Assessing Pool’s (POOL) Valuation After a Year of Falling Returns and Sliding Share Price

Event driven move in Pool stock

Pool (POOL) shares have drifted lower over the past year, even as revenue and net income kept growing, which sets up an interesting gap between the stock performance and the underlying business.

See our latest analysis for Pool.

That gap has been widening, with the 90 day share price return of negative 25.7 percent and a one year total shareholder return near negative 29.5 percent pointing to fading momentum as investors reassess cyclical risks and valuation.

If Pool has you thinking about where else durable growth might be hiding, this could be a good moment to explore fast growing stocks with high insider ownership.

With profits still rising and the share price sliding, investors are left with a puzzle: is Pool now trading at a discount to its true potential, or is the market already pricing in a slower growth future?

Most Popular Narrative: 26.8% Undervalued

With Pool last closing at $236.36 against a narrative fair value near $322.91, the story leans toward a meaningful upside gap in expectations.

The aging installed U.S. pool base continues to create steady, nondiscretionary demand for renovation, maintenance, and parts, partially insulating revenues from new build cyclicality and underpinning durable long term earnings growth.

Curious how modest top line growth, firmer margins and a richer future earnings multiple can still argue for big upside, despite softer recent returns and flat guidance.

Result: Fair Value of $322.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent housing market weakness and rising cost pressures could curb new pool construction and squeeze margins, challenging assumptions behind the upside case.

Find out about the key risks to this Pool narrative.

Another Angle on Valuation

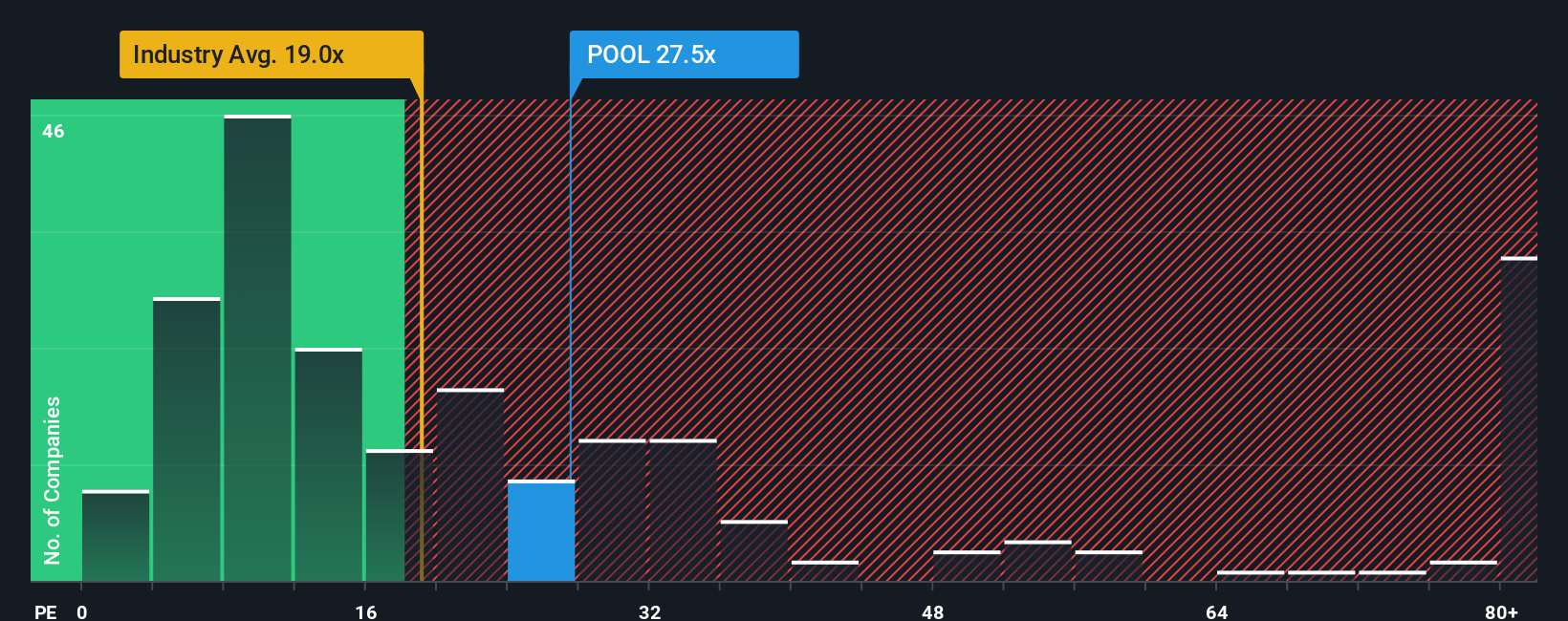

Multiples tell a tougher story. Pool trades on a price to earnings ratio of about 21.5 times, versus a fair ratio of 15.4 times and a global Retail Distributors average near 18.5 times. That premium points to valuation risk, even if earnings continue to move higher from here.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pool Narrative

If you see the story differently or prefer digging into the numbers yourself, you can build a personalized view in just a few minutes: Do it your way.

A great starting point for your Pool research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop your research with just one company. Use the Simply Wall St screener to uncover fresh, data backed ideas that other investors may overlook.

- Capture powerful growth themes early by scanning these 24 AI penny stocks and targeting companies reshaping industries with machine learning, automation, and real time intelligence.

- Strengthen your portfolio’s cash flow potential by assessing these 13 dividend stocks with yields > 3% that aim to deliver reliable income alongside solid fundamentals.

- Position yourself ahead of the crowd by reviewing these 80 cryptocurrency and blockchain stocks that are building the infrastructure and services behind digital assets and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報