FedEx (FDX) Valuation Check as Q2 2026 Earnings, Cost Cuts and Freight Spin-Off Draw Investor Focus

FedEx (FDX) is back in the spotlight as investors gear up for its Q2 2026 earnings on December 18, with attention fixed on three things: earnings momentum, cost cuts, and the coming FedEx Freight spin off.

See our latest analysis for FedEx.

That backdrop of upbeat commentary and the coming Freight spin off has helped fuel a 25.1% 3 month share price return to $282.46, while the 3 year total shareholder return of 83.3% shows longer term momentum is still very much intact.

If FedEx’s setup has you thinking about opportunities across transport and logistics, it could be a good moment to explore auto manufacturers as another way to find what is quietly rerating higher.

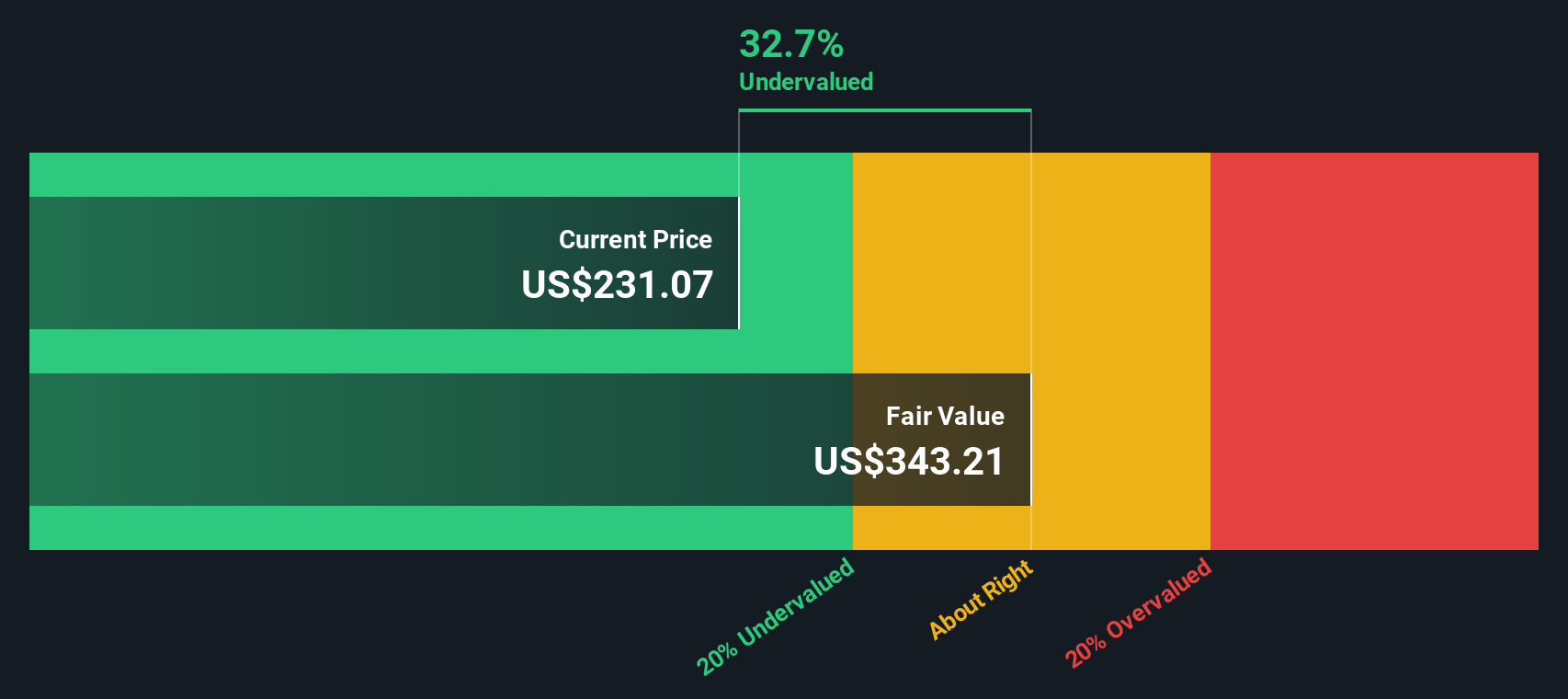

With shares now trading near analyst targets but still at roughly a 20 percent discount to some intrinsic value estimates and with major catalysts ahead, is FedEx quietