Reassessing GE Vernova (GEV) Valuation After Its Upgraded 2028 Targets and Boosted Shareholder Returns

GE Vernova (GEV) just laid out a much more ambitious roadmap, pairing higher revenue and margin targets through 2028 with a doubled dividend and a larger buyback, and Wall Street is clearly paying attention.

See our latest analysis for GE Vernova.

The near term pullback, including a 1 day share price return of about negative 10 percent and a 7 day share price return of roughly negative 15 percent, looks more like a reset after a huge run, given the year to date share price return above 80 percent and a 1 year total shareholder return of roughly 94 percent that still point to powerful underlying momentum.

If GE Vernova’s story has you thinking about where the next big infrastructure winners might come from, this could be a good moment to explore aerospace and defense stocks.

With shares still up almost 95 percent over the past year but trading at a roughly 22 percent discount to the average analyst target, is GE Vernova now a rare pullback buying opportunity, or is the market already pricing in years of growth?

Most Popular Narrative: 9.9% Undervalued

With GE Vernova last closing at $614.19 versus a narrative fair value near $681, the most followed storyline leans toward further upside and lays out specific growth milestones behind that view.

Analysts expect earnings to reach $5.8 billion (and earnings per share of $21.36) by about September 2028, up from $1.2 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $6.4 billion in earnings, and the most bearish expecting $3.5 billion.

Want to see how this jump in profits, expanding margins, and shrinking share count are woven into one valuation story? The narrative hides a bold earnings path, an aggressive revenue ramp, and a premium profit multiple usually reserved for market darlings. Curious which assumptions really tip the model toward upside rather than caution? The full breakdown reveals exactly how those moving pieces stack up against that fair value line.

Result: Fair Value of $681.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, weaker European demand and ongoing wind segment losses could quickly chip away at those margin gains if project delays and cost pressures worsen.

Find out about the key risks to this GE Vernova narrative.

Another View: Rich Multiples Test the Upside Story

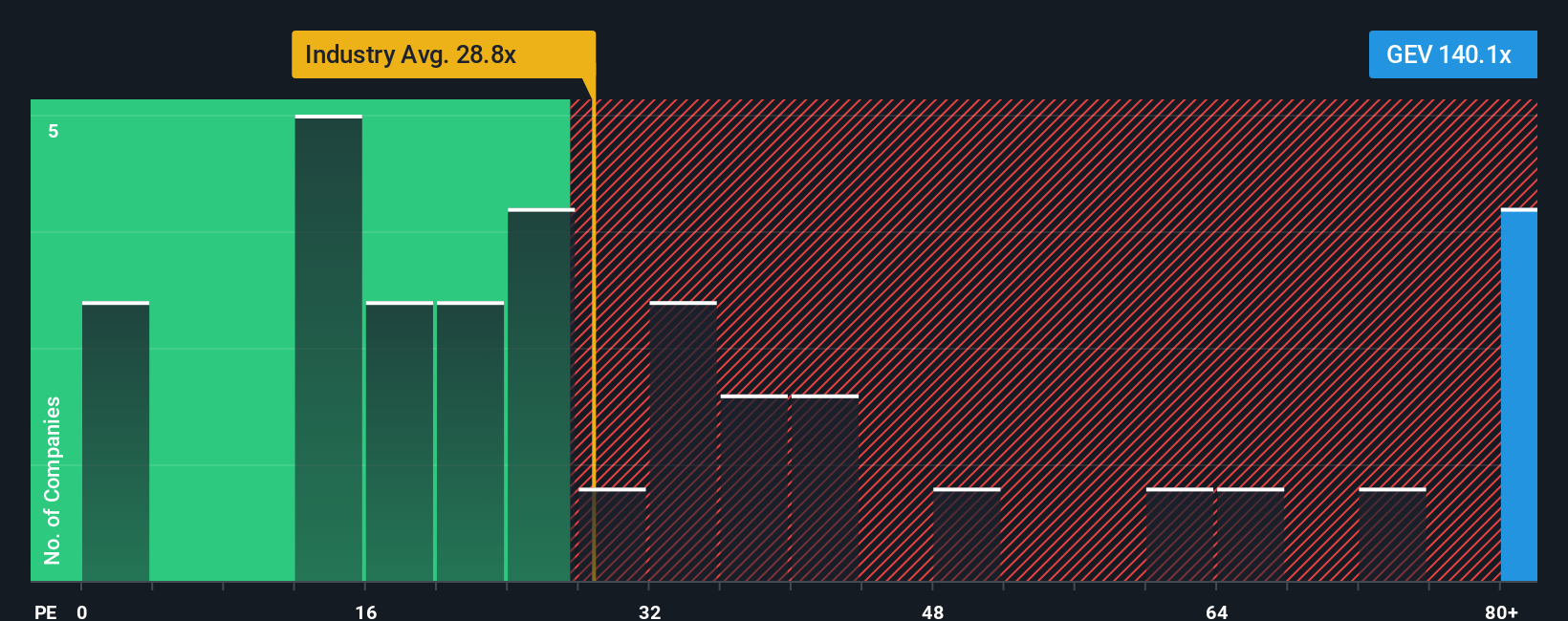

That upbeat fair value sits awkwardly beside today’s earnings multiple, with GE Vernova trading at about 97.8 times earnings versus 31.2 times for the US Electrical industry and 27.9 times for peers, and even above a 79.3 times fair ratio our model suggests the market could drift toward. Does that leave more room for upside or more risk of a painful rerating if growth wobbles?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GE Vernova Narrative

If you are skeptical of these conclusions or simply prefer to dive into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding GE Vernova.

Looking for your next investing edge?

Before you move on, lock in your advantage by using the Simply Wall St Screener to pinpoint fresh, data driven ideas that most investors overlook.

- Capitalize on mispriced opportunities by targeting these 906 undervalued stocks based on cash flows that strong cash flow analysis suggests the market has not fully appreciated yet.

- Ride the next innovation wave by focusing on these 26 AI penny stocks positioned at the front line of the AI and automation boom.

- Strengthen your income stream by zeroing in on these 13 dividend stocks with yields > 3% that can support reliable cash returns alongside potential capital gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報