Undiscovered Gems in Asia for December 2025

As global markets react to the Federal Reserve's interest rate cuts and mixed economic signals, investors are increasingly focusing on smaller, more agile companies that can navigate these uncertain times. In Asia, where markets have shown resilience amidst global volatility, identifying stocks with strong fundamentals and growth potential is key to uncovering hidden opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Soliton Systems K.K | 0.47% | 2.84% | 2.40% | ★★★★★★ |

| Jetwell Computer | 34.75% | 16.24% | 27.51% | ★★★★★★ |

| Imuraya Group | 9.20% | 5.21% | 23.19% | ★★★★★★ |

| AzureWave Technologies | 11.00% | -1.30% | 12.72% | ★★★★★★ |

| Wison Engineering Services | 28.12% | -0.65% | 12.25% | ★★★★★★ |

| YH Entertainment Group | 4.44% | -11.47% | -43.36% | ★★★★★★ |

| Torigoe | 8.08% | 4.54% | 8.78% | ★★★★★☆ |

| Walton Advanced Engineering | 17.59% | 2.08% | -18.17% | ★★★★★☆ |

| YuanShengTai Dairy Farm | 15.09% | 11.64% | -31.87% | ★★★★★☆ |

| Qingdao Daneng Environmental Protection Equipment | 57.57% | 29.08% | 28.94% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Shanghai Yimin Commercial Group (SHSE:600824)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Yimin Commercial Group Co., Ltd. operates in the retail industry and has a market capitalization of CN¥5.16 billion.

Operations: The company generates revenue primarily from its retail operations. It has a market capitalization of CN¥5.16 billion.

