3 Promising Asian Penny Stocks With Over US$900M Market Cap

As Asian markets navigate a landscape marked by evolving economic policies and shifting investor sentiment, the focus on smaller-cap investments continues to grow. Penny stocks, while often associated with risk due to their lower price points and market caps, still present intriguing opportunities for those seeking growth potential in emerging companies. This article will explore three such penny stocks that combine financial resilience with promising prospects in the Asian market.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.145 | SGD61.07M | ✅ 2 ⚠️ 4 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.51 | HK$933.97M | ✅ 4 ⚠️ 1 View Analysis > |

| Asia Medical and Agricultural Laboratory and Research Center (SET:AMARC) | THB2.68 | THB1.13B | ✅ 3 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.52 | HK$2.09B | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB5.00 | THB3B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.104 | SGD54.45M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.47 | SGD13.66B | ✅ 5 ⚠️ 1 View Analysis > |

| NagaCorp (SEHK:3918) | HK$4.66 | HK$20.61B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$138.07M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.80 | NZ$235.47M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 982 stocks from our Asian Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Build King Holdings (SEHK:240)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Build King Holdings Limited operates as an investment holding company focused on building construction and civil engineering projects in Hong Kong and the People's Republic of China, with a market cap of approximately HK$1.80 billion.

Operations: The company generates revenue primarily from its construction work segment, which amounts to HK$14.80 billion.

Market Cap: HK$1.8B

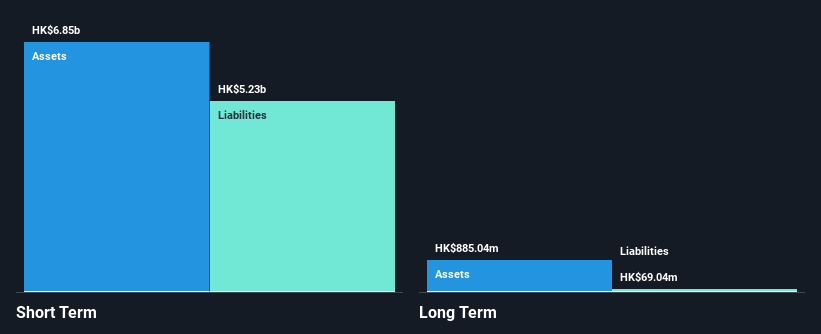

Build King Holdings, with a market cap of HK$1.80 billion, primarily derives its revenue from the construction segment, generating HK$14.80 billion. The company's financial health is robust; it covers interest payments comfortably and has short-term assets exceeding liabilities by HK$1.6 billion. Despite a low return on equity of 17.1%, earnings have grown significantly at 25% over the past year, surpassing industry performance. The management team is relatively new with an average tenure of 0.9 years, while the board remains experienced at 7.1 years on average. Recent events include a shareholder meeting to discuss transactions with Wai Kee Holdings Limited regarding ready mixed concrete sales and purchases.

- Unlock comprehensive insights into our analysis of Build King Holdings stock in this financial health report.

- Learn about Build King Holdings' historical performance here.

Hong Leong Finance (SGX:S41)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hong Leong Finance Limited is a financial services company serving consumer and SME markets in Singapore, with a market cap of SGD1.18 billion.

Operations: The company generates revenue of SGD214.37 million from its financing business segment.

