Is It Too Late to Consider Texas Roadhouse After Its Recent Share Price Pullback?

- Wondering if Texas Roadhouse at around $165 a share is still a bargain or if the easy gains are gone? This piece will walk through what the current price is really baking in.

- The stock is roughly flat in the very short term, up 0.5% over the last week and down 0.9% over the past month. That sits against a tougher backdrop of an 8.5% drop year to date and a 9.9% slide over the last year, after a huge 81.4% and 124.5% run over the past 3 and 5 years respectively.

- Investors have been reacting to a mix of themes, including ongoing strength in US consumer dining trends, persistent wage and food cost inflation that could squeeze margins, and the chain's continued focus on expanding locations in both existing and new markets. At the same time, Texas Roadhouse keeps getting attention for its strong guest traffic relative to casual dining peers, which supports the idea that demand is holding up even as the macro picture remains uncertain.

- On our framework, the stock scores a 3/6 valuation check, suggesting it looks undervalued on some measures and stretched on others. Next, we will break down what different valuation approaches say about Texas Roadhouse, and then finish with a more holistic way to think about what the market might be missing.

Find out why Texas Roadhouse's -9.9% return over the last year is lagging behind its peers.

Approach 1: Texas Roadhouse Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a business is worth by projecting the cash it can generate in the future and discounting those cash flows back to today. For Texas Roadhouse, the model used is a 2 Stage Free Cash Flow to Equity approach, built on cash flow projections and a gradual slowdown in growth over time.

Texas Roadhouse generated about $341.3 Million in free cash flow over the last twelve months. Analyst expectations and extrapolations by Simply Wall St indicate this figure rising steadily, with projected free cash flow of roughly $1.13 Billion by 2035 in $. These ten year projections feed into the DCF and result in an estimated fair value of about $221.18 per share.

Against a recent market price around $165, the DCF implies the stock is roughly 25.0% undervalued. In other words, if these cash flow assumptions prove broadly accurate, the current price still leaves a meaningful margin of safety.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Texas Roadhouse is undervalued by 25.0%. Track this in your watchlist or portfolio, or discover 912 more undervalued stocks based on cash flows.

Approach 2: Texas Roadhouse Price vs Earnings

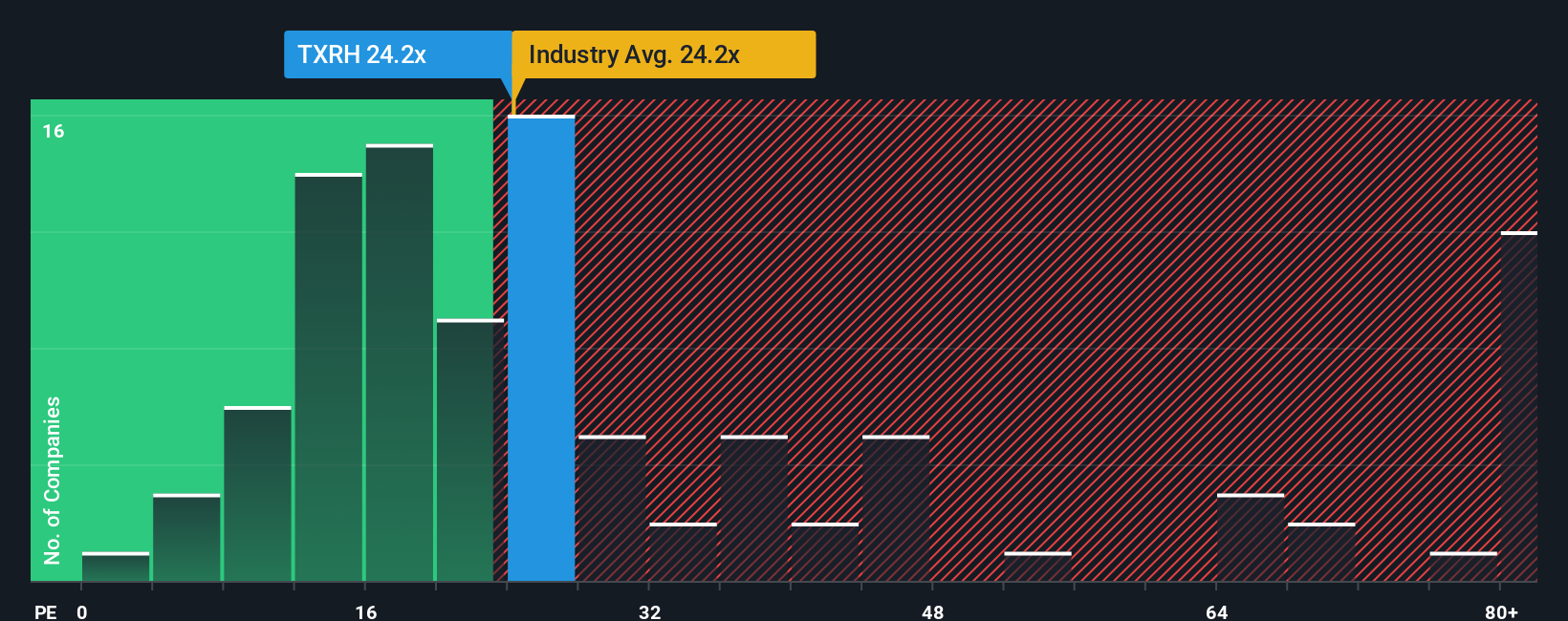

For a consistently profitable company like Texas Roadhouse, the price to earnings, or PE, ratio is a straightforward way to judge whether investors are paying a reasonable price for each dollar of earnings. In general, faster growing and lower risk businesses justify a higher PE, while slower or riskier names deserve a discount.

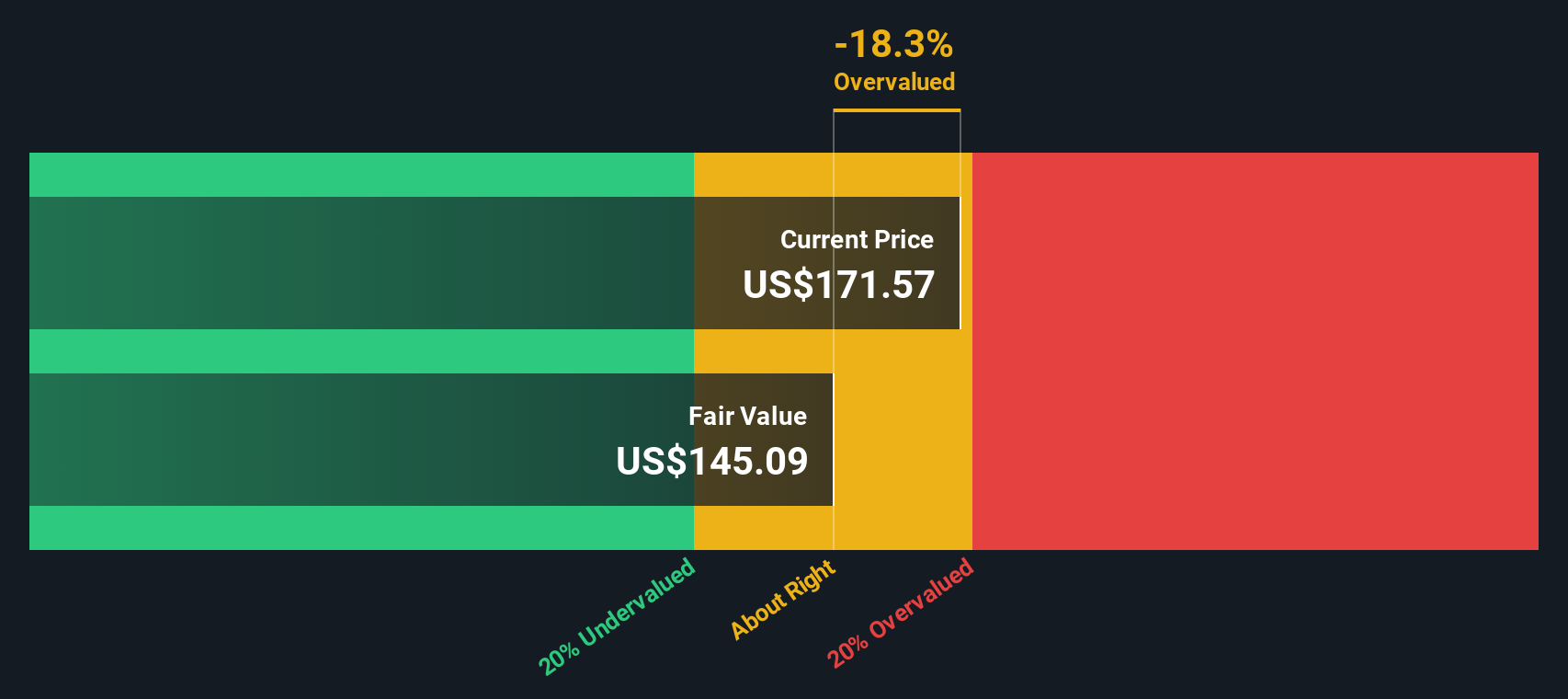

Texas Roadhouse currently trades on a PE of about 25.1x, which is slightly above the broader Hospitality industry average of roughly 24.1x, but well below the 49.2x average of its higher growth peers. To go a step further than simple comparisons, Simply Wall St calculates a proprietary Fair Ratio: the PE level that would be justified given the company’s earnings growth profile, margins, risk factors, industry and market cap. For Texas Roadhouse, that Fair Ratio comes out at around 21.2x.

Because the Fair Ratio we estimate, 21.2x, is below the current market PE of 25.1x, the shares look somewhat expensive on this metric, even after allowing for the company’s strengths and growth outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1462 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Texas Roadhouse Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. These are simple stories you can build on Simply Wall St’s Community page that connect your view of Texas Roadhouse’s business drivers to a financial forecast and a Fair Value. You can then compare that to the current price to help guide your own decisions, while Narratives automatically update as new earnings, news or price targets come in. For example, one investor might create a bullish Texas Roadhouse Narrative that leans into beef cost relief, digital improvements and suburban expansion to justify a Fair Value closer to $227 per share. Another might focus on persistent beef inflation, labor pressure and digital execution risk to anchor a more cautious Fair Value nearer $170. Both of these perspectives can coexist on the platform, giving you an accessible, dynamic way to decide which story you believe and what that implies for your own required return.

Do you think there's more to the story for Texas Roadhouse? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報