The Estée Lauder Companies Inc. (NYSE:EL) Stock Rockets 26% As Investors Are Less Pessimistic Than Expected

The Estée Lauder Companies Inc. (NYSE:EL) shareholders have had their patience rewarded with a 26% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 45%.

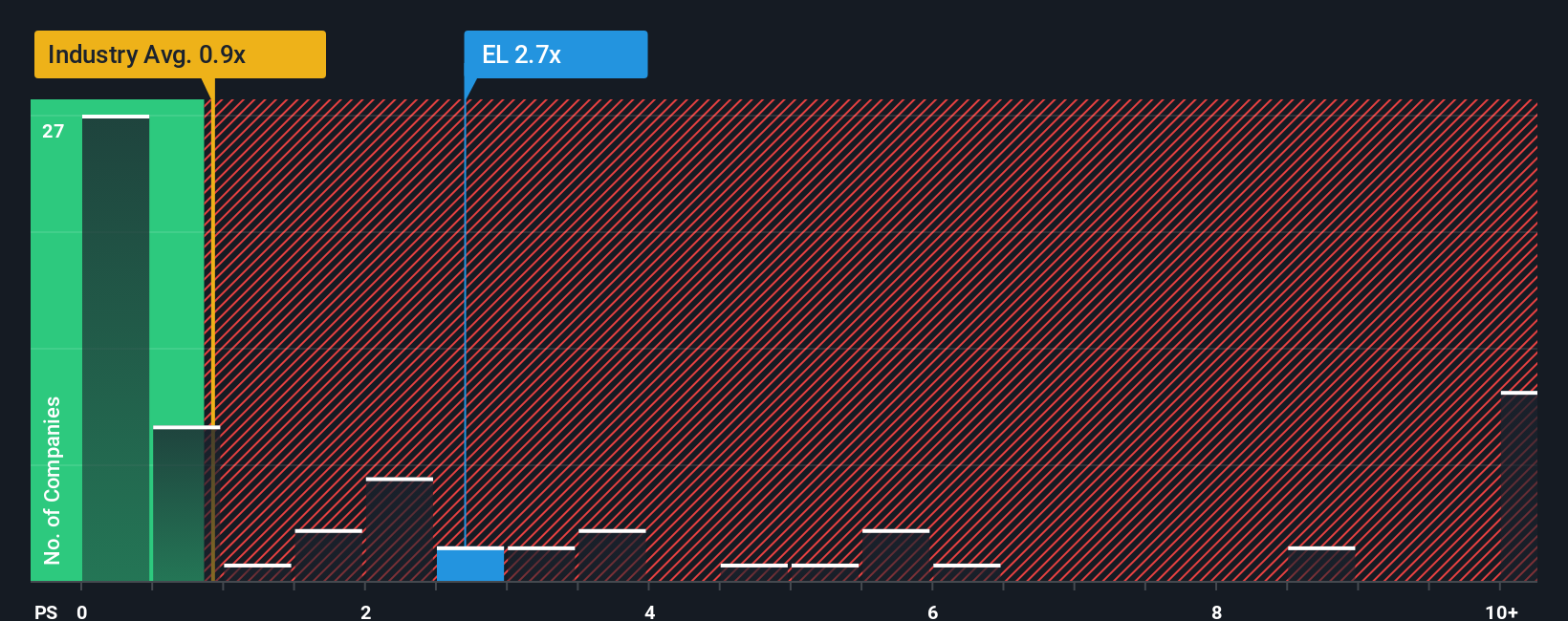

Following the firm bounce in price, you could be forgiven for thinking Estée Lauder Companies is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.7x, considering almost half the companies in the United States' Personal Products industry have P/S ratios below 0.9x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Estée Lauder Companies

How Has Estée Lauder Companies Performed Recently?

Recent times haven't been great for Estée Lauder Companies as its revenue has been falling quicker than most other companies. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Estée Lauder Companies will help you uncover what's on the horizon.How Is Estée Lauder Companies' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Estée Lauder Companies' is when the company's growth is on track to outshine the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.5%. The last three years don't look nice either as the company has shrunk revenue by 16% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 4.2% each year during the coming three years according to the analysts following the company. That's shaping up to be similar to the 4.9% per annum growth forecast for the broader industry.

With this in consideration, we find it intriguing that Estée Lauder Companies' P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Key Takeaway

Estée Lauder Companies' P/S is on the rise since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Estée Lauder Companies currently trades on a higher than expected P/S. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Estée Lauder Companies that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報