CarGurus (CARG): Evaluating the Stock’s Valuation After the Launch of PriceVantage Pricing Technology

CarGurus (CARG) just rolled out PriceVantage, a data driven pricing tool that turns more than 10 billion monthly shopper signals into real time guidance for dealers, promising faster sales and stronger lead generation.

See our latest analysis for CarGurus.

That launch comes after a solid run in the shares, with a 10.07 percent 1 month share price return and a 3 year total shareholder return of 187.38 percent, which together suggest that momentum and confidence are still building.

If PriceVantage has you thinking about where the next growth story might come from, this is a good moment to explore auto manufacturers as potential complements to your watchlist.

With earnings and growth both accelerating, yet shares still trading at a modest discount to analyst targets, investors now face a critical question: Is CarGurus quietly undervalued, or has the market already priced in its next leg of growth?

Most Popular Narrative Narrative: 4.5% Undervalued

With CarGurus last closing at $38.48 against a narrative fair value near $40, the story leans toward upside, hinging on how its marketplace scales.

Expansion and deeper adoption of data driven analytics tools and AI powered solutions across the dealer base are creating higher engagement, improved retention, and more actionable insights, which are expected to drive sustained Marketplace revenue growth and support increasing margins as dealers see measurable ROI and make CarGurus central to their workflow.

Curious how steady, mid single digit growth can still justify a richer profit profile and lower future multiple than peers? The narrative leans on bold earnings compounding, aggressive margin expansion, and shrinking share count. Want to see the exact roadmap that bridges today’s price to that higher intrinsic value?

Result: Fair Value of $40.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained pressure from Amazon Autos, along with slower than expected international expansion, could squeeze margins and stall the upbeat earnings and valuation narrative.

Find out about the key risks to this CarGurus narrative.

Another Angle on Valuation

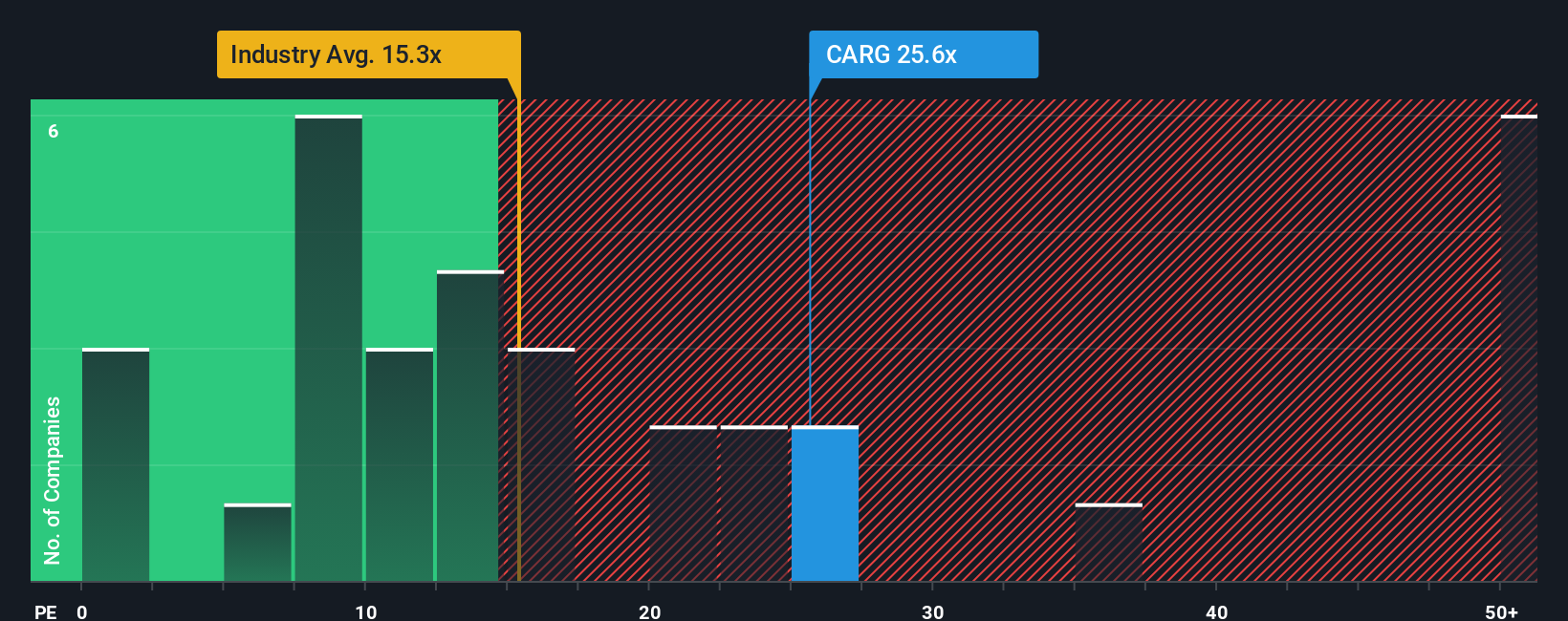

While the narrative fair value suggests only a small upside, the earnings multiple tells a different story. CarGurus trades on a 24.2 times earnings ratio versus a 21.4 times fair ratio, and well above both industry and peer averages. That rich premium could unwind quickly if growth stumbles, or it could be justified by the earnings ramp and buybacks.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CarGurus Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a complete view in minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding CarGurus.

Looking for more investment ideas?

Before the next move in CarGurus plays out, broaden your opportunity set with curated stock ideas from Simply Wall Street that target specific themes, income, and growth.

- Capitalize on market mispricings by reviewing these 918 undervalued stocks based on cash flows that pair solid fundamentals with attractive entry points.

- Target future facing innovation by assessing these 24 AI penny stocks positioned to benefit from rapid advances in artificial intelligence.

- Strengthen your income stream by scanning these 13 dividend stocks with yields > 3% that balance yield with sustainable payout potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報