League of Nations Minsheng Securities: Did the US CPI exceed expectations in November and re-examine the path of interest rate cuts?

The Zhitong Finance App learned that Guolian Minsheng Securities released a research report saying that the November US inflation data “surprised” the market. From a structural perspective, energy and food inflation are still the main forces supporting the overall CPI, while core inflation is showing a clear weakening trend. For the Federal Reserve, although the November CPI is unlikely to change the decision to suspend interest rate cuts in January next year, it will undoubtedly increase dovish voices within the Federal Reserve. If the December data continues the current slow upward trend, it may prompt the Federal Reserve to re-examine next year's interest rate cut path, but everything will have to wait until the December “clean” data is released before making a conclusion.

The main views of the League of Nations Minsheng Securities are as follows:

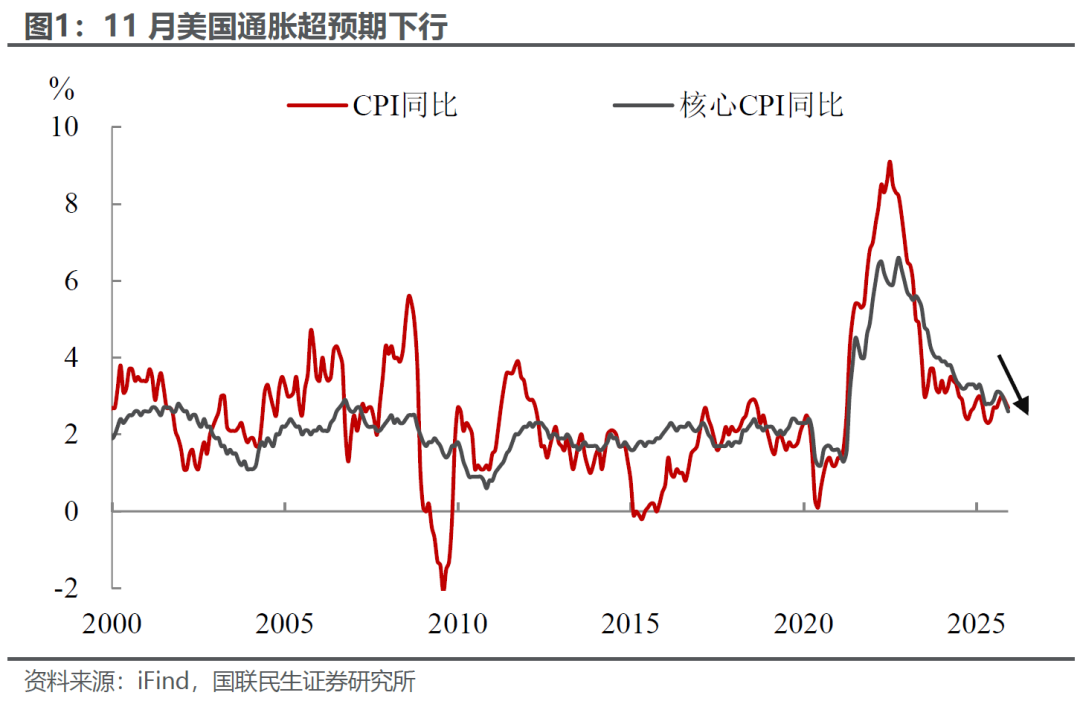

As the last major US data of the year, the November inflation certainly “surprised” the market. CPI and core CPI fell sharply to 2.7% and 2.6% year over year. Not only was it far below the previous average market forecast of 3%, but core inflation even fell to its lowest level since the beginning of 2021. Faced with this sudden “good news,” the asset side also showed optimistic pricing. The US dollar declined in the short term, stocks and bonds rose sharply, the NASDAQ rose by more than 1 percentage point, and precious metals showed some profit recovery characteristics after rising.

