Worthington Steel (WS) Q2 2026 Margin Compression Undercuts Bullish Turnaround Narrative

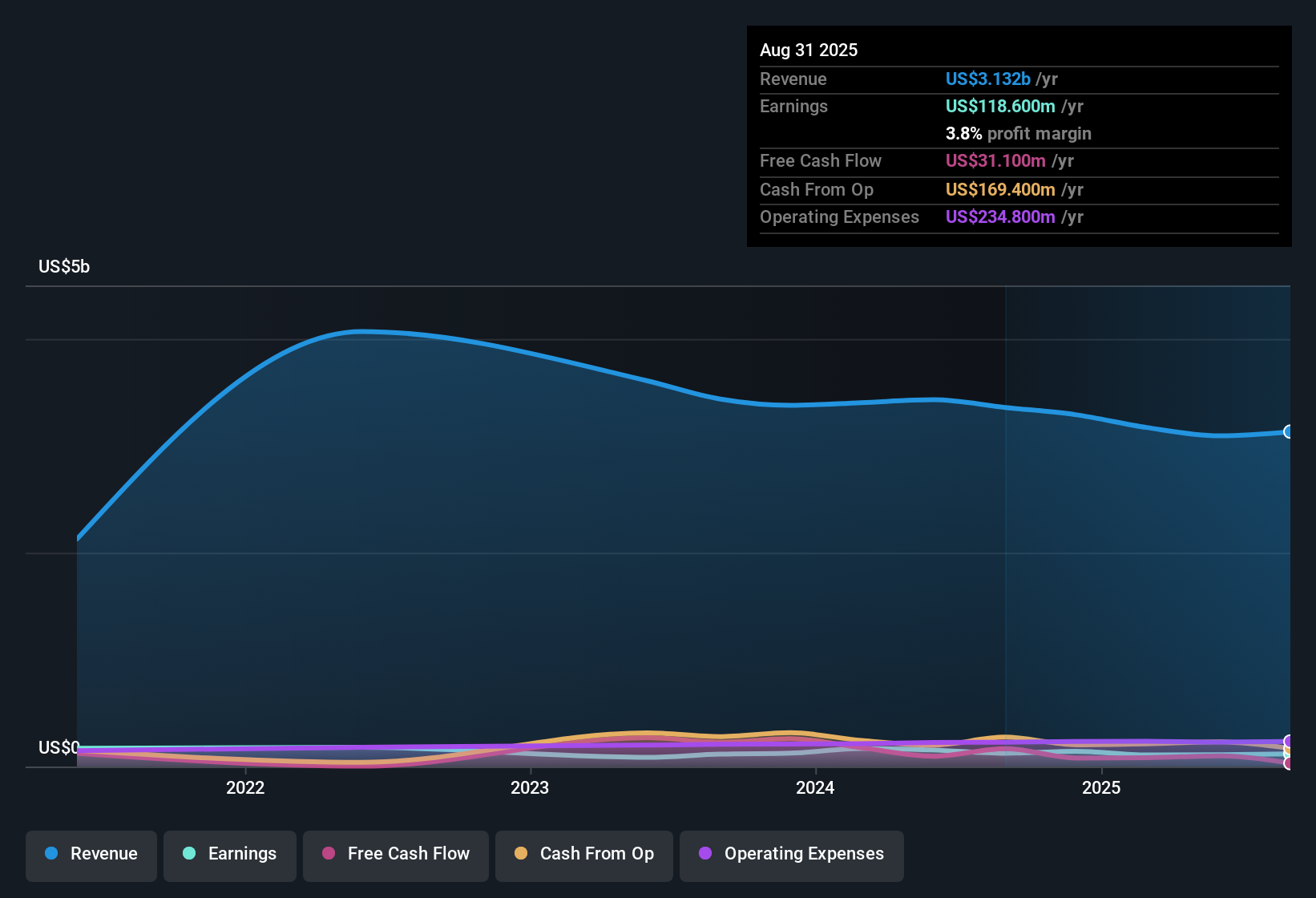

Worthington Steel (WS) just posted Q2 2026 results with revenue of about $871.9 million and EPS of $0.38, while trailing twelve month revenue came in at roughly $3.3 billion with EPS of $2.52, setting a clear snapshot of its recent performance. The company has seen quarterly revenue move from $739 million in Q2 2025 to $871.9 million in Q2 2026 and EPS shift from $0.26 to $0.38 over the same period, giving investors a data rich backdrop against which to evaluate the recent trends in growth expectations and margin compression.

See our full analysis for Worthington Steel.With the latest numbers on the table, the next step is to see how they line up with the dominant narratives around Worthington Steel and whether the margin picture supports the story investors have been considering.

See what the community is saying about Worthington Steel

Margins Softening as Profit Trails Revenue

- Net income for Q2 2026 was $18.8 million on $871.9 million of revenue, compared with $36.3 million on $872.9 million just one quarter earlier, showing profit falling even while sales stayed roughly flat.

- Consensus narrative leans on efficiency improvements and better market conditions to lift margins, yet trailing net profit margin has slipped from 4.4 percent to 3.8 percent over the last year, which pushes management’s transformation plans to work against a recent margin decline rather than on top of stable profitability.

- Analysts expect margins to rise to about 5.0 percent over the next three years, so the current 3.8 percent level leaves a noticeable gap to close.

- Shipments in areas like automotive and construction have already been described as weaker, which makes that planned margin improvement more dependent on cost control than on strong volume growth.

Valuation Signals Versus Slower Growth

- Worthington Steel trades on a trailing P/E of 14.4 times versus about 24.4 times for the US Metals and Mining industry and 50.7 times for its peer set, while a DCF fair value of $69.53 stands well above the current share price of $36.11.

- Bulls highlight that forecast earnings growth of roughly 7.2 percent per year and revenue growth of about 2.8 percent support that valuation gap, but the same data shows that both growth rates sit below the referenced US market averages of 16.2 percent for earnings and 10.6 percent for revenue, so the optimistic view leans heavily on valuation rather than outsize growth.

