FuelCell Energy (FCEL) Narrows Q4 Losses, Testing Bearish Profitability Narratives

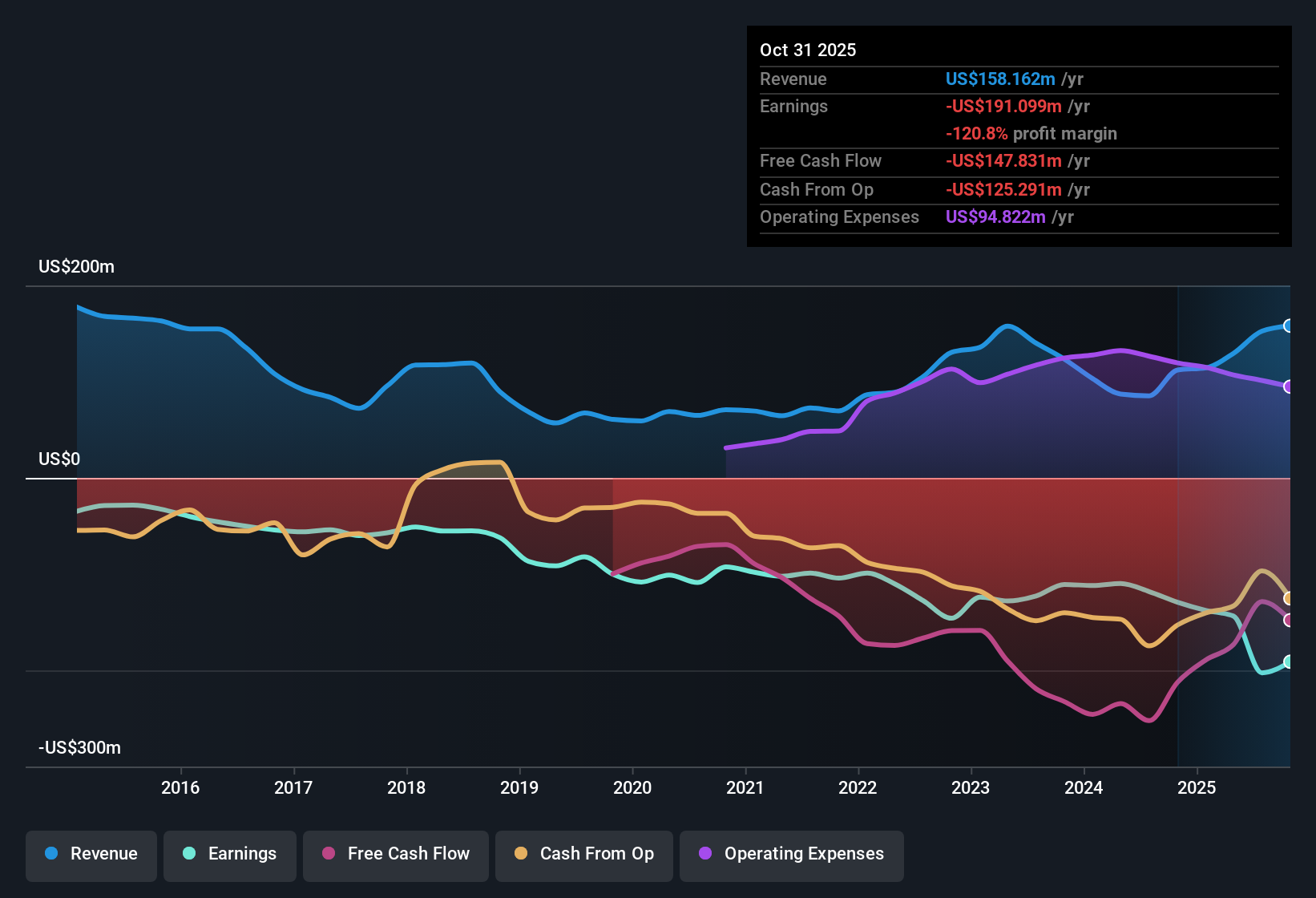

FuelCell Energy (FCEL) has put out its FY 2025 numbers with fourth quarter revenue at about $55.0 million and basic EPS of roughly -$0.85, capping off a trailing twelve months that saw revenue of around $158.2 million and basic EPS of about -$7.42. The company has seen quarterly revenue move from roughly $49.3 million in Q4 2024 to $55.0 million in Q4 2025, while net income for these quarters remained negative at about -$42.2 million and -$30.7 million respectively. This underscores that top line scale is still running ahead of any margin recovery. With losses persisting even as sales expand, investors will be watching how quickly margins might improve from here.

