Will Bruker’s (BRKR) AbCellera Settlement and Beacon Royalties Deal Change Its Investment Narrative?

- Earlier this month, AbCellera and Bruker Corporation entered into a global settlement and patent license agreement, under which Bruker will pay AbCellera US$36 million upfront plus ongoing royalties on sales of its Beacon Optofluidic platform products for the life of the licensed patents.

- This settlement removes a major source of legal uncertainty around Bruker’s Beacon platform, clarifying future economics and potentially easing investor concerns about litigation risk.

- Next, we’ll examine how resolving the AbCellera patent dispute, and committing to royalties on Beacon sales, reshapes Bruker’s investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Bruker Investment Narrative Recap

To own Bruker, you need to believe that demand for its advanced research tools and life science platforms will recover and support a return to profitable growth, despite recent earnings pressure and funding headwinds. The AbCellera settlement adds a clear royalty cost to Beacon but also removes a key legal overhang, which looks more like a clean-up of uncertainty than a change to the near term demand and funding risks that still dominate the story.

Among recent announcements, the roughly US$25 million in European NMR and EPR orders stands out as a reminder that high end academic research customers are still investing, even as broader funding visibility remains cloudy. These multi-year orders support Bruker’s backlog and tie directly into one of the main near term catalysts: a stabilization in global research spending that could help convert the company’s innovation pipeline into more consistent revenue growth.

Yet for all the progress on legal issues and new orders, investors still need to be aware that prolonged weakness in global academic and biopharma funding could...

Read the full narrative on Bruker (it's free!)

Bruker’s narrative projects $3.8 billion revenue and $404.1 million earnings by 2028.

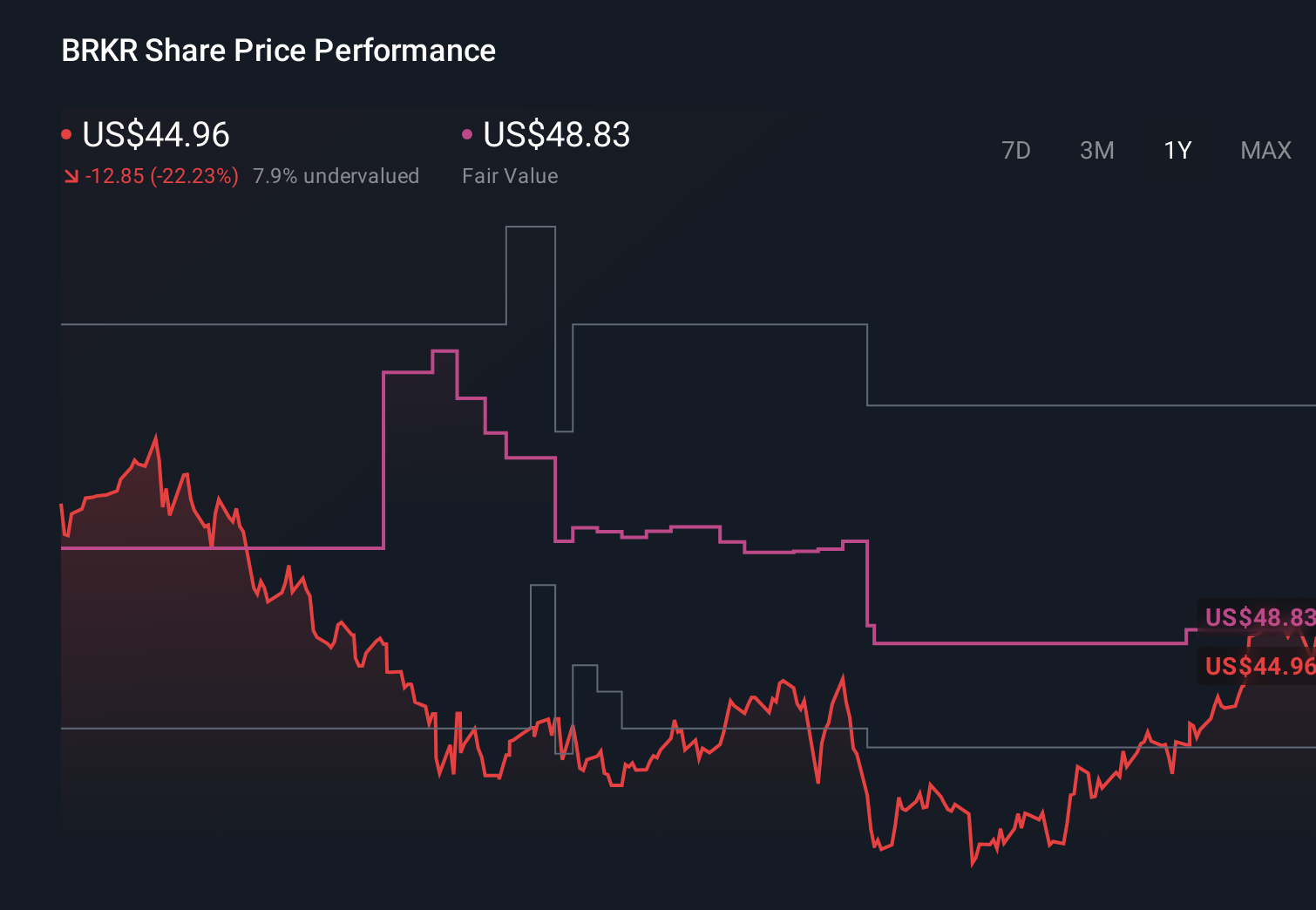

Uncover how Bruker's forecasts yield a $51.79 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Five Simply Wall St Community fair value estimates for Bruker range widely from US$31.30 to US$75, underlining how far apart individual views can be. You can weigh those against the risk that sustained weakness in research funding and delayed stimulus could keep pressure on Bruker’s revenue and margins, with important implications for how the business performs over the next few years.

Explore 5 other fair value estimates on Bruker - why the stock might be worth 30% less than the current price!

Build Your Own Bruker Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bruker research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bruker research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bruker's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報