Market Cap: SGD1.18B

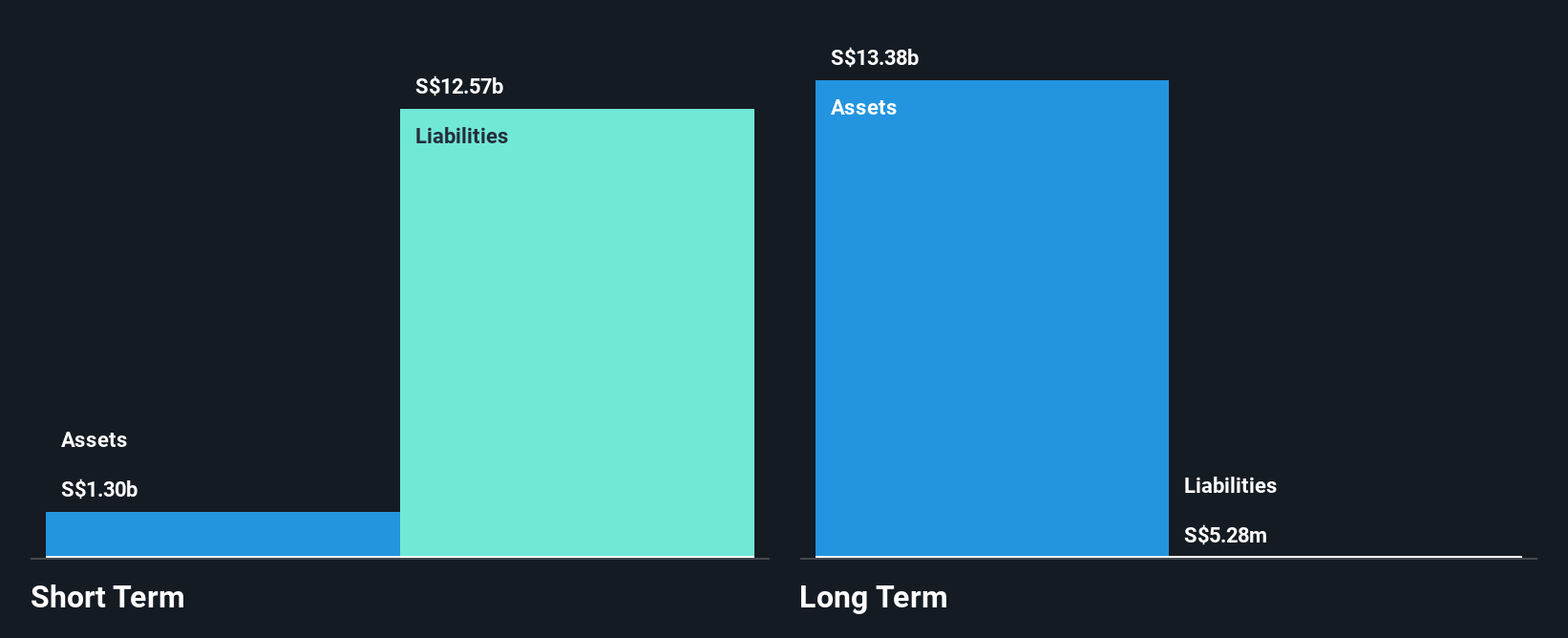

Hong Leong Finance, with a market cap of SGD1.18 billion, generates SGD214.37 million in revenue from its financing business segment. The management team and board are experienced, with average tenures of 8.5 and 6.5 years respectively, contributing to stability in leadership. Despite a decline in net profit margins from 43.8% to 39.1%, the company maintains high-quality earnings and primarily low-risk funding through customer deposits (98%). Its assets-to-equity ratio stands at a low 7x, indicating financial prudence, though return on equity is modest at 4%. Earnings growth has been negative recently but averaged an annual increase of 6.4% over five years.

- Navigate through the intricacies of Hong Leong Finance with our comprehensive balance sheet health report here.

- Gain insights into Hong Leong Finance's historical outcomes by reviewing our past performance report.

Zhejiang CONBA PharmaceuticalLtd (SHSE:600572)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang CONBA Pharmaceutical Co., Ltd. focuses on the research, development, production, and sales of pharmaceuticals and health products in mainland China with a market cap of CN¥11.77 billion.

Operations: The company generates CN¥6.58 billion in revenue from its operations in China.

Market Cap: CN¥11.77B

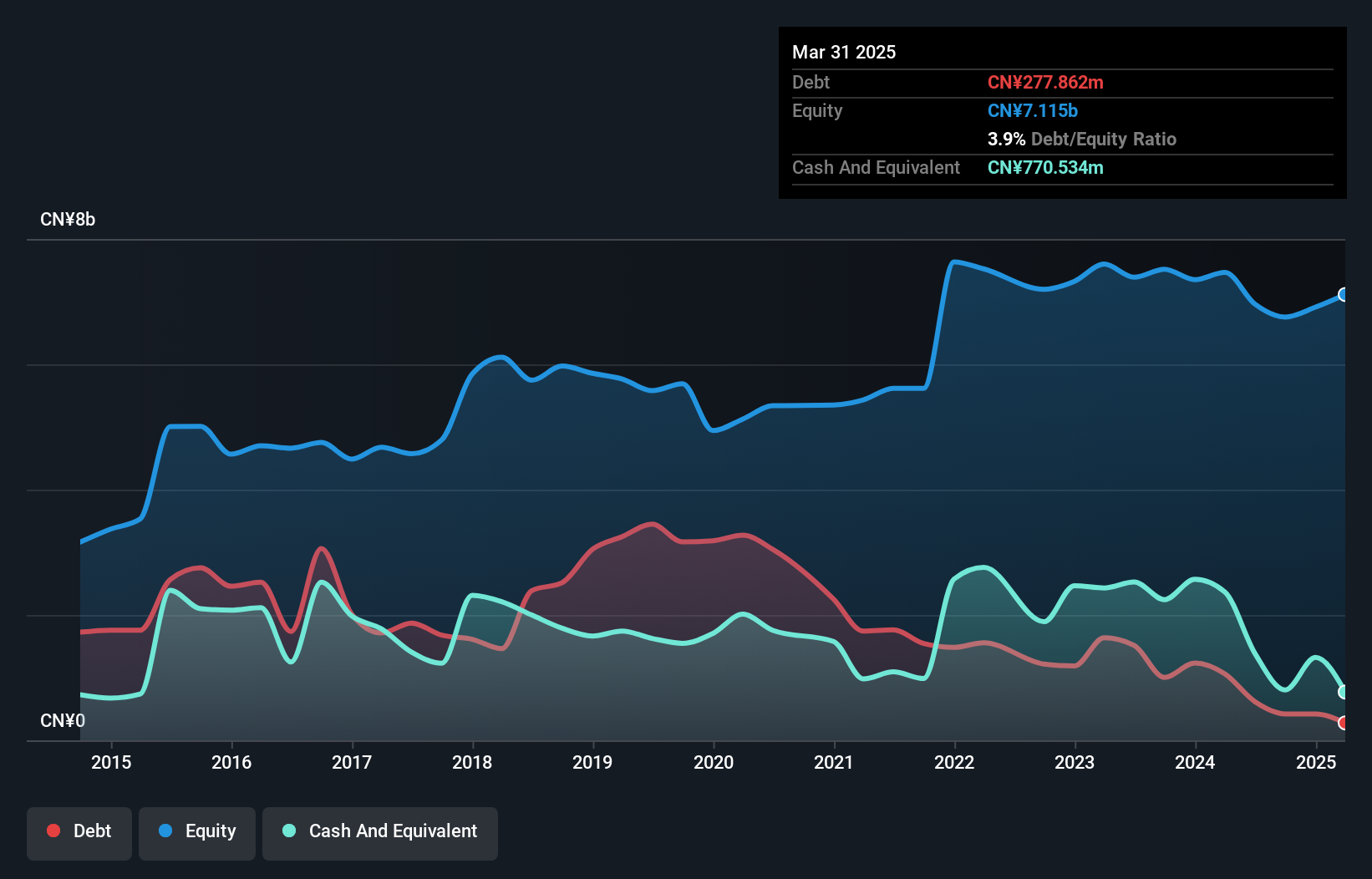

Zhejiang CONBA Pharmaceutical Co., Ltd. has demonstrated robust financial health with a significant reduction in its debt to equity ratio from 49.5% to 5.6% over five years, and it holds more cash than total debt, indicating strong liquidity. The company's earnings growth of 41.3% over the past year surpasses both its previous five-year average and the industry benchmark, although this was partly influenced by a large one-off gain of CN¥238.4 million. Despite an unstable dividend track record and a relatively new board with an average tenure of 1.9 years, short-term assets comfortably cover liabilities, supporting operational stability amidst ongoing revenue generation from China operations totaling CN¥6.58 billion annually.

- Click here and access our complete financial health analysis report to understand the dynamics of Zhejiang CONBA PharmaceuticalLtd.

- Gain insights into Zhejiang CONBA PharmaceuticalLtd's past trends and performance with our report on the company's historical track record.

Make It Happen

- Access the full spectrum of 982 Asian Penny Stocks by clicking on this link.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報