US Undiscovered Gems These 3 Stocks to Watch Closely

In the wake of recent inflation data revealing a cooler-than-expected rise, major U.S. stock indexes have rebounded, with the Dow and S&P 500 poised to end their losing streaks. This positive shift in market sentiment provides an opportune moment to explore potential undiscovered gems in the small-cap sector, where companies often exhibit strong growth potential and resilience amid broader economic changes.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| Morris State Bancshares | 1.99% | 2.14% | 1.63% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| FineMark Holdings | 114.54% | 2.38% | -28.53% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Citizens & Northern (CZNC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Citizens & Northern Corporation is the bank holding company for Citizens & Northern Bank, offering a range of banking and related services to individual and corporate customers, with a market cap of $391.29 million.

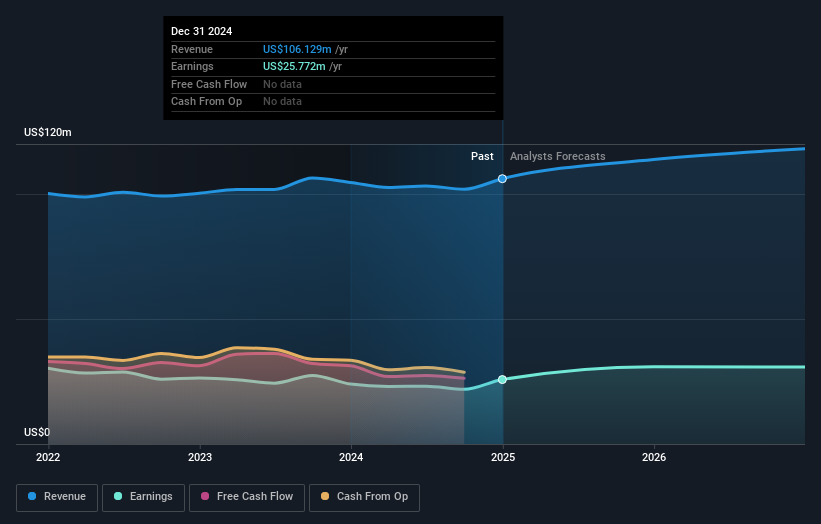

Operations: Citizens & Northern generates revenue primarily from its Community Banking segment, which contributed $109.63 million. The company's net profit margin is a key metric to consider when evaluating its financial performance.

Citizens & Northern, a financial entity with total assets of US$2.7 billion and total equity of US$294 million, has shown robust performance with earnings growth of 23% over the past year, surpassing the industry average. It operates on a solid foundation with US$2.2 billion in deposits and US$1.9 billion in loans, while maintaining an appropriate level of bad loans at 1.4%. The bank trades at 27.7% below its estimated fair value and boasts high-quality earnings despite recent shareholder dilution due to share repurchases totaling $0.44 million for 26,034 shares under a buyback program initiated in September 2023.

- Click here to discover the nuances of Citizens & Northern with our detailed analytical health report.

Assess Citizens & Northern's past performance with our detailed historical performance reports.

Tiptree (TIPT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tiptree Inc. operates through its subsidiaries to offer specialty insurance products and related services in the United States and Europe, with a market capitalization of approximately $690.66 million.

Operations: Tiptree generates revenue primarily from its insurance segment, which accounts for $2 billion, and a smaller contribution from the mortgage segment at $66.83 million.