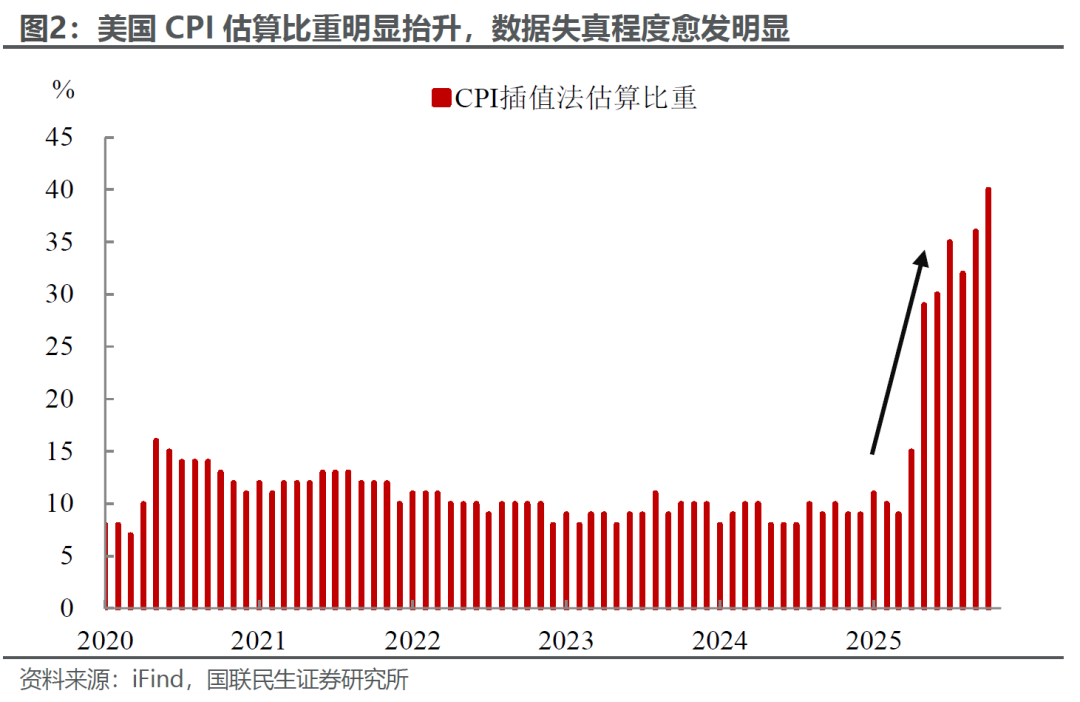

However, on closer inspection, there is clear statistical “noise” in the November inflation data. On the one hand, the government shutdown has seriously affected the Department of Labor's data collection work, resulting in the lack of month-on-month data on October inflation and November inflation, and there is limited effective information that can be interpreted in the market; on the other hand, given that the US government only resumed normal operation in mid-November, the statistical range of the November price survey only covers the latter part of the month, coinciding with holiday sales seasons such as Thanksgiving, seasonal disturbances in price fluctuations may cause statistical results to be distorted to a certain extent.

As far as the market is concerned, although there are quality issues with the data, this flawed report at least gave it a glimmer of light, easing concerns about short-term upward inflation. Given the gradual narrowing of the current room for the Federal Reserve to cut interest rates, only a sharp improvement or deterioration in economic data that exceeds expectations may have a clear impact on the market. Both good news (Goldilocks status) and bad news (the Federal Reserve's PUT has power) are considered good news, but news that isn't good enough or bad enough doesn't count. However, the non-agricultural sector did not fully achieve in November, and the current inflation successfully took the key “first step.”

For the Federal Reserve, although the November CPI is unlikely to change the decision to suspend interest rate cuts in January next year, it will undoubtedly increase dovish voices within the Federal Reserve. If the December data continues the current slow upward trend, it may prompt the Federal Reserve to re-examine next year's interest rate cut path. The combination of “economic slowing+low inflation” will help the Fed make more choices to cut interest rates than the median value in the December bitmap (interest rate cut only once in 2026), but everything will have to wait until December is more “clean” data to be released before a conclusion can be made.

