Hygeia Healthcare Holdings (SEHK:6078): Taking a Fresh Look at Valuation After Launching a Major Share Buyback

Hygeia Healthcare Holdings (SEHK:6078) has kicked off a sizeable share buyback after shareholders approved a mandate to repurchase up to 10% of its issued share capital, signaling a clearer commitment to shareholder returns.

See our latest analysis for Hygeia Healthcare Holdings.

The buyback comes after a weak stretch in the market, with the share price down sharply on a 3 year total shareholder return basis. However, the recent 7 day share price return of 9.64% suggests sentiment may be turning as investors reassess its growth and risk profile.

If this buyback has you rethinking opportunities in healthcare, it could be a good moment to explore other healthcare stocks with resilient fundamentals and potential for rerating.

With profits still growing, the share price far below analyst targets and management now buying back stock, is Hygeia quietly undervalued, or are investors already factoring in all of its future growth?

Price to Earnings of 15.3x, Is it justified?

On earnings, Hygeia trades at a 15.3x price to earnings multiple, which screens as expensive relative to both its peers and the wider Hong Kong healthcare sector.

The price to earnings ratio compares the current share price with per share earnings. It is a simple gauge of how much investors pay for each unit of profit in a business built on relatively steady oncology hospital revenues.

Hygeia looks richly priced when stacked against the Hong Kong healthcare industry average multiple of 12x and an even lower 7.8x for its direct peer group. However, versus an estimated fair price to earnings of 18x, there is room for the market to re rate the stock closer to that higher benchmark if earnings growth delivers as forecast.

Explore the SWS fair ratio for Hygeia Healthcare Holdings

Result: Price to Earnings of 15.3x (OVERVALUED)

However, sustained share price weakness and any slowdown in earnings growth or oncology demand could quickly undermine the case for a valuation re-rating.

Find out about the key risks to this Hygeia Healthcare Holdings narrative.

Another View on Value

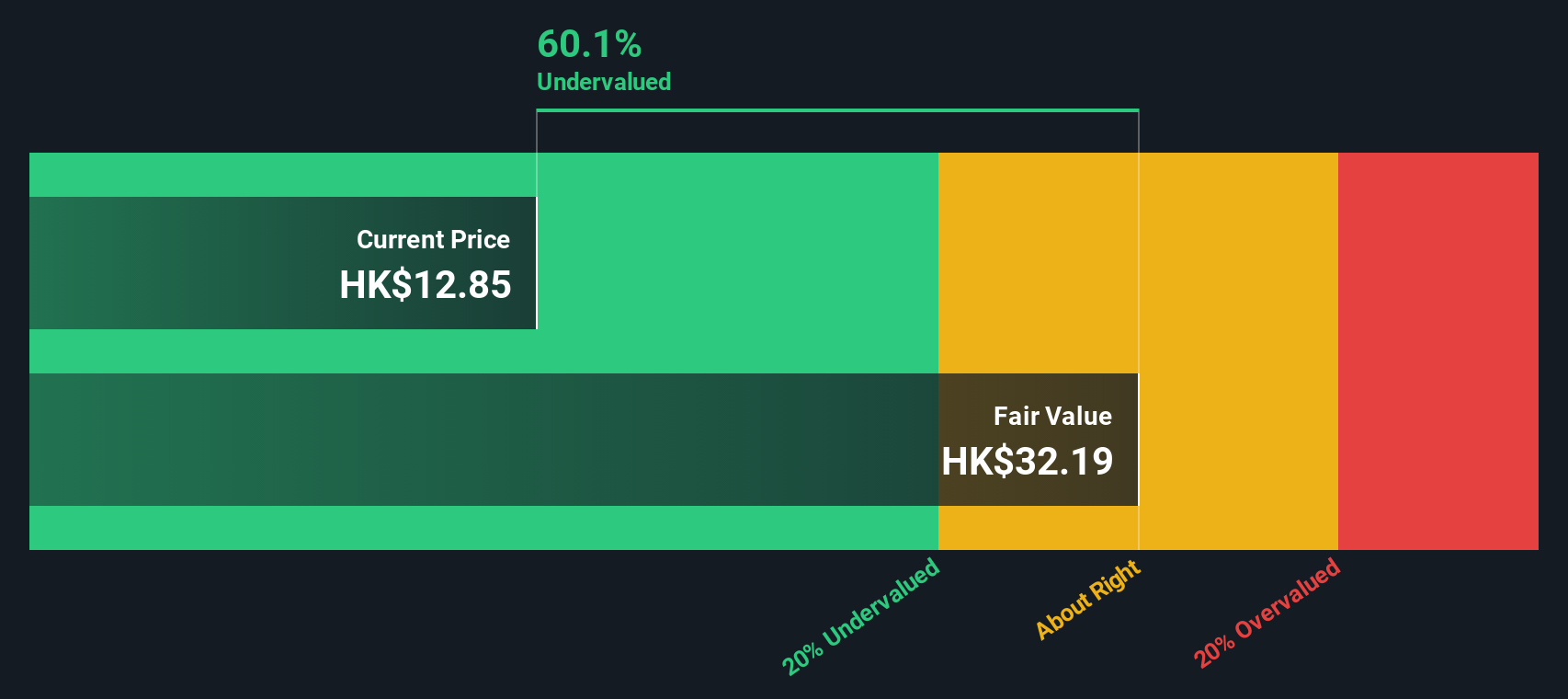

Our DCF model paints a very different picture, suggesting Hygeia is trading about 61% below an estimated fair value of roughly HK$32. That implies the market may be heavily discounting its long term cash generation. Is this caution justified, or is it an opportunity hiding in plain sight?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Hygeia Healthcare Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 917 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Hygeia Healthcare Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a tailored view in just minutes, Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Hygeia Healthcare Holdings.

Ready for more high conviction ideas?

Before markets move on without you, put Hygeia in context by scanning other opportunities on Simply Wall Street, where fresh ideas meet clear, data backed analysis.

- Target potential mispricings by running through these 917 undervalued stocks based on cash flows that may offer stronger upside than the usual large cap names on your radar.

- Capitalize on breakthrough innovation by filtering for these 24 AI penny stocks positioned at the intersection of software, automation and long term structural growth.

- Strengthen your income stream by focusing on these 13 dividend stocks with yields > 3% that combine reliable payouts with balance sheets built to withstand tougher conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報