UBS Group (SWX:UBSG) Valuation After Leadership Shake-Up and Potential Swiss Capital Rule Easing

UBS Group (SWX:UBSG) is back in focus after a shake up in its operations and technology leadership, just as Swiss lawmakers debate looser capital rules that could reshape the bank’s balance sheet and strategic flexibility.

See our latest analysis for UBS Group.

Those leadership changes and potential capital rule relief are landing against a strong backdrop, with UBS’s share price at about $36.7 after a 1 month share price return of 21.20 percent and a 5 year total shareholder return of 235.08 percent. This suggests momentum is still very much building rather than fading.

If UBS’s recent run has you thinking about where else capital and leadership shifts could drive upside, now is a good time to explore fast growing stocks with high insider ownership.

With the shares now trading slightly above the average analyst price target and after such a powerful multi year run, the key question is clear: is UBS still attractive at this level, or is future growth already priced in?

Most Popular Narrative: 8.3% Overvalued

With UBS Group trading around CHF36.7 against a narrative fair value near CHF33.9, the current share price sits ahead of projected fundamentals.

The analysts have a consensus price target of CHF32.13 for UBS Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF39.5, and the most bearish reporting a price target of just CHF21.0.

Curious how modest revenue growth, sharply higher profit margins and a lower future earnings multiple can still justify today’s lofty price tag? The narrative spells it out.

Result: Fair Value of $33.89 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, looming Swiss capital rule changes, as well as lingering Credit Suisse integration risks, could still undermine UBS’s earnings momentum and constrain shareholder returns.

Find out about the key risks to this UBS Group narrative.

Another Lens on Value

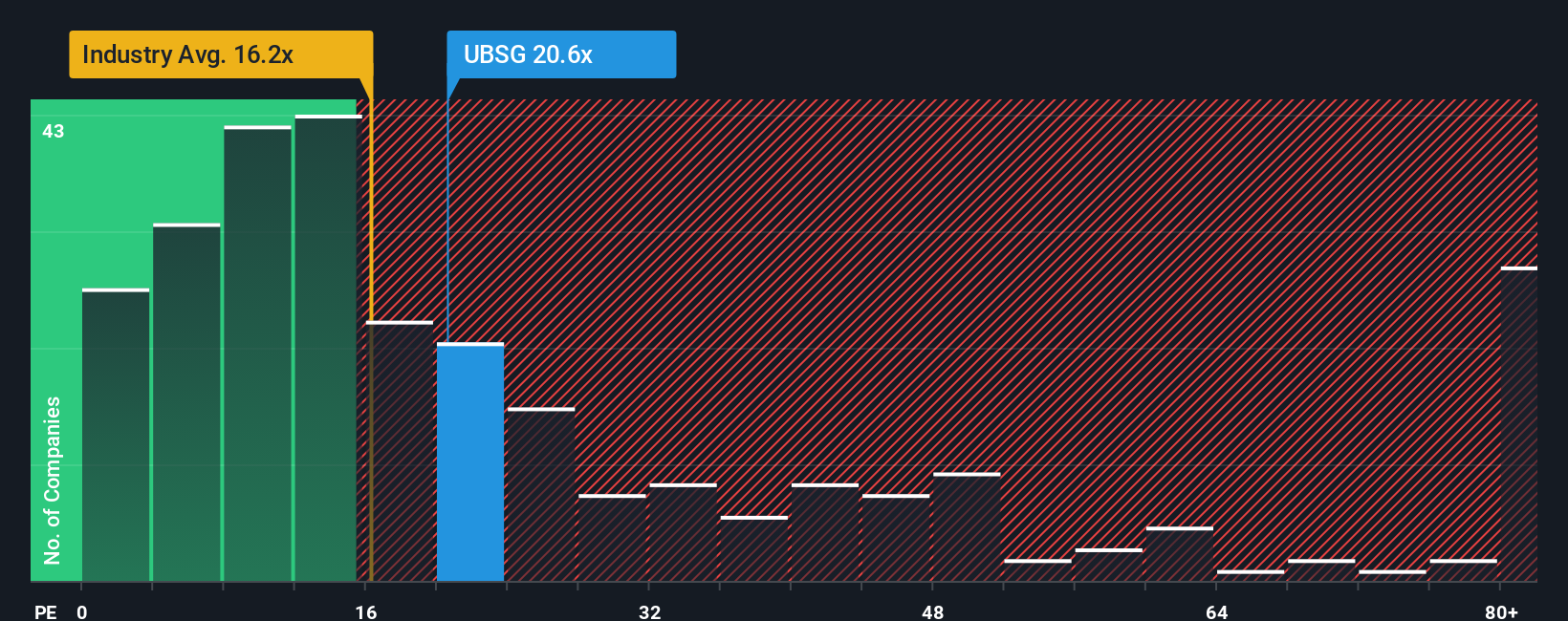

While the narrative fair value suggests UBS is about 8 percent overvalued, its current price to earnings ratio of roughly 20 times screens cheaper than peers at 21.2 times and below a 24.6 times fair ratio, pointing to room for upside if sentiment or earnings keep improving.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UBS Group Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes using Do it your way.

A great starting point for your UBS Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

UBS might be in your spotlight right now, but you will miss some of the market’s most compelling opportunities if you stop your search here.

- Capture potential multi baggers early by targeting these 3630 penny stocks with strong financials with robust balance sheets and real business momentum rather than hype.

- Capitalize on structural growth in automation and data by zeroing in on these 24 AI penny stocks powering the next wave of intelligent software and services.

- Lock in stronger long term return prospects by focusing on these 917 undervalued stocks based on cash flows where cash flows and prices are still meaningfully misaligned.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報