Jiangsu Zhanxin GEM IPO has been accepted, focusing on high-reliability analog chip and micromodule products

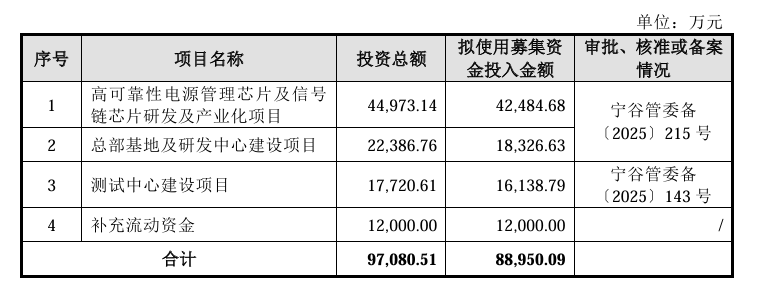

The Zhitong Finance App learned that on December 17, Jiangsu Zhanxin Semiconductor Technology Co., Ltd. (Jiangsu Zhanxin) Shenzhen Stock Exchange GEM IPO was accepted. Huatai United Securities is its sponsor and plans to raise 889.5 million yuan.

According to the prospectus, Jiangsu Zhanxin focuses on R&D, design, testing and sales of high-reliability analog chips and micromodule products. Among them, analog chip products are mainly power management chips, and segmented products include DC/DC conversion chips, linear voltage regulators (LDO), load and current limit switches (LoadSwitch), etc.; micromodule products can achieve various functions such as isolated and non-isolated DC/DC conversion, logic control, signal modulation, and diode control; at the same time, the company also provides customers with discrete device products.

In addition, the company has also continued to expand its product line and extend its product matrix to signal chain chips. At present, it has initially completed the research and development of various products such as current detection chips, voltage reference chips, comparators, operational amplifiers, and timing chips.

The company's products have been highly recognized by customers of major central enterprises and military industry groups such as China Telecom Group, China Electronics Group, China Aviation Industry Group, Aerospace Science and Technology Group, and Ordnance Industry Group, etc., and are widely used in various equipment platforms such as airborne, ballistic, shipborne, land-based, and individual soldiers. The company has supplied more than 1,600 customers during the reporting period, and has accumulated rich customer resources.

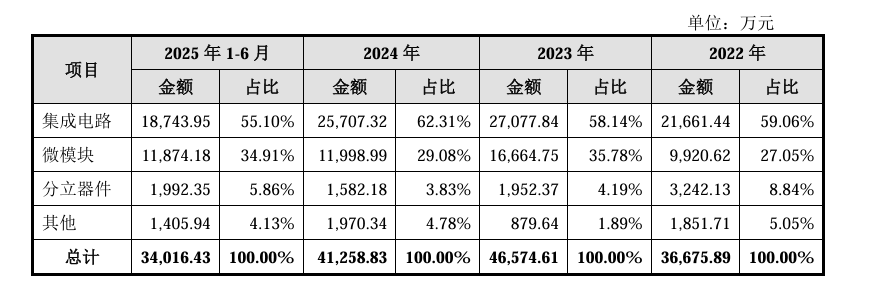

The details of the company's main business revenue during the reporting period are as follows:

In terms of the market competition pattern, based on the special characteristics of the military electronics industry, there is currently no public market share data for third-party military electronics integrated circuit manufacturers.

Currently, military power management chip companies mainly include Jiangsu Zhanxin, Beijing Qixing Huachuang, Jiangsu Zhanxin Semiconductor Technology Co., Ltd., Microelectronics Co., Ltd. (a subsidiary of the listed company North Huachuang Holdings), Zhenlei Technology, Zhenhua Scenery, Beijing Shengyu Technology Co., Ltd., and Beijing Yanhuang Guoxin Technology Co., Ltd.

After deducting expenses such as issuance, the company actually raised funds, plans to invest in the following projects according to priority:

On the financial side, in 2022, 2023, 2024, and January-June 2025, Jiangsu Zhanxin achieved operating income of approximately 367 million yuan, 466 million yuan, 413 million yuan, and 340 million yuan.

For the same period, net profit was RMB 148 million, RMB 179 million, RMB 95,3543 million, and RMB 124 million, respectively.

Nasdaq

Nasdaq 華爾街日報

華爾街日報