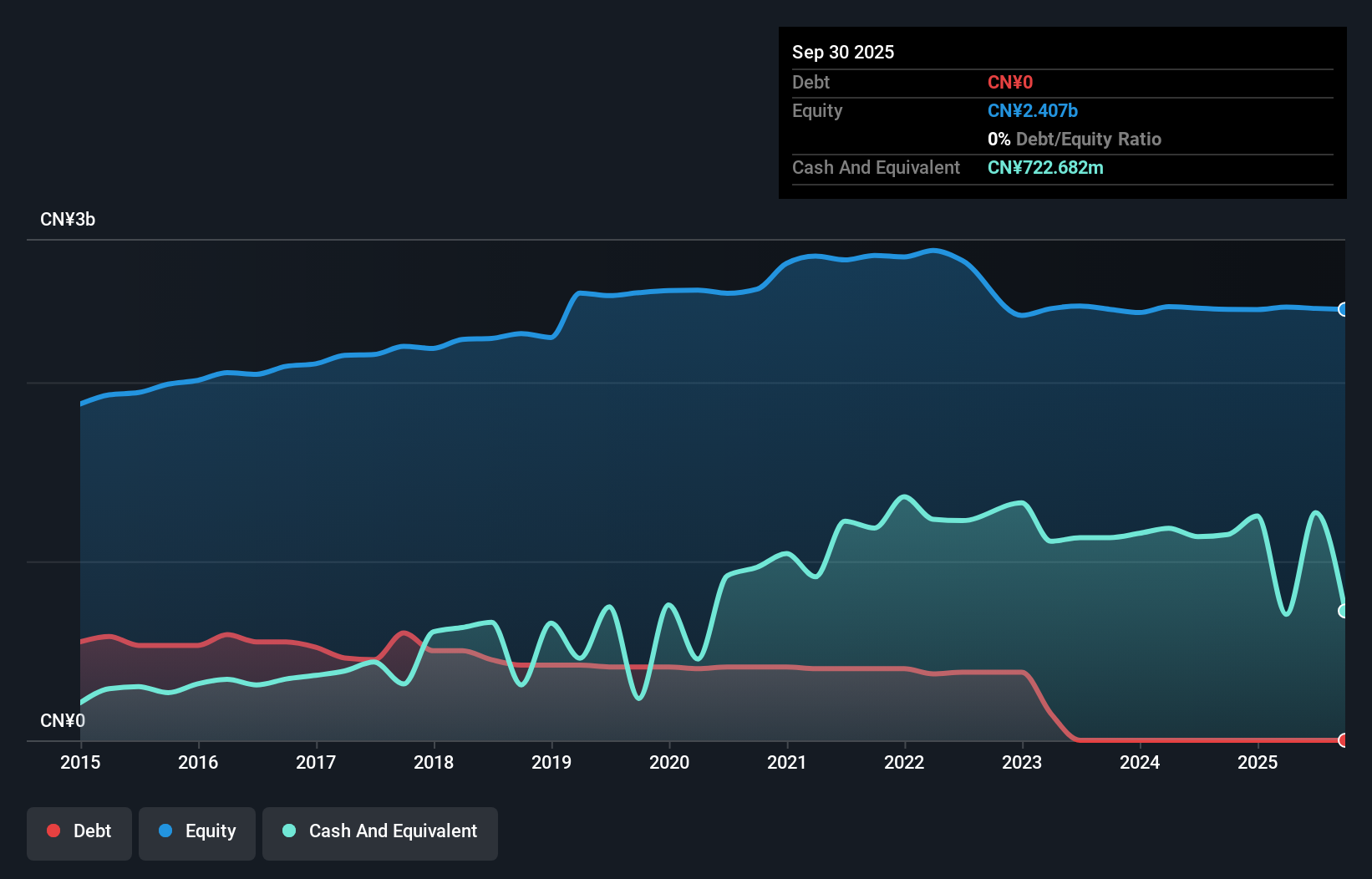

Shanghai Yimin Commercial Group, a relatively small player in the retail sector, has shown resilience despite recent challenges. Over the past year, earnings grew by 10.5%, outperforming the Multiline Retail industry which saw an -18.5% change. The company is debt-free now compared to five years ago when its debt-to-equity ratio was 16.3%. However, a notable CN¥25 million one-off gain influenced its financial results over the last year ending September 2025. Recent reports show sales of CN¥507 million for nine months ending September 2025, down from CN¥711 million in the previous year, with net income at CN¥19 million compared to last year's CN¥36 million.

Anhui Huamao Textile (SZSE:000850)

Simply Wall St Value Rating: ★★★★★★

Overview: Anhui Huamao Textile Co., Ltd. is engaged in the production and sale of textile products in China, with a market cap of CN¥4.60 billion.

Operations: Anhui Huamao Textile generates revenue primarily from the production and sale of textile products within China. The company's net profit margin is a key indicator of its financial performance.

Anhui Huamao Textile, a nimble player in the textile industry, has shown noteworthy financial resilience. The company reported earnings growth of 91% over the past year, significantly outpacing the luxury sector's -1.2%. Its debt to equity ratio improved slightly from 42.7% to 41% over five years, reflecting prudent financial management. A large one-off gain of CN¥258.7 million influenced recent results, highlighting potential volatility in earnings quality. Despite this fluctuation, Anhui Huamao remains appealing with a price-to-earnings ratio of 15x compared to the broader CN market's 42.9x, suggesting attractive valuation for investors seeking opportunities in Asia's textile sector.

Zhejiang Garden BiopharmaceuticalLtd (SZSE:300401)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Garden Biopharmaceutical Co., Ltd. operates in the biopharmaceutical industry, focusing on the development and production of pharmaceutical products, with a market cap of CN¥8.18 billion.

Operations: Zhejiang Garden Biopharmaceutical generates revenue through the sale of pharmaceutical products. The company's financial performance is highlighted by its net profit margin, which has shown a notable trend over recent periods.