- Trailing twelve month net income of $125.1 million on about $3.3 billion of revenue reflects a modest profit base, which needs to scale meaningfully for the DCF fair value of $69.53 to look achievable.

- Five year earnings have declined at about 8.2 percent per year, so the forward looking growth story is asking investors to believe in a clear reversal of that longer term trend.

Short Term Profit Volatility and Longer Term Slippage

- Basic EPS dropped from $1.13 in Q4 2025 to $0.73 in Q1 2026 and then to about $0.38 in Q2 2026, while trailing twelve month EPS sits at roughly $2.52 after years in which earnings declined on average by 8.2 percent annually.

- Skeptical investors point to the fall in trailing net margin from 4.4 percent to 3.8 percent and the five year EPS decline as signs that recent drops in quarterly EPS are part of a longer pattern, not just noise, especially when analysts only expect revenue to grow around 3.5 percent a year even as shipments in markets like agriculture and heavy trucks are already described as weak.

- Inventory holding losses and higher SG and A costs have been identified as headwinds to earnings, which directly aligns with the observation that EPS has slid from over one dollar to under forty cents across the last three reported quarters.

- With these pressures, the current $36.11 share price might already be reflecting worries that margins will not quickly climb to the roughly 5.0 percent level that analysts are building into their future earnings path.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Worthington Steel on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Use your own take on the data to build a fresh narrative in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Worthington Steel.

Explore Alternatives

Worthington Steel’s softening margins, volatile EPS and below market growth expectations suggest its turnaround story carries meaningful execution risk and uncertainty.

If that kind of earnings wobble makes you uneasy, use our stable growth stocks screener (2096 results) to quickly refocus on companies delivering steadier revenue and profit progress through different cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報