RTX (RTX) Valuation Check After Major Defense Wins and Strengthening Growth Outlook

RTX (RTX) just strung together a series of big wins, from multibillion dollar missile deals with Germany and Canada to a $1.6 billion F135 sustainment contract, all taking place against a friendlier U.S. defense spending backdrop.

See our latest analysis for RTX.

Those wins have helped push RTX toward fresh highs, with the share price now around $178.29 and a powerful year to date share price return of roughly 54% feeding into a five year total shareholder return of about 185%. This points to momentum still building rather than fading.

If RTX has you rethinking the defense space, this could be a good moment to scan the broader field and see what stands out among aerospace and defense stocks.

With RTX sprinting to record highs and trading at only a modest discount to analyst targets despite strong growth, investors now face a pivotal question: is this still an opportunity, or has the market already priced in the next leg of expansion?

Most Popular Narrative Narrative: 8.4% Undervalued

RTX closed at $178.29, while the most widely followed narrative pegs fair value closer to $194.65. That frames the rally as only partway through.

Robust and growing backlog, highlighted by a 1.86 quarter book to bill ratio, $236 billion backlog (up 15% year over year), and major new international contracts (e.g., EU, MENA, Asia Pacific) indicate RTX is well positioned to benefit from sustained increases in global defense spending and heightened geopolitical tensions, setting up strong visibility for future revenue growth.

Curious how that backlog, margin lift, and richer future earnings multiple all mesh into one price tag? The narrative knits them together in surprising ways.

Result: Fair Value of $194.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent engine reliability costs, along with any retrenchment in U.S. or allied defense budgets, could quickly erode today’s upbeat growth and valuation assumptions.

Find out about the key risks to this RTX narrative.

Another Angle on Value

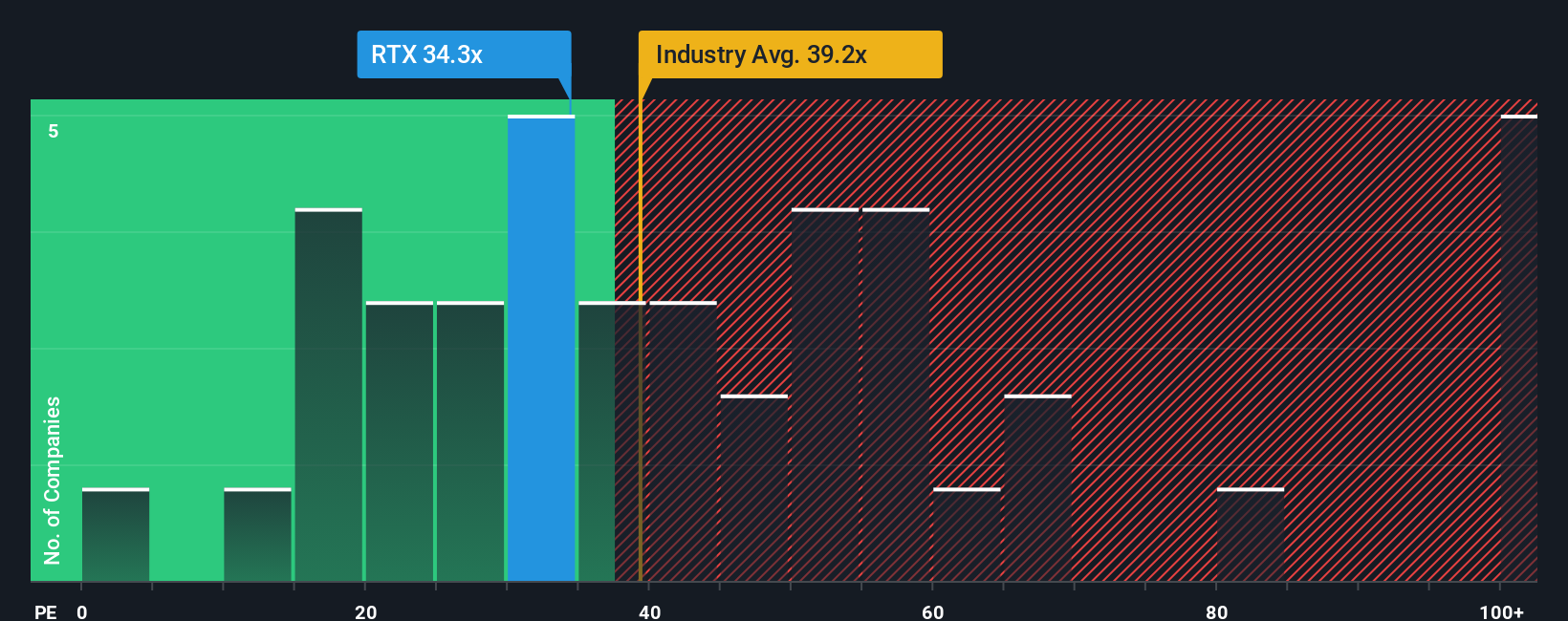

On earnings, RTX looks full rather than cheap. Its P/E of 36.3 times sits just above the 35.5 times peer average and its own 35.5 times fair ratio. This suggests the market may already be paying up for its strengths, which could leave less room for mistakes.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RTX Narrative

If you see the numbers differently or would rather dig into the details yourself, you can craft a custom view in just minutes. Do it your way.

A great starting point for your RTX research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

RTX might be front of mind today, but your next big winner could already be waiting in the Simply Wall St Screener if you know where to look.

- Capture powerful cash flow opportunities by targeting these 917 undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Tap into the next wave of innovation with these 24 AI penny stocks positioned to benefit from accelerating artificial intelligence adoption.

- Strengthen your income potential by focusing on these 13 dividend stocks with yields > 3% that can support returns even when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報