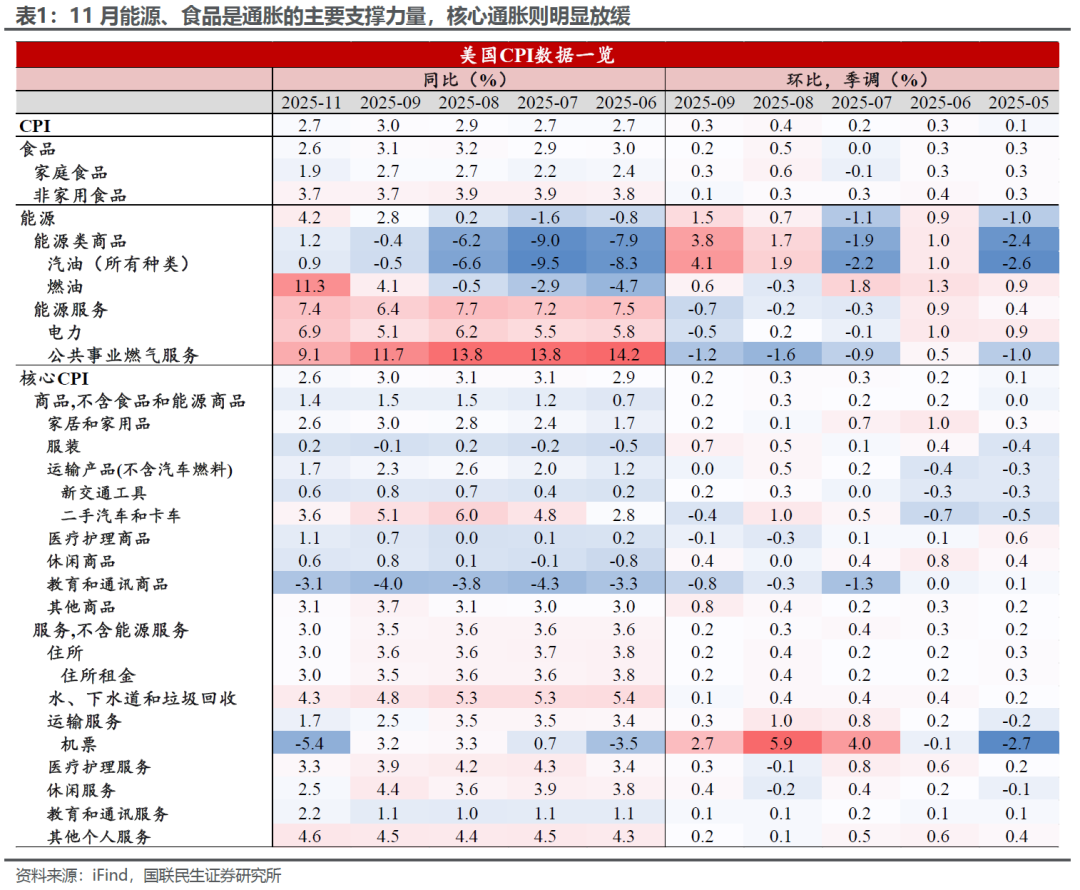

From a structural point of view, energy and food inflation is still the main force supporting the overall CPI, while core inflation is showing a clear weakening trend:

The year-on-year growth rate of food and energy inflation remained high, which is basically consistent with high-frequency data. The year-on-year increase in retail gasoline prices in the US further expanded in November, while the year-on-year growth rate of global food prices monitored by the International Food and Oil Organization also rebounded compared to September. The two major sub-items together contributed to the upward trend in overall inflation.

