Investors Appear Satisfied With Berner Industrier AB's (STO:BERNER B) Prospects As Shares Rocket 28%

Despite an already strong run, Berner Industrier AB (STO:BERNER B) shares have been powering on, with a gain of 28% in the last thirty days. The annual gain comes to 181% following the latest surge, making investors sit up and take notice.

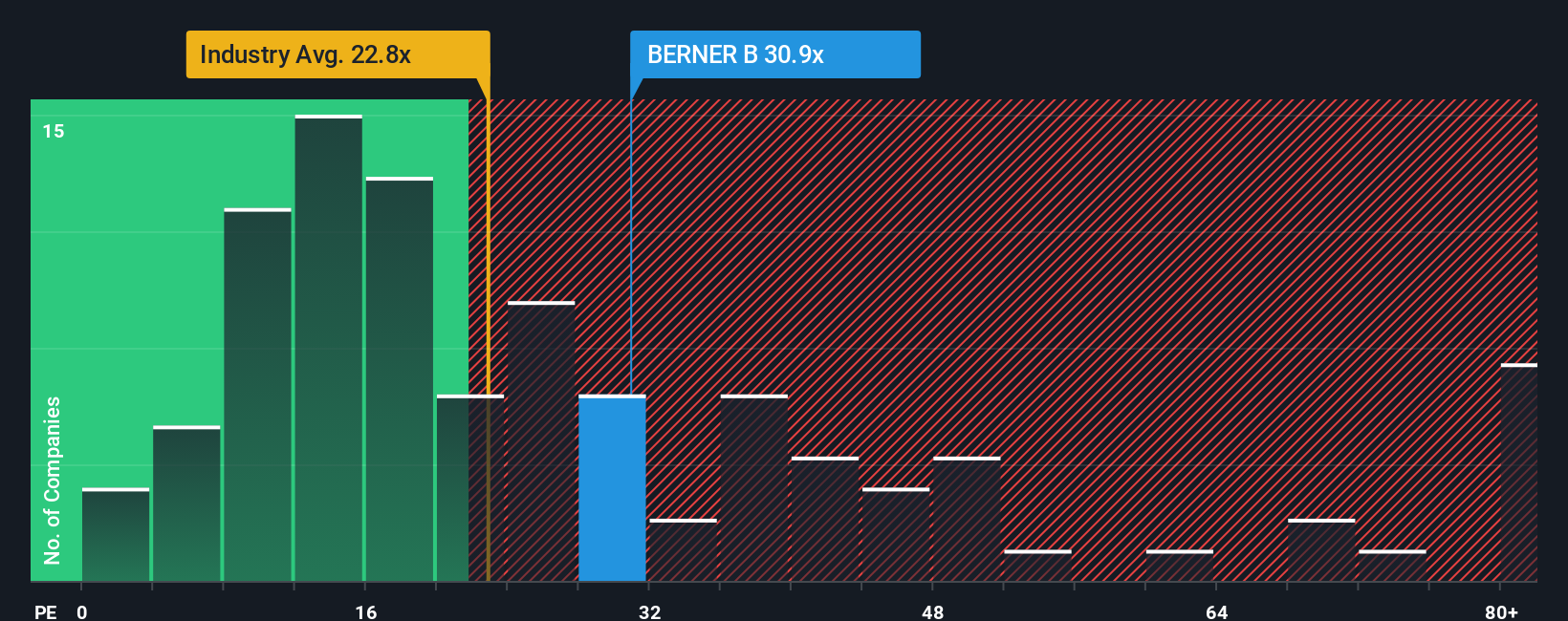

Since its price has surged higher, given around half the companies in Sweden have price-to-earnings ratios (or "P/E's") below 21x, you may consider Berner Industrier as a stock to potentially avoid with its 30.9x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Berner Industrier certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Berner Industrier

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Berner Industrier would need to produce impressive growth in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 49% last year. The strong recent performance means it was also able to grow EPS by 235% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 29% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why Berner Industrier is trading at such a high P/E compared to the market. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

The large bounce in Berner Industrier's shares has lifted the company's P/E to a fairly high level. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Berner Industrier maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Berner Industrier you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報