StandardAero’s Buyback Plan Prompts Fresh Look at Valuation and Growth Prospects

StandardAero, Inc. is turning heads after its board approved a major buyback plan, followed by a share repurchase program of up to $450 million. That kind of capital commitment is often interpreted as a sign of management confidence.

See our latest analysis for StandardAero.

The buyback news lands just as StandardAero’s momentum is starting to build, with a 1 month share price return of 14.05 percent and a 1 year total shareholder return of 11.68 percent, around the recent Bernstein investor conference backdrop.

If this kind of capital allocation story has your attention, it could be a good moment to scan the wider aerospace space and see what else stands out via aerospace and defense stocks.

With earnings growing briskly, a fresh buyback in place, and the stock still trading at a double-digit discount to analyst targets, is StandardAero quietly undervalued or already reflecting all of its runway for future growth?

Price-to-Earnings of 50.6x: Is it justified?

StandardAero trades at a steep 50.6 times earnings, signaling a rich valuation relative to both its own growth profile and sector benchmarks.

The price to earnings ratio compares what investors are willing to pay today for each dollar of current earnings, a key lens in aerospace and defense where cash generation and profitability often drive long term returns more than headline revenue growth.

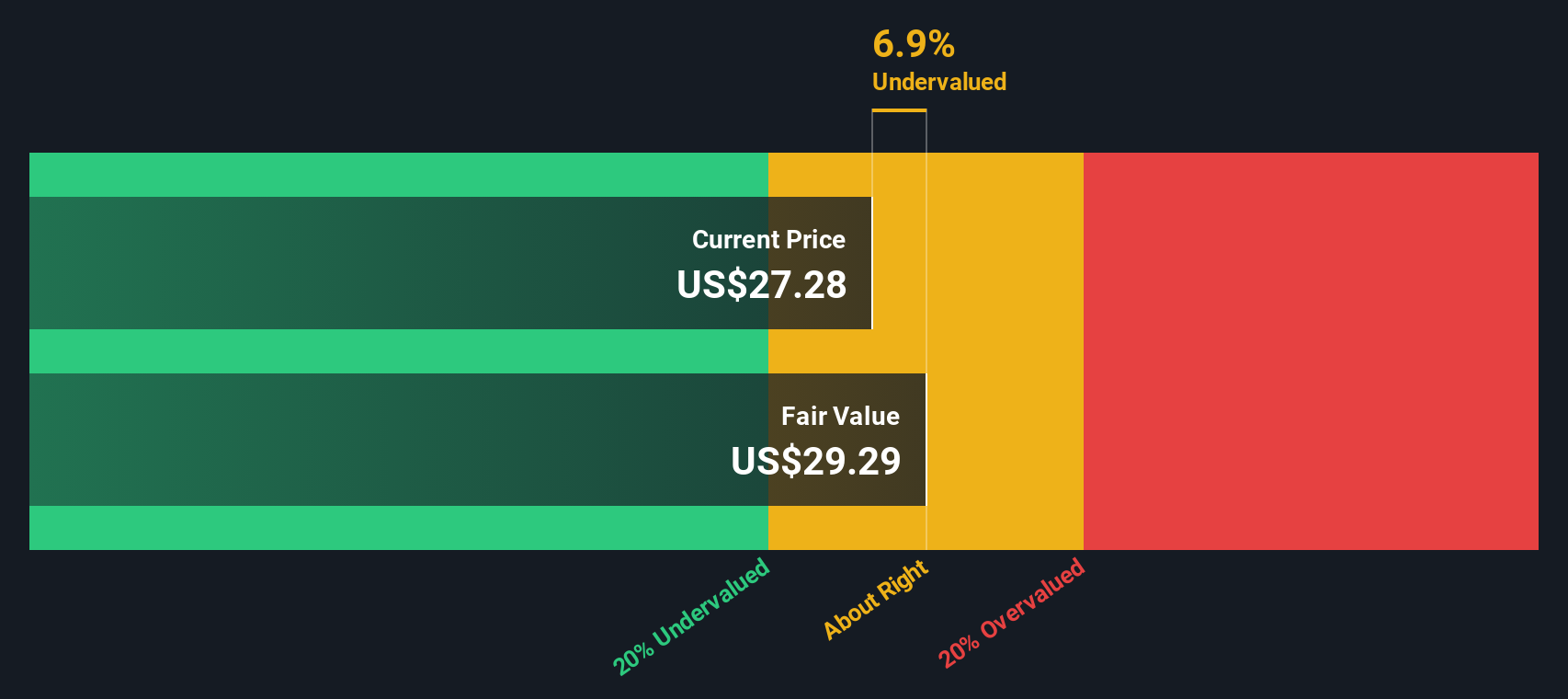

At 50.6 times earnings, the market is clearly baking in robust profit expansion, even though our DCF work suggests the shares are only around 9.5 percent below intrinsic value and not dramatically mispriced on cash flow fundamentals.

Versus the wider US Aerospace and Defense industry on 36.3 times earnings and the peer group average of 47.3 times, StandardAero stands out as distinctly more expensive today. Compared with an estimated fair price to earnings ratio of 33.9 times, that premium leaves room for the multiple to compress if expectations cool.

Explore the SWS fair ratio for StandardAero

Result: Price-to-Earnings of 50.6x (OVERVALUED)

However, stretched valuation and any slowdown in aftermarket demand or defense budgets could quickly pressure sentiment and trigger a sharper multiple reset.

Find out about the key risks to this StandardAero narrative.

Another View: Cash Flows Paint a Softer Picture

While the earnings multiple looks stretched, our DCF model suggests StandardAero is only about 9.5 percent below fair value at $30.85. That points to modest undervaluation rather than outright excess. This raises the question: is sentiment too harsh, or is the cash flow outlook too generous?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out StandardAero for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 915 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own StandardAero Narrative

If you see things differently or want to dig into the numbers yourself, you can craft a personalized view in just minutes. Do it your way

A great starting point for your StandardAero research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Do not stop with a single opportunity. Use the Simply Wall Street Screener to pinpoint fresh stocks that match your strategy before the next big move happens.

- Capture potential market mispricings by targeting companies trading below their estimated worth using these 915 undervalued stocks based on cash flows, grounded in cash flow fundamentals.

- Tap into cutting edge innovation by hunting for early stage innovators shaping tomorrow’s breakthroughs through these 28 quantum computing stocks.

- Strengthen your income stream by focusing on companies offering reliable payouts with these 13 dividend stocks with yields > 3% so that your returns can keep compounding.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報