBridge at 52.6 dollars. This comes even though its 1 year total shareholder return of minus 9.18 percent and slightly positive 3 month share price return suggest early momentum that the new storage deals could either reignite or test if investors stay skeptical.

If this kind of strategic pivot has your attention, it is a good moment to see what else is reshaping the energy and infrastructure space through fast growing stocks with high insider ownership.

With earnings growing fast and the shares still trading at a steep discount to analyst targets, is LandBridge quietly undervalued ahead of its first storage projects, or is the market already pricing in that future growth?

Most Popular Narrative Narrative: 29.4% Undervalued

Compared with LandBridge's last close at 52.60 dollars, the most widely followed narrative points to a materially higher fair value anchored in aggressive growth and margins.

Analysts are assuming LandBridge's revenue will grow by 27.2% annually over the next 3 years. Analysts assume that profit margins will increase from 41.8% today to 57.2% in 3 years time.

Curious how this land heavy, fee based model is being valued like a high growth platform, with richer margins and a punchy future earnings multiple? The full narrative unpacks the bold revenue ramp, the margin lift and the valuation math that ties it all together, but keeps one crucial assumption hidden in plain sight.

Result: Fair Value of $74.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delayed renewable projects and LandBridge’s heavy Permian exposure could derail the upbeat earnings path if timing, regulatory or commodity shocks hit simultaneously.

Find out about the key risks to this LandBridge narrative.

Another Way to Look at Value

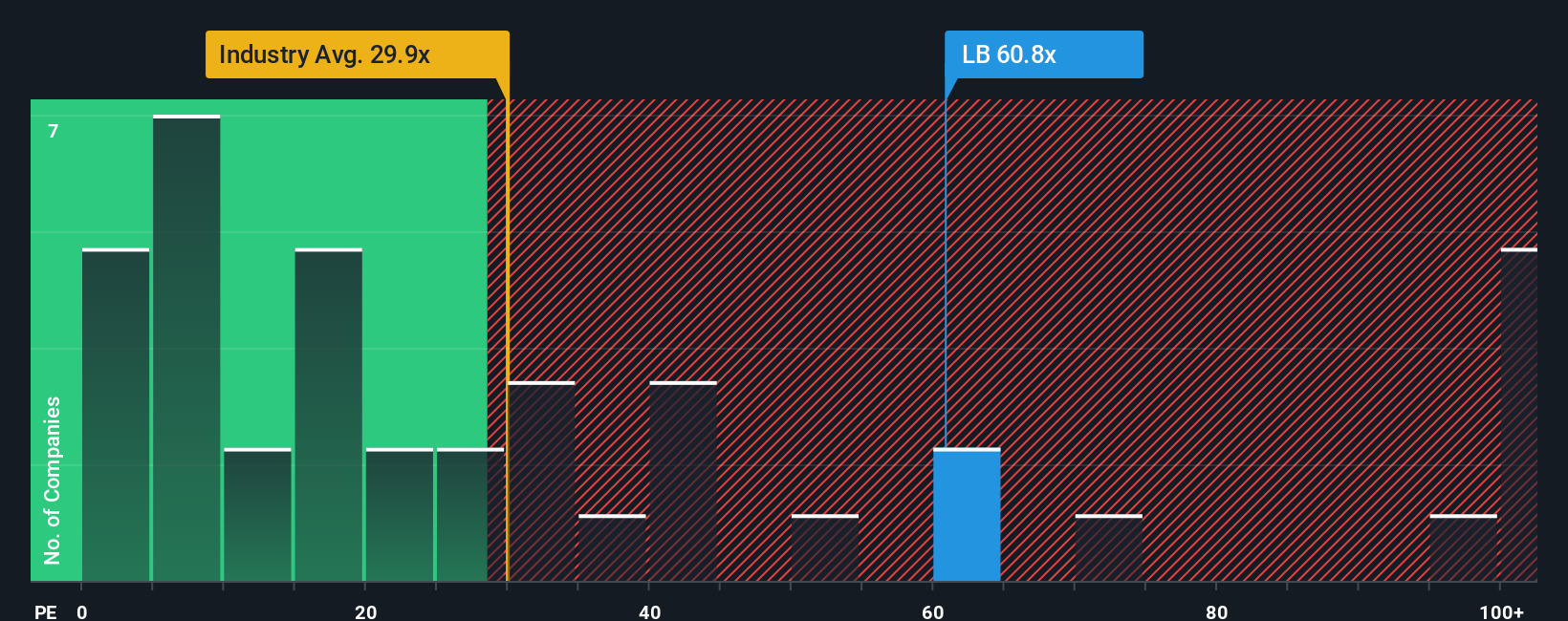

That upbeat narrative clashes with how the market is pricing LandBridge today. At 56.2 times earnings, it trades well above the US real estate sector at 30.9 times, its peers at 40.2 times, and even its own 52.3 times fair ratio. This leaves little room for execution slip ups.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LandBridge Narrative

If this view does not quite fit your own, or you would rather dig into the numbers yourself, you can build a fresh narrative in minutes: Do it your way.

A great starting point for your LandBridge research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop at LandBridge, you risk missing other powerful setups that match your style. Use the Simply Wall St Screener to surface targeted opportunities fast.

- Capitalize on mispriced opportunities by targeting companies trading below intrinsic value through these 916 undervalued stocks based on cash flows tailored to fundamentals, cash flows, and long term potential.

- Ride structural trends in healthcare by focusing on innovators transforming medicine with these 29 healthcare AI stocks that blend data, diagnostics, and scalable digital platforms.

- Position ahead of the next digital payment wave by zeroing in on businesses exposed to blockchain and tokenization via these 80 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報