Ionis Pharmaceuticals (IONS): Revisiting Valuation After a Powerful Year-to-Date Share Price Rally

Ionis Pharmaceuticals (IONS) has been quietly grinding higher this year, and the stock’s recent move gives investors a reason to revisit the story, from its expanding RNA pipeline to improving revenue and profit trends.

See our latest analysis for Ionis Pharmaceuticals.

That steady climb has now put Ionis shares at $77.63, and while the 7 day share price return has cooled, the 90 day share price return of 27.24 percent and powerful year to date share price return of 123.78 percent indicate that momentum remains strong, supported by a 1 year total shareholder return of 117.88 percent.

If Ionis has you rethinking biotech exposure, this could be a good moment to explore other promising healthcare stocks that pair defensible science with compelling growth narratives.

Yet even after a blockbuster year and a rich late stage pipeline, the shares still trade at a sizable discount to some intrinsic value estimates. This raises the question: is this a fresh entry point, or is future growth already priced in?

Most Popular Narrative Narrative: 9.7% Undervalued

With Ionis closing at $77.63, the most widely followed narrative points to a fair value closer to the mid 80 dollar range, framing recent gains as only part of the story.

The fair value estimate has risen slightly to approximately $85.95 per share from about $85.47 per share, reflecting modestly higher long term assumptions. The future P/E has risen slightly to about 298.9x from roughly 297.2x, suggesting a modestly higher valuation multiple on projected earnings.

Curious why a high growth biotech with negative earnings today could merit such a bold future earnings multiple and premium discount rate assumptions? Dig into the narrative to see how long term revenue expansion, margin lift, and a multi billion dollar sales runway are stitched together into this fair value call.

Result: Fair Value of $85.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, several late stage regulatory setbacks or tougher than expected pricing in broader indications could quickly challenge the bullish revenue and valuation narrative.

Find out about the key risks to this Ionis Pharmaceuticals narrative.

Another View: Rich on Sales, Even if the Story Looks Cheap

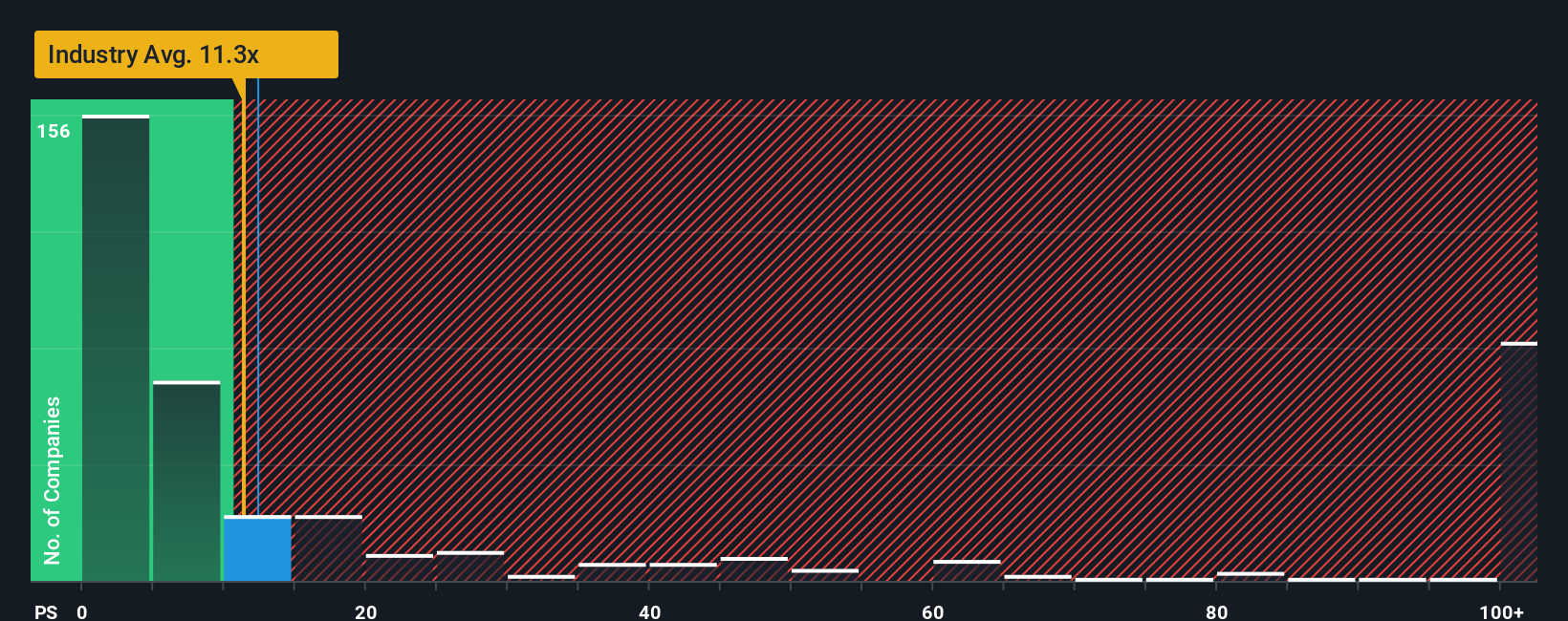

Our SWS fair ratio approach tells a different story. On a price to sales of 13x, Ionis trades well above the US biotech average of 11.8x and a fair ratio of 4.7x, as well as peer levels near 4.4x. This points to meaningful downside risk if sentiment cools. Does that premium still feel comfortable after such a run?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ionis Pharmaceuticals Narrative

If this perspective does not fully resonate or you would rather follow your own trail through the numbers, you can build a complete view in under three minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Ionis Pharmaceuticals.

Looking for your next investing edge?

Before markets move on without you, lock in your next set of ideas using the Simply Wall St Screener, tuned for high potential and real-world fundamentals.

- Capitalize on mispriced opportunities by targeting companies trading below their estimated worth through these 917 undervalued stocks based on cash flows.

- Ride powerful structural shifts in medicine and automation by focusing on breakthrough innovators with these 29 healthcare AI stocks.

- Capture income and growth in one move by filtering quality payers via these 13 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報