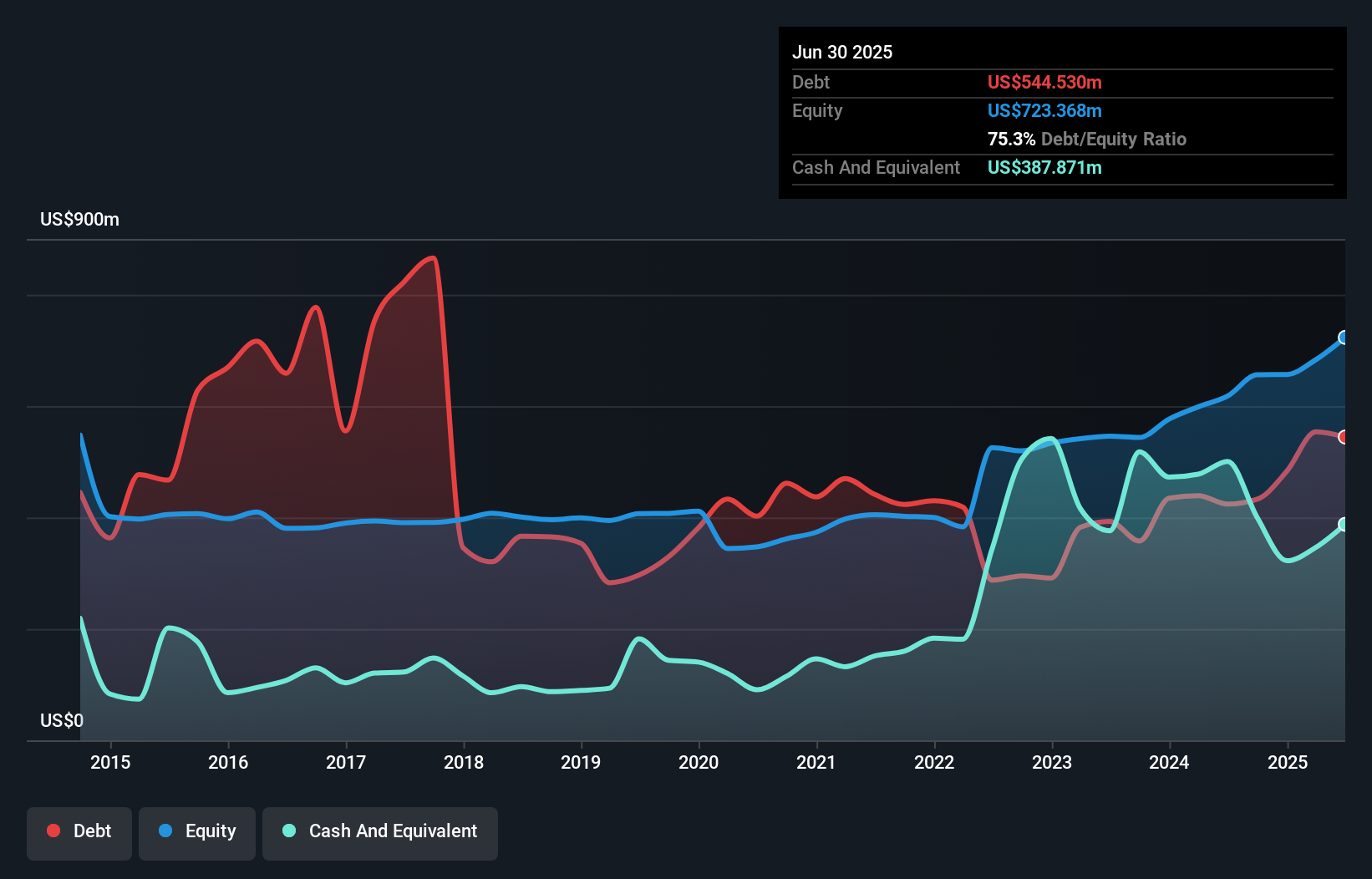

Tiptree has made notable strides with a debt-to-equity ratio dropping to 75.8% from 127.6% over five years, demonstrating improved financial health. Its earnings growth of 24.4% outpaces the insurance industry average of 11.6%, indicating strong performance, while its price-to-earnings ratio of 13.8x suggests it's undervalued compared to the US market average of 19x. Despite high-quality earnings and satisfactory net debt levels at 26%, recent events have stirred investor activism, particularly regarding the proposed sale of Fortegra Group to DB Insurance, which some argue is undervalued and lacks shareholder benefits, causing stock volatility with a ~23% drop post-announcement.

- Take a closer look at Tiptree's potential here in our health report.

Gain insights into Tiptree's historical performance by reviewing our past performance report.

First Bancorp (FNLC)

Simply Wall St Value Rating: ★★★★★★

Overview: The First Bancorp, Inc. serves as the bank holding company for First National Bank, offering a variety of banking products and services to both individual and corporate clients, with a market capitalization of $317.17 million.

Operations: First Bancorp generates revenue primarily from its banking operations, totaling $88.12 million.

