Does ACA Subsidy Uncertainty Reshape Centene’s Government Programs Story And Prevention Focus (CNC)?

- Earlier this week, reports that the House Speaker would not allow a vote on renewing Affordable Care Act premium subsidies raised fresh concerns about Centene’s ACA marketplace exposure and the broader pressure of rising medical costs on health insurers’ profitability.

- At the same time, Centene’s Ambetter Health and Sunshine Health units have been rolling out community-focused partnerships with professional and elite athletes, highlighting the company’s emphasis on preventive care, Medicaid outreach, and member engagement even as policy uncertainty builds.

- We’ll now explore how the prospect of expiring ACA premium subsidies could reshape Centene’s investment narrative built around government program growth.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Centene Investment Narrative Recap

To own Centene, you need to believe that its focus on government-backed health programs can translate policy-driven enrollment into sustainable profits, despite recent net losses and sector-wide cost pressures. The report that ACA premium subsidies may not be renewed directly challenges a key short term catalyst, the Marketplace growth story, while reinforcing that Centene’s biggest near term risk is policy and reimbursement uncertainty around subsidized coverage.

Against that backdrop, Ambetter Health’s new “Stay Healthy, Stay in the Game” campaign with the Tampa Bay Buccaneers underlines how Centene is leaning into preventive care and engagement in its ACA Marketplace book, right where subsidy risk is highest. These kinds of initiatives may matter for keeping members active and managing costs if benefits or affordability come under pressure.

Yet despite Centene’s efforts to grow Medicaid and Marketplace membership, investors still need to be aware that expiring ACA premium subsidies could...

Read the full narrative on Centene (it's free!)

Centene's narrative projects $195.6 billion revenue and $2.1 billion earnings by 2028. This requires 7.0% yearly revenue growth and flat earnings from $2.1 billion today.

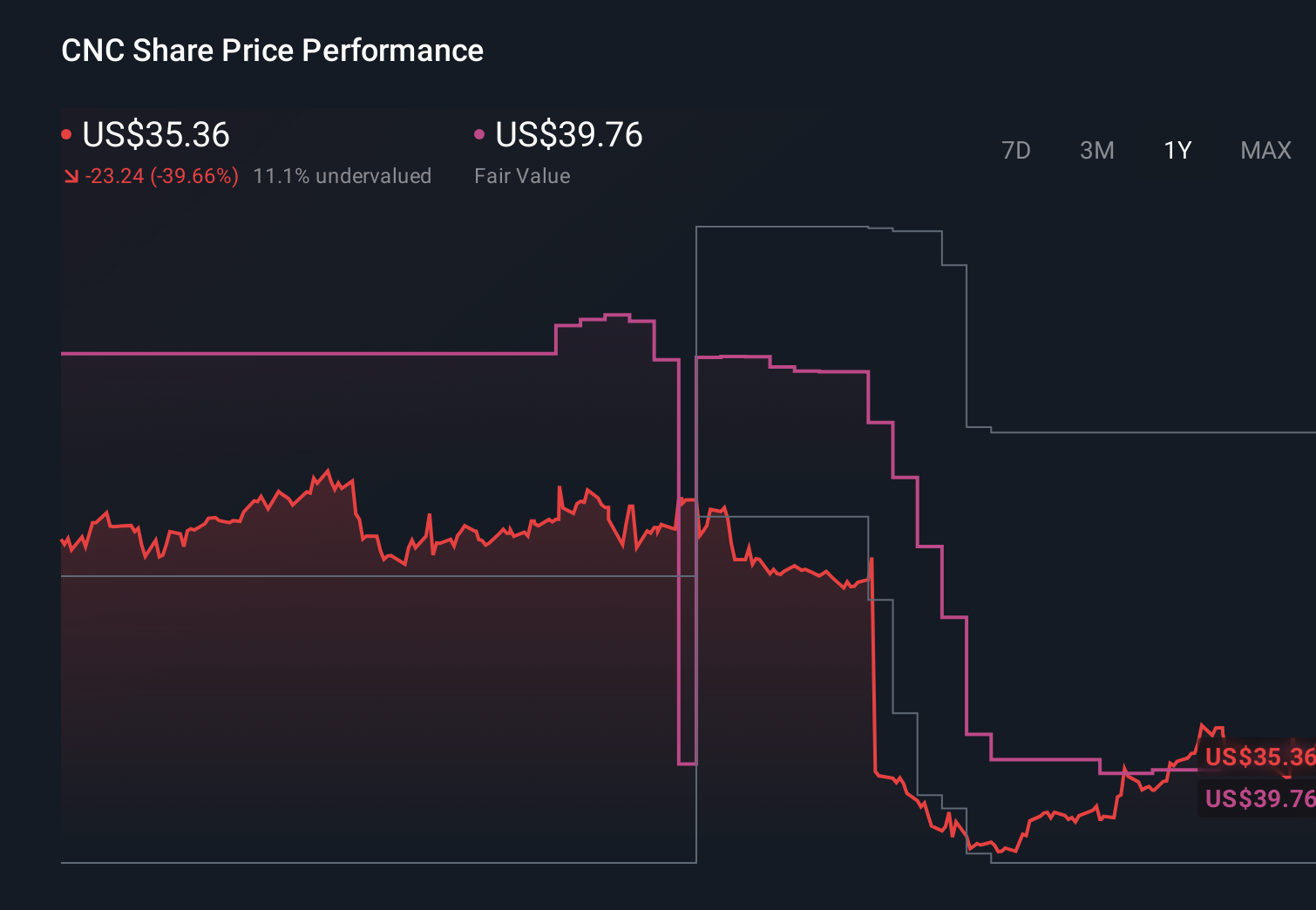

Uncover how Centene's forecasts yield a $39.94 fair value, in line with its current price.

Exploring Other Perspectives

Sixteen members of the Simply Wall St Community place Centene’s fair value anywhere between US$31.58 and US$187.27, showing a wide spread in expectations. Against that backdrop, the risk that enhanced ACA premium tax credits may lapse is a critical policy swing factor that could reshape views on future earnings and Marketplace stability, so it is worth weighing several perspectives before deciding how you see the stock.

Explore 16 other fair value estimates on Centene - why the stock might be worth 19% less than the current price!

Build Your Own Centene Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Centene research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Centene research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Centene's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報