However, core inflation weakened significantly, with the core services segment leading the decline:

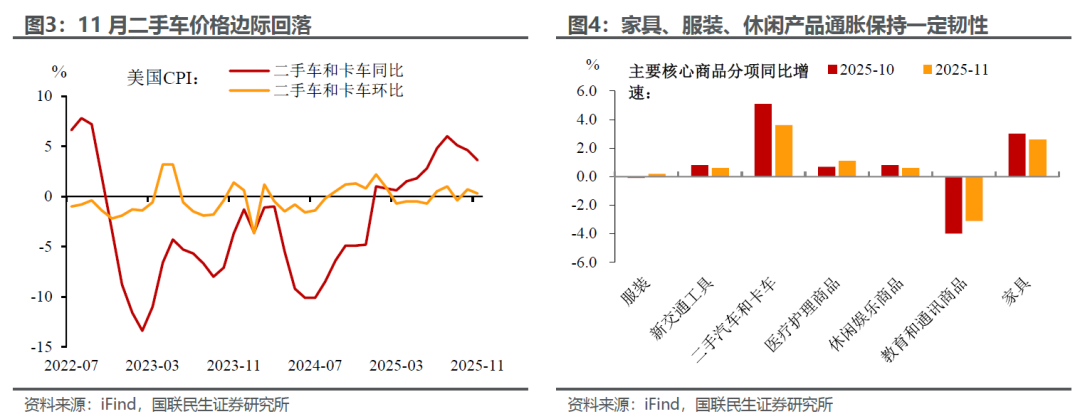

On the one hand, commodity inflation is more resilient under the influence of tariffs. Core commodities fell only slightly to 1.4% year on year in November, mainly affected by the fall in automobile inflation. This may be related to the phased decline in automobile sales due to the expiration of the federal preferential tax policy for electric vehicles in the previous period. However, for categories that are highly dependent on imports, such as clothing, furniture, and leisure goods, the year-on-year price growth rate remains relatively high, indicating that the transmission effect of tariffs on the cost side of related categories has not subsided. ,

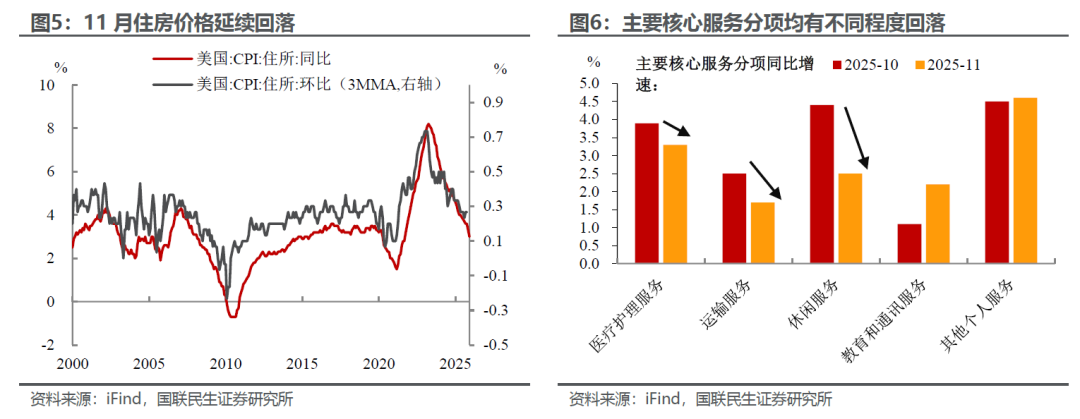

On the other hand, core service inflation was the leading factor in the overall decline in core inflation during the current period. Specifically, housing inflation fell sharply to 3.0% year on year from the previous value of 3.6%, and the suppressing effect of the high interest rate environment on the housing market demand continued to show, hedging the upward pressure on the commodity side to a great extent. At the same time, super core inflation continued to decline, and the year-on-year growth rate declined from 3.2% of the previous value to 2.7%. Among them, the price decline in segments such as transportation services (especially air ticket prices) and leisure services was the most prominent.

Risk warning: US economic and trade policies have changed drastically; the spread of tariffs has exceeded expectations, leading to a slowdown in the global economy that exceeds expectations and an increase in market adjustments.

Nasdaq

Nasdaq 華爾街日報

華爾街日報