See our full analysis for FuelCell Energy.With the latest headline numbers on the table, the next step is to see how they line up with the dominant narratives around FuelCell Energy, and where the data pushes back against what investors think they know.

See what the community is saying about FuelCell Energy

Revenue Up 31 Millions Year on Year

- Total revenue over the last twelve months reached about 158.2 millions dollars, up from roughly 112.1 millions dollars at the end of FY 2024. This shows that sales are scaling even while the business is still loss making.

- Consensus narrative highlights new projects like the up to 360 megawatts data center partnership and the 30 module order in South Korea as big drivers of that growth. However, the trailing twelve month net loss of about 191.1 millions dollars and a Basic EPS of around -7.42 dollars show that higher sales alone have not yet translated into better overall profitability.

- Those partnerships fit the bullish growth story, but the widening losses over the past five years at roughly 11.1 percent per year back the cautious side of the narrative that stresses execution and cost risk.

- Forecast revenue growth of about 24.9 percent per year supports optimism on the top line, while the expectation of ongoing losses over the next three years supports the more restrained, balanced view on when or whether that growth will pay off for shareholders.

Losses Narrow After Q3 Spike

- Net loss improved from about 92.5 millions dollars in Q3 2025 to roughly 30.7 millions dollars in Q4 2025, and Basic EPS moved from around -3.78 dollars to about -0.85 dollars quarter on quarter, even though the trailing twelve month net loss is still a sizable 191.1 millions dollars.

- Bears focus on the pattern of losses, pointing out that the company is forecast to stay unprofitable for at least the next three years, and the 191.1 millions dollars trailing twelve month loss backs their concern that cost cuts and restructuring have a long way to go before they can offset ongoing spending on technology and growth.

- Cost reduction plans targeting a 15 percent cut in operating expenses in fiscal 2025 sit against this backdrop of deep losses, so any slip in execution would directly support the cautious view that profitability remains distant.

- At the same time, quarterly improvement from Q3 to Q4 gives bears less evidence of a steadily worsening trend, so their argument leans more on the multi year loss record than on the very latest quarter.

Rich 2.9x Sales Valuation

- The stock trades on a Price to Sales ratio of about 2.9 times, compared with roughly 2.1 times for the US Electrical industry and about 1.0 times for peers, even though the business generated a trailing twelve month net loss of around 191.1 millions dollars and is not expected to reach profitability in the next three years.

- Bullish investors argue that fast forecast revenue growth of about 24.9 percent per year justifies paying that premium multiple today. Yet the current share price of 9.67 dollars versus an analyst consensus target of roughly 7.84 dollars and ongoing dilution, with shares expected to grow about 7 percent annually, means the numbers also leave room for the bearish valuation view that the market is already pricing in a lot of that future growth.

- The premium Price to Sales ratio against both the industry and direct peers strengthens the skeptics case that this is a higher risk, growth first story rather than a value play.

- On the other hand, if revenue did reach the 310.5 millions dollars level analysts are modeling for 2028, that same multiple would imply a larger absolute valuation base, which helps explain why some bulls are still willing to pay up despite the lack of near term profits.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for FuelCell Energy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers from another angle? Use that perspective to build your own narrative in just a few minutes with Do it your way.

A great starting point for your FuelCell Energy research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

FuelCell Energy still faces steep ongoing losses, a rich revenue based valuation, and no clear path to profitability over the next several years.

If that combination of deep red ink and premium pricing feels too risky, shift your focus to these 916 undervalued stocks based on cash flows to quickly uncover stronger value opportunities today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報