Has Cummins Run Too Far After Its 46% Surge Or Is Value Still Left?

- Wondering if Cummins at around $501 a share is still a smart buy or if the easy money has already been made? You are not alone, and that is exactly what we are going to unpack here.

- Despite a recent 4.2% pullback over the last week, the stock is still up 7.9% over the past month, 44.2% year to date, and an impressive 46.3% over the last year, with multi year returns well into triple digits.

- Those moves have come as investors focus on Cummins long term positioning in engines, power systems, and low emission technologies, alongside ongoing interest in industrial names tied to infrastructure and energy transition themes. At the same time, shifting sentiment around cyclical industrial demand and interest rates has added a bit more volatility to the ride.

- Right now, Cummins scores a 3/6 on our valuation checks, suggesting pockets of undervaluation but not a screaming bargain. Next we will break down what different valuation methods say about the stock, before finishing with a more complete way to think about its true worth.

Approach 1: Cummins Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today in dollar terms.

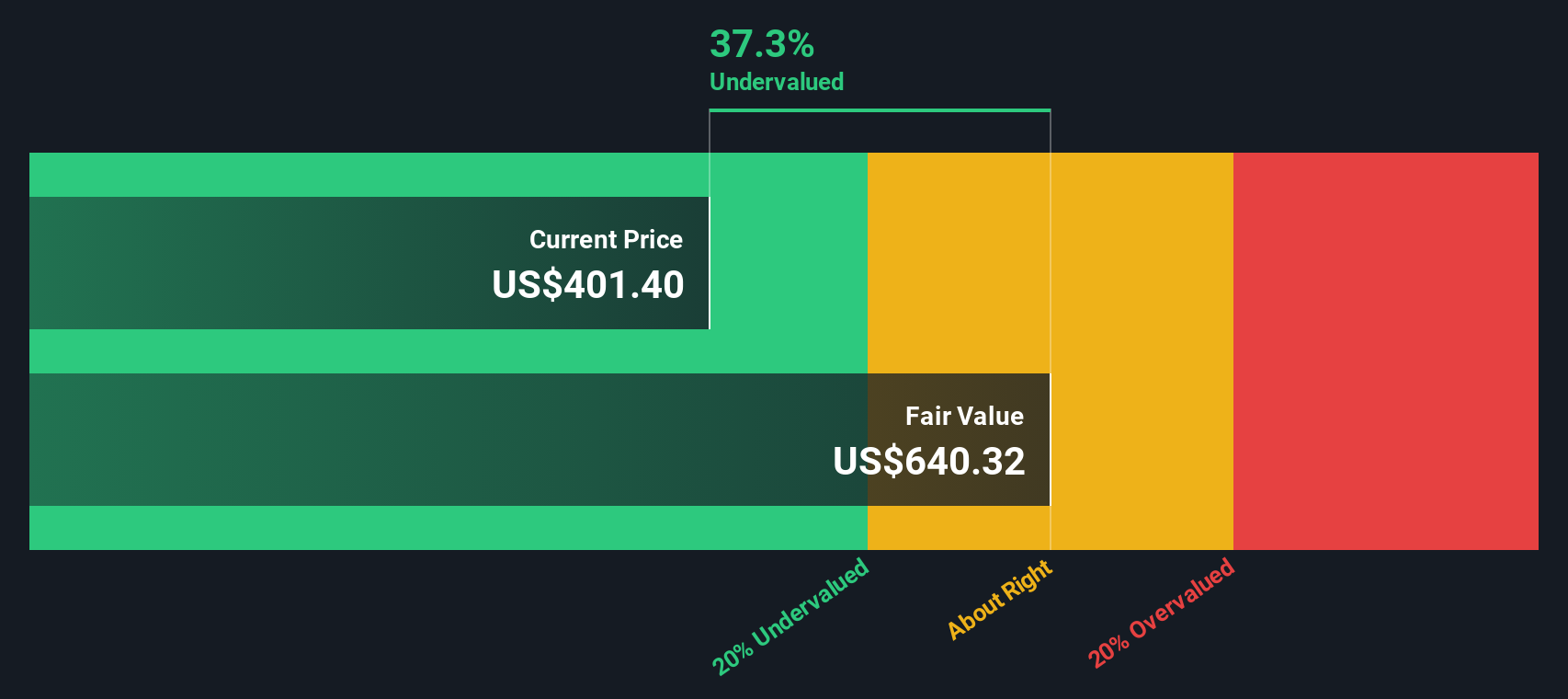

For Cummins, the 2 Stage Free Cash Flow to Equity model starts with last twelve months free cash flow of about $2.3 billion. It then uses analyst estimates for the next few years before extrapolating longer term trends. By 2029, free cash flow is projected to reach roughly $4.6 billion, with further growth assumed into the early 2030s based on more moderate, model-driven increases.

Aggregating and discounting these projected cash flows produces an estimated intrinsic value of about $641.46 per share. Compared with a recent share price around $501, the model implies the stock is roughly 21.8% undervalued on a cash flow basis. This suggests a potential margin of safety if these projections prove broadly accurate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Cummins is undervalued by 21.8%. Track this in your watchlist or portfolio, or discover 917 more undervalued stocks based on cash flows.