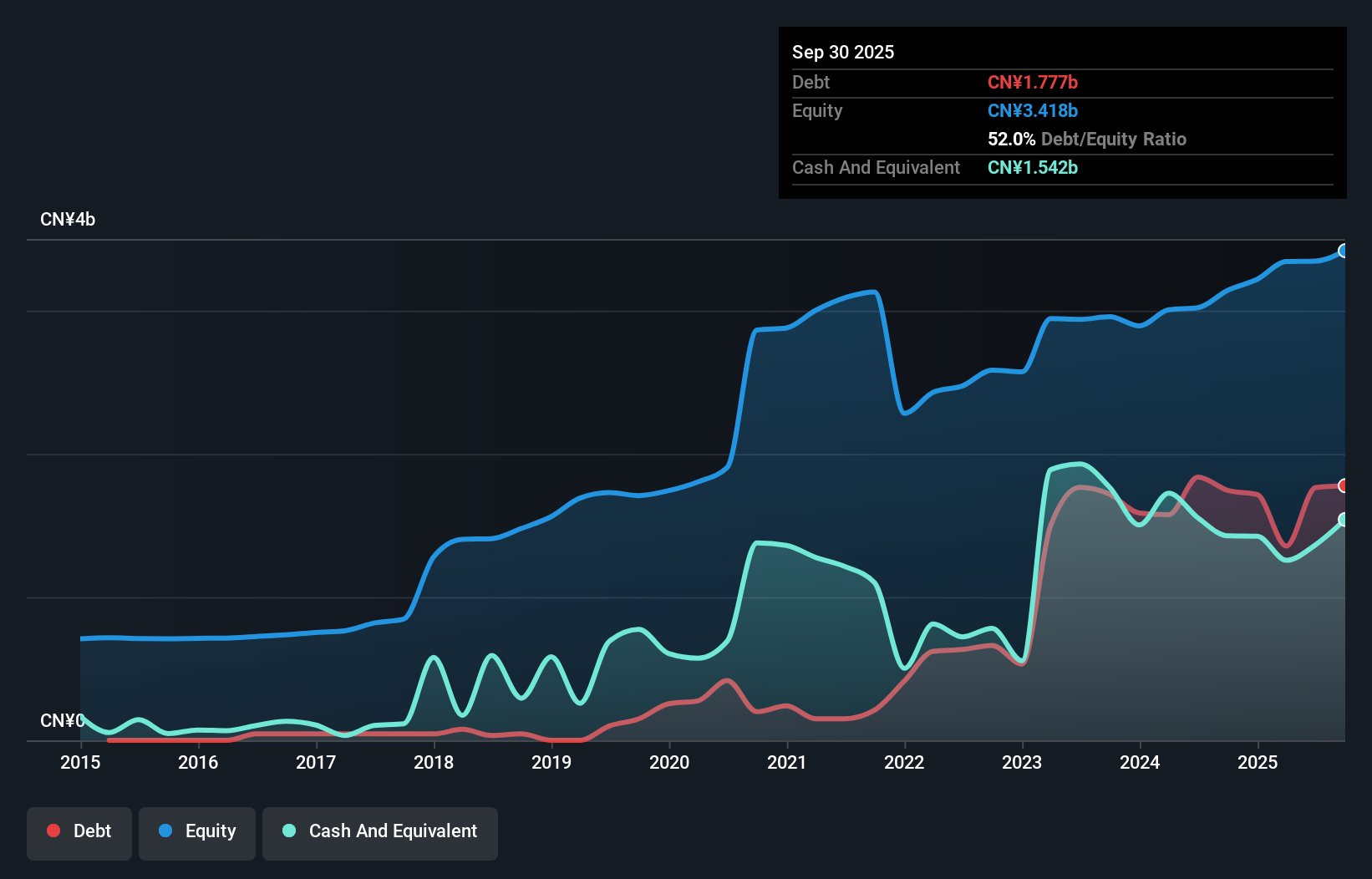

Zhejiang Garden Biopharmaceutical, a notable player in the pharmaceutical sector, reported earnings growth of 5.9% over the past year, outpacing the industry average of 3.8%. Despite a slight dip in net income to CNY 234.06 million from CNY 241.47 million last year, its earnings per share remained stable at CNY 0.4 for diluted shares. The company is trading significantly below its estimated fair value by about 80.9%, suggesting potential undervaluation opportunities for investors. With a satisfactory net debt to equity ratio of 6.9% and EBIT covering interest payments by a factor of 15.6x, financial stability appears robust despite an increase in debt over five years from 7% to 52%. Looking ahead, projected annual earnings growth at nearly double-digit rates hints at promising future prospects within this dynamic market space.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 2499 Asian Undiscovered Gems With Strong Fundamentals now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報