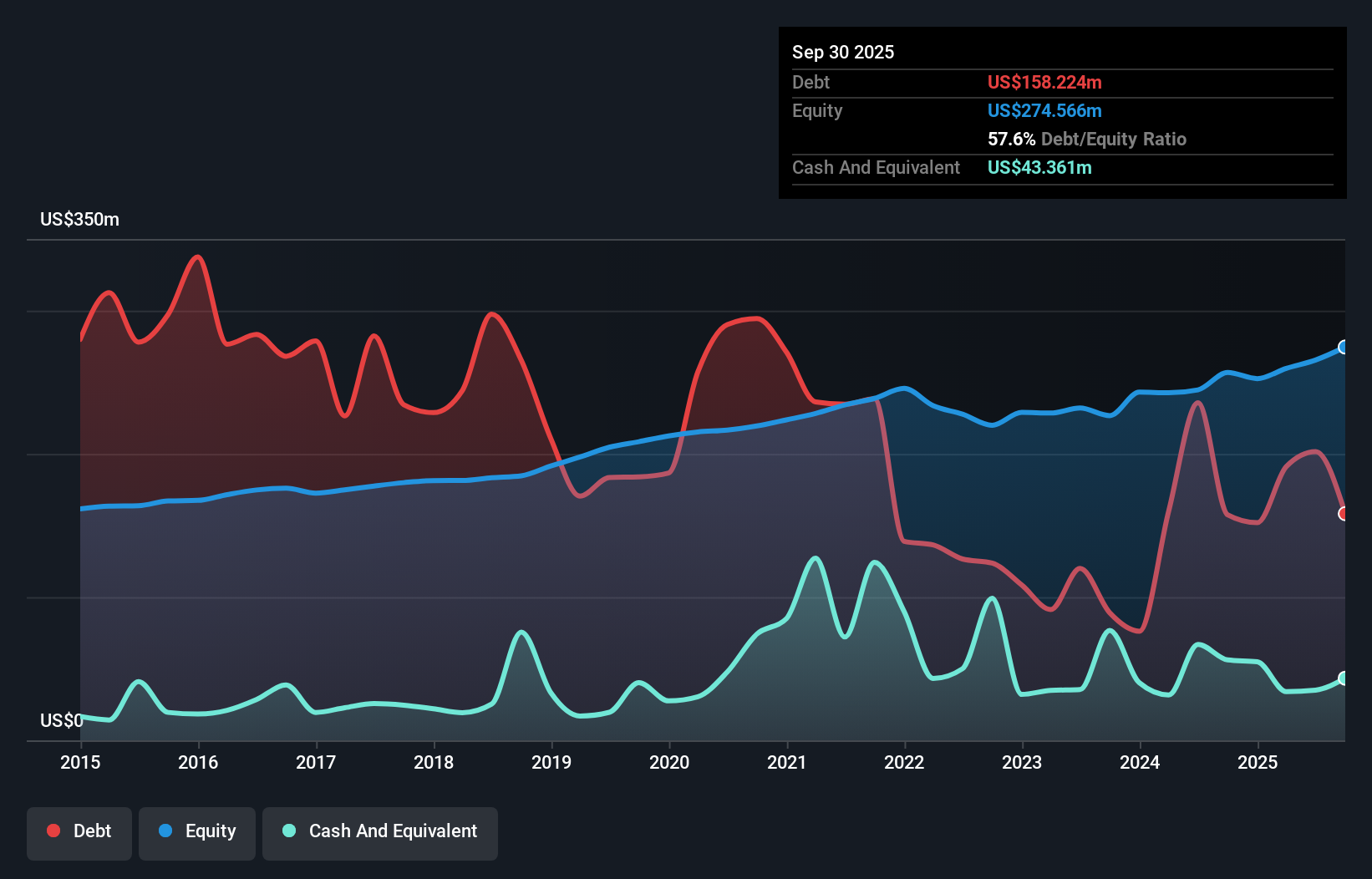

With total assets of US$3.2 billion, First Bancorp is a notable player with a solid financial foundation. The company boasts total deposits of US$2.7 billion and loans amounting to US$2.4 billion, reflecting its active lending operations. Its net interest margin stands at 2.3%, while the allowance for bad loans remains sufficient at 0.4% of total loans, indicating prudent risk management practices. Recent earnings growth of 19% surpasses the industry average, highlighting robust performance in a competitive market environment despite an annualized net charge-off rate of 0.07%. The bank's liabilities are primarily funded through low-risk customer deposits (94%).

- Dive into the specifics of First Bancorp here with our thorough health report.

Review our historical performance report to gain insights into First Bancorp's's past performance.

Next Steps

- Click here to access our complete index of 298 US Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報