Approach 2: Cummins Price vs Earnings

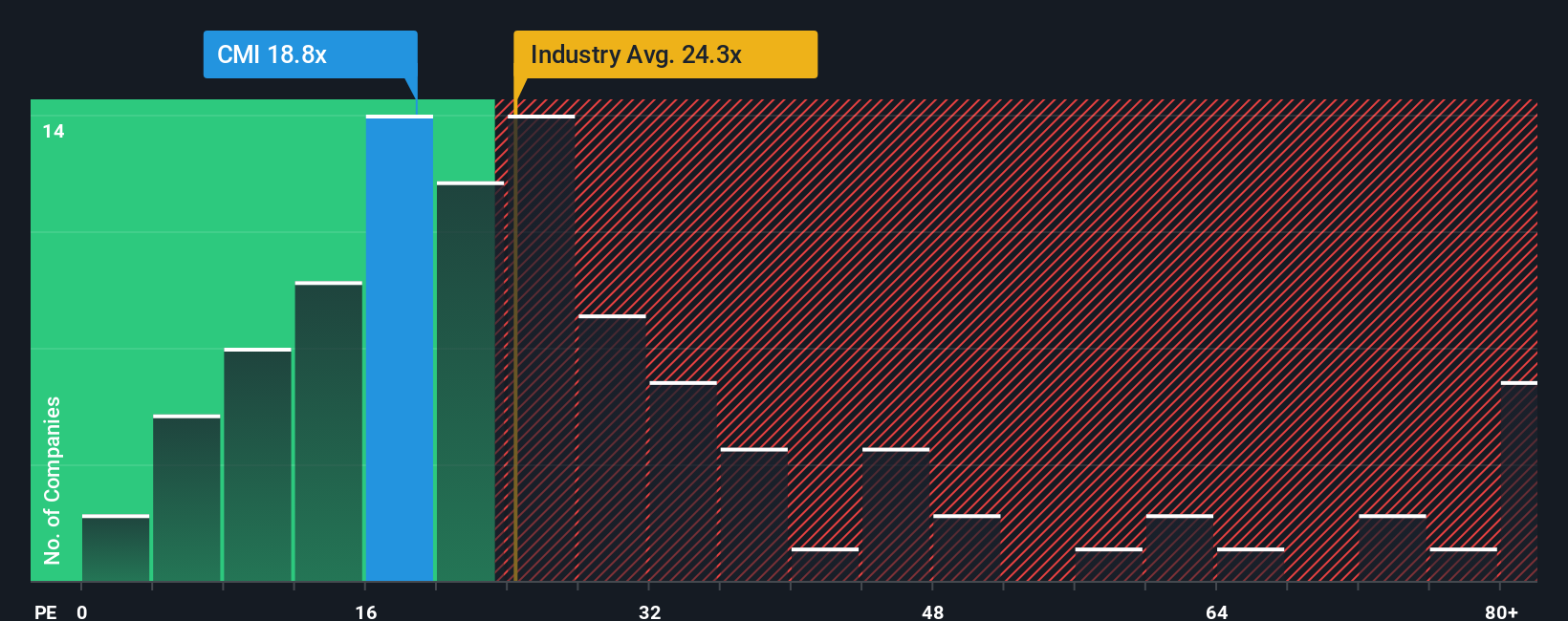

For a mature, consistently profitable manufacturer like Cummins, the price to earnings (PE) ratio is a natural way to judge valuation because it directly links what you pay for the stock to the profits the business is generating today.

In general, companies with stronger growth prospects and lower perceived risk tend to have higher PE ratios, while slower growing or riskier businesses tend to trade on lower multiples. Cummins currently trades on about 25.9x earnings, which is slightly above the broader Machinery industry average of roughly 25.4x and also ahead of the peer group average near 23.3x. On that simple comparison, the shares do not appear cheap.

However, Simply Wall St’s Fair Ratio, the proprietary estimate of what Cummins’ PE could be after accounting for its growth outlook, profitability, risk profile, industry, and market cap, is materially higher at around 34.8x. Because this Fair Ratio reflects company-specific drivers rather than blunt comparisons, it can be a more nuanced benchmark than just lining Cummins up against peers.

With the current PE at 25.9x compared to a Fair Ratio of 34.8x, the multiple suggests Cummins stock still screens as undervalued on an earnings basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1456 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cummins Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to attach your story about Cummins to the numbers by connecting your assumptions for future revenue, earnings, and margins to a clear fair value estimate that you can easily compare to today’s share price.

A Narrative on Simply Wall St’s Community page lets you spell out why you think Cummins’ data center demand, truck cycle, regulations, and competitive landscape will play out a certain way. It then automatically turns that view into a forward looking forecast and a dynamic fair value that updates when new news, earnings, or analyst revisions arrive.

For example, one Cummins Narrative might describe a view that data center power demand, higher margins, and a recovering truck cycle support a fair value near $522 per share. A more cautious Narrative that focuses on truck weakness, regulatory uncertainty, and slower alternative powertrain adoption might instead support a fair value closer to $350. This gives you a transparent, side by side view of how different perspectives translate into different decisions as the market price moves.

Do you think there's more to the story for Cummins? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報