Does Progyny’s 2025 Rally Match Its Fertility Growth Story and Cash Flow Outlook?

- If you are wondering whether Progyny is still a smart way to play the long term growth of fertility benefits, you are not alone and the numbers give us plenty to unpack.

- The stock has quietly climbed 0.6% over the last week and 1.2% over the past month, but the real eye catcher is its 47.5% year to date gain and 84.4% return over the last year despite still being down over 3 and 5 years.

- Behind that rebound, Progyny has continued expanding its roster of large employer clients and deepening relationships with existing partners. This reinforces the idea that fertility benefits are moving from perk to core healthcare spend. At the same time, the broader shift toward personalized, outcomes based healthcare has kept investor attention on specialists like Progyny, helping justify the recent rerating in its share price.

- Even after this run, Progyny only scores a 2 out of 6 on our valuation checks today. In the rest of this article we will break down what different valuation methods say about the stock and then look at a more nuanced way to think about fair value.

Progyny scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Progyny Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and discounting them back to today in dollar terms. For Progyny, the model uses a two-stage Free Cash Flow to Equity approach, starting from last twelve month free cash flow of about $199.8 million.

Analysts provide detailed forecasts for the next several years, and Simply Wall St extrapolates beyond that. By 2029, free cash flow is projected to reach roughly $240.3 million, and longer-term estimates are in the low to mid $200 million range over the next decade as the business scales and then matures.

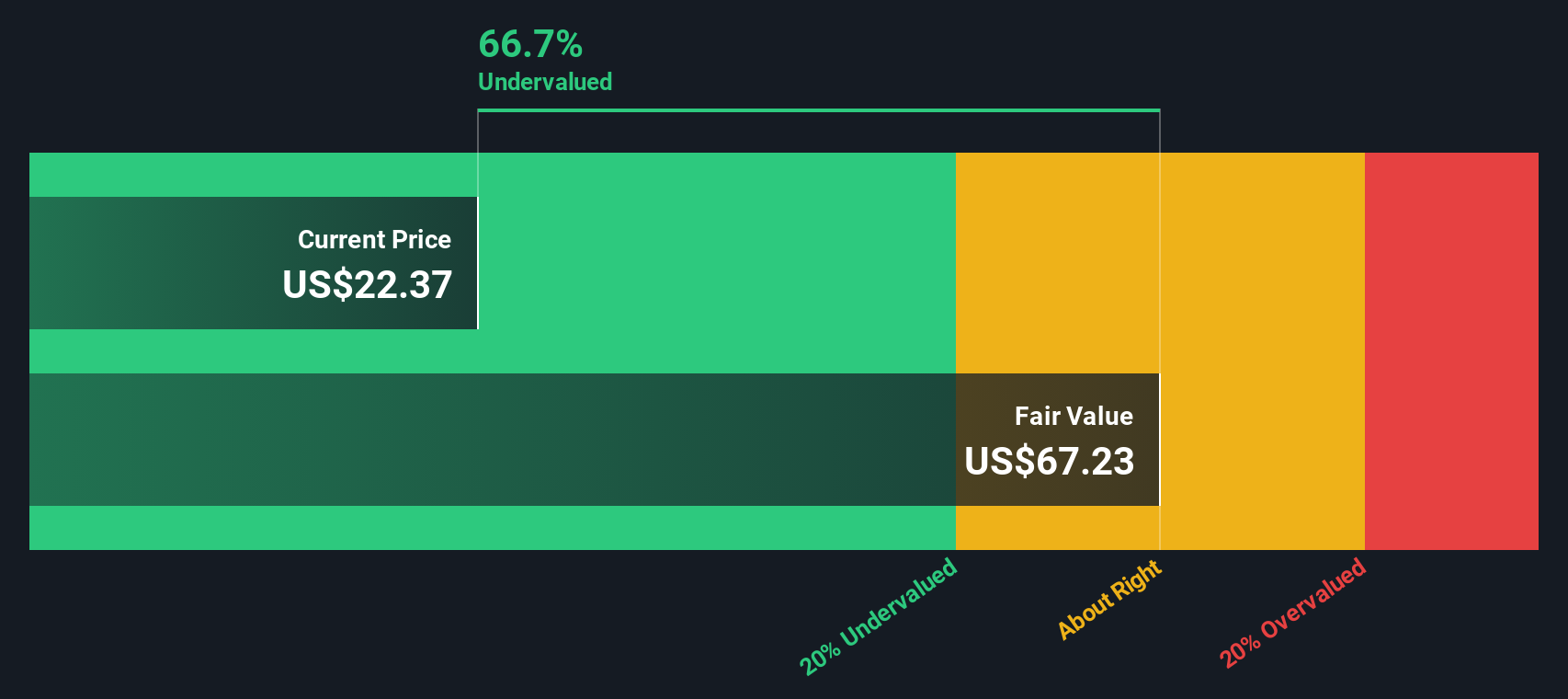

When these cash flows are discounted back to today, the model arrives at an intrinsic value of about $71.04 per share. Compared to the current share price, this implies Progyny is trading at a 63.2% discount to its estimated fair value, which indicates potential upside if the cash flow path plays out as expected.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Progyny is undervalued by 63.2%. Track this in your watchlist or portfolio, or discover 916 more undervalued stocks based on cash flows.

Approach 2: Progyny Price vs Earnings

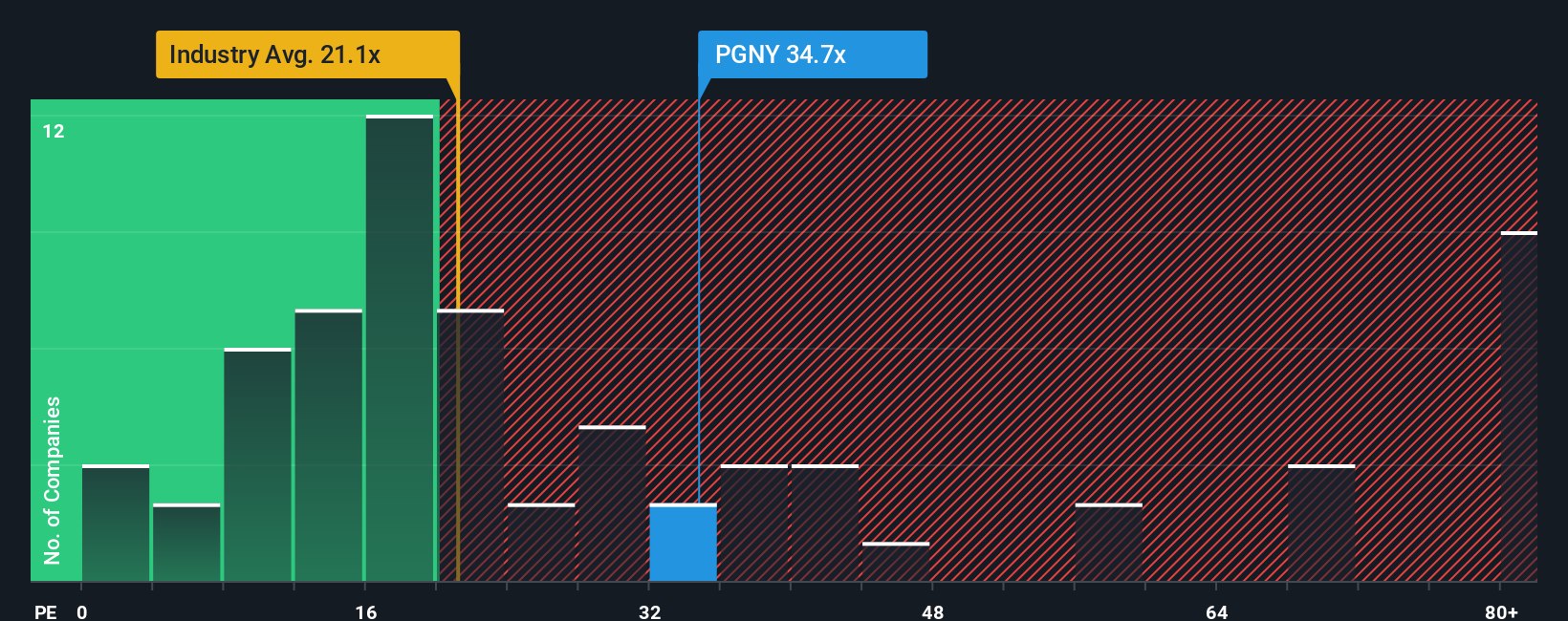

For profitable companies like Progyny, the price to earnings (PE) ratio is a useful way to gauge how much investors are willing to pay today for each dollar of current earnings. A higher PE can be reasonable if a business is expected to grow faster or is seen as less risky. Lower growth or higher uncertainty usually warrant a lower, more conservative multiple.

Progyny currently trades on a PE of about 39.9x, well above both the Healthcare industry average of roughly 23.6x and the peer average of around 22.5x. On the surface, that premium suggests investors are already factoring in strong growth and durable profitability.

Simply Wall St also calculates a proprietary Fair Ratio for each stock. In Progyny’s case, this is 26.3x. This Fair Ratio aims to be more precise than simple peer or industry comparisons because it folds in the company’s own earnings growth outlook, risk profile, profit margins, industry, and market cap. Comparing Progyny’s current 39.9x PE to its 26.3x Fair Ratio points to a valuation that is higher than what those fundamentals justify, indicating the shares look expensive on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1455 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Progyny Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, an easy tool on Simply Wall St’s Community page where millions of investors connect a company’s story to a concrete financial forecast and a fair value. They do this by writing down their view of Progyny’s long term demand for fertility benefits, revenue growth, earnings power, and margins, then comparing that fair value estimate to today’s share price to decide whether to buy, hold, or sell. The platform automatically updates those Narratives as new earnings, news, or policy changes arrive. One investor might build a bullish Progyny Narrative around expanding IVF coverage, rising utilization and a fair value near $32. A more cautious investor could focus on macro risks, client concentration, and slower growth to justify a fair value closer to $23, both using the same framework but different assumptions to support more transparent decision making.

Do you think there's more to the story for Progyny? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報