Texas Pacific Land (TPL): Revisiting Valuation After Data Center Deal and 3-for-1 Stock Split

Texas Pacific Land (TPL) has suddenly jumped back onto investors radar after unveiling a data center partnership with Bolt Data and Energy and a 3 for 1 stock split, together signaling a clear diversification push.

See our latest analysis for Texas Pacific Land.

Those announcements come after a choppy stretch where weak year to date share price returns contrast with a solid five year total shareholder return. This suggests long term momentum remains intact even as sentiment has been reset.

If you are curious which other names might be quietly reshaping their growth stories, this is a good moment to explore fast growing stocks with high insider ownership.

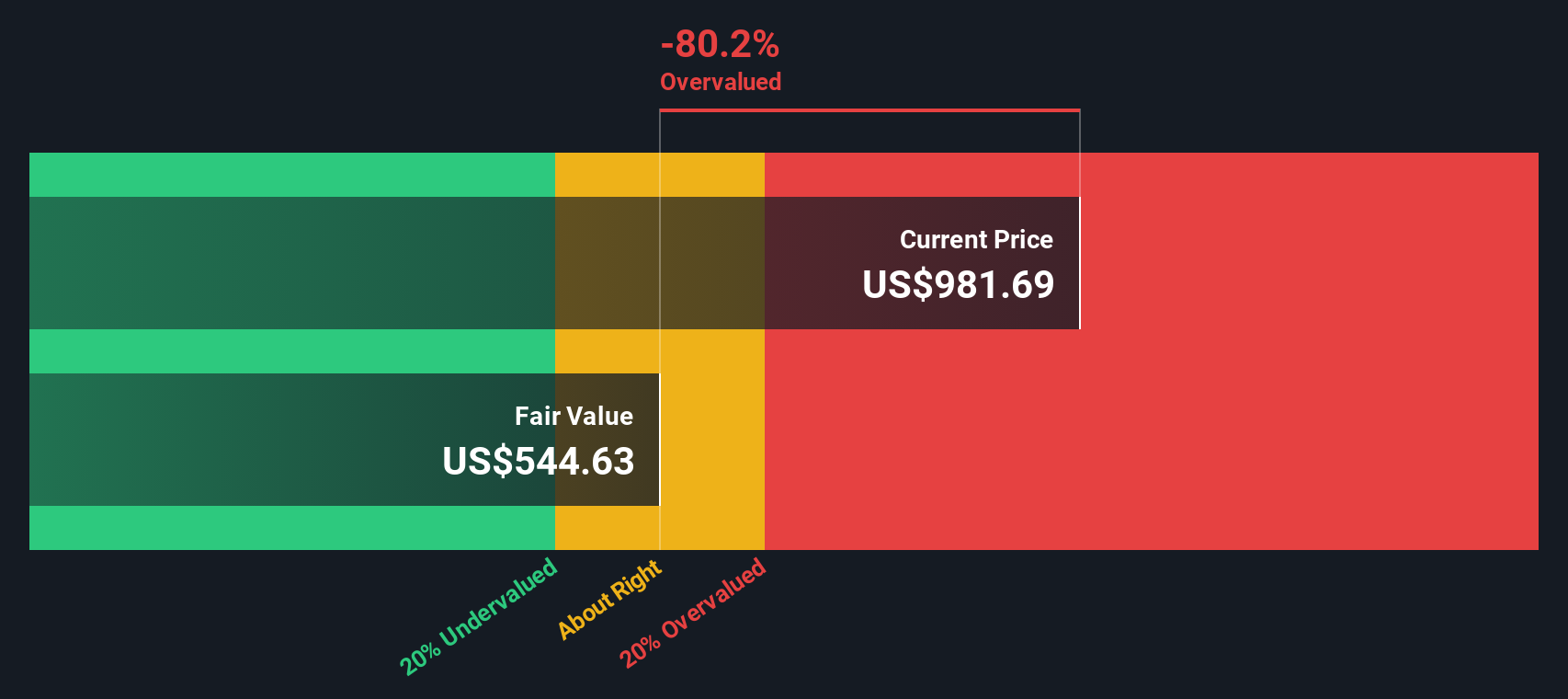

With the shares still down sharply year to date despite solid long term returns and fresh AI infrastructure ambitions, the core question now is simple: Is Texas Pacific Land quietly undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 6.3% Overvalued

With Texas Pacific Land last closing at $895.41 against a narrative fair value of $842.50, expectations lean rich and hinge on ambitious profitability assumptions.

Analysts expect the number of shares outstanding to remain consistent over the next 3 years. To value all of this in today's terms, we will use a discount rate of 6.4%, as per the Simply Wall St company report.

Curious how steady share counts, rising margins and premium multiples can still point to downside from here? The narrative stitches these ingredients into one bold valuation case. Want to see how far earnings and revenues must climb to keep that multiple in place, even as the discount rate stays restrained?

Result: Fair Value of $842.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, several upside catalysts, such as resilient royalty production from super majors and double-digit growth in water services, could challenge the overvaluation narrative.

Find out about the key risks to this Texas Pacific Land narrative.

Another Lens on Valuation

While the narrative fair value suggests TPL is 6.3% overvalued, our DCF model paints a slightly different picture, with shares trading about 1.1% below its fair value of $905.48. If cash flows point to upside while sentiment flags risk, which signal deserves more weight?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Texas Pacific Land for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Texas Pacific Land Narrative

If you see the story differently, or want to pressure test the assumptions yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Texas Pacific Land research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an edge by scanning fresh opportunities on Simply Wall St, where the right screener can surface your next conviction buy.

- Capitalize on mispriced quality by using these 916 undervalued stocks based on cash flows, which highlights companies whose cash flows suggest far more potential than their current market prices imply.

- Ride powerful technological shifts early by checking out these 24 AI penny stocks, which are poised to benefit from breakthroughs in automation, machine learning and data driven products.

- Strengthen your income stream with these 13 dividend stocks with yields > 3%, which pinpoints businesses offering robust yields above 3 percent backed by solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報