After double reports, emerging markets: a new safe haven, or a brief boom?

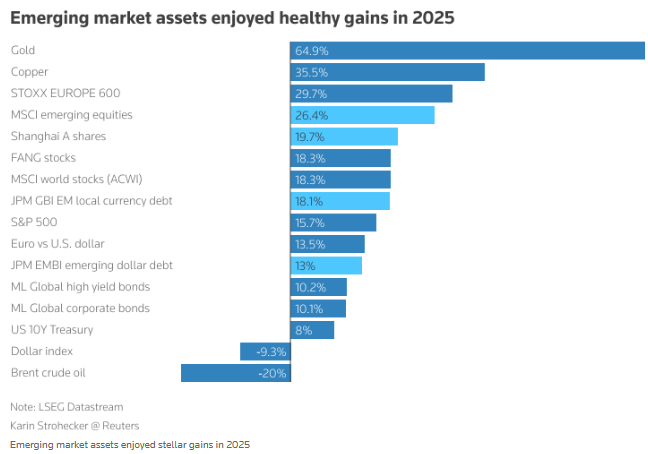

The Zhitong Finance App learned that in 2025, emerging markets ignored tariffs, trade wars, and global turmoil and achieved impressive double-digit returns. Investors are expecting to achieve the same results again next year.

Over the years, emerging market governments and central banks have made difficult policy choices, which have stabilized the once-risky emerging market assets in the face of political and economic clouds and growing geopolitical divisions in the US and Europe.

Elina Theodorakopoulou, managing director of Manulife Investment Management, said, “There are many positive factors this year that can be carried over into next year, especially considering how outstanding and brilliant this year's performance was.” Theodorakopoulou emphasized “the combination of good policy and good fortune.”

Emerging markets' counterattack

This year, US President Trump's return to the White House brought turmoil to the market. Originally, uncertainty would encourage investors to flock to safe-haven assets such as US Treasury bonds or dollars. However, America's erratic tariff policies and Trump's attacks on the Federal Reserve have reversed the situation and made emerging markets seem more stable.

Although for many investors, the impact of US policies is still the primary risk to the expected rise next year, some investors are still looking forward to buying large amounts of emerging market assets by taking advantage of the asset decline caused by Trump's announcement of the “Liberation Day” tariff policy in April.

Thomas Haugaard, portfolio manager at Janus Henderson Investors, said: “You'll find more and more investors diversifying their investments outside of the US or generally seeking global diversification.” Emerging market debt has been undervalued due to years of capital outflows, Haugaard added.

The fundamentals of emerging markets have also changed dramatically. Turkey switched to orthodox economic policies in mid-2023, Nigeria removed subsidies and devalued the naira, Egypt continued reforms with support from the International Monetary Fund, while Ghana, Zambia, and Sri Lanka experienced default and received rating upgrades.

The resulting rebound reversed the outflow of investors' capital over the years. Investors say the difficult choices made by many emerging market governments have paid off, laying the foundation for strong economic growth in 2026.

Giulia Pellegrini of Allianz Global Investors said, “They can withstand greater shocks. They have a stronger economic base.”

Analysts also pointed out that the net credit rating was raised for the second year in a row, proving that this resilience can continue. James Lord, strategist at Morgan Stanley, said: “The fundamentals of this asset class are improving, particularly in terms of sovereign credit ratings. Credit ratings in emerging markets are improving more and more strongly year by year.”

A new safe haven?

Investors said that despite criticism from the Federal Reserve, emerging market central banks have shown independence and sound policy making capabilities.

Charles de Quinsonas, head of emerging markets debt at M&G, said: “As far as monetary policy is concerned, the creditworthiness of emerging markets may have reached an unprecedented level. In fact, they even cut interest rates earlier than the Federal Reserve, but they didn't cut interest rates excessively, which helped the currency to remain quite resilient.”

Prudent monetary policies helped emerging market currencies outperform the market, while the dollar continued to weaken. This has greatly stimulated investors' interest in emerging market local-currency bonds. Since this year, the return on such bonds has been around 18%. Investors such as Pellegrini said the return is expected to reach double digits again by 2026.

Even the uncertainty brought about by elections in places such as Hungary, Brazil, and Colombia often makes investors nervous, but for some, it means an opportunity. “The potential minor policy changes that will follow... are actually potential market movements that will create opportunities for us,” Pellegrini said.

No more bear markets?

The biggest risk still comes from the US. If the US falls into recession, capital cuts will hurt emerging markets. And if the Federal Reserve raises interest rates, it may boost the dollar and inhibit the strengthening of local currencies in emerging markets. Trump plans to appoint a new chairman of the Federal Reserve in 2026, adding to the uncertainty.

But even so, it's no longer as risky as it used to be. “Fundamentally, [emerging markets] are far less economically sensitive to the US than they used to be,” Quinsonas said.

If there was anything that made analysts rethink, it was this overly optimistic sentiment. According to the emerging market sentiment survey released by HSBC in December, pessimism about the outlook for emerging markets has completely disappeared, and net sentiment has reached the highest level in the survey's history.

David Hauner, head of global emerging market fixed income strategy at Bank of America's Global Research Division, said that although he has talked to more than 100 customers in recent weeks, he has not met a single customer who is pessimistic about emerging markets.

Hauner explained, “Everyone has constructive opinions, so this is probably a negative sign. History shows that when everyone is in agreement on where the market is headed, you have to be careful.”

Nasdaq

Nasdaq 華爾街日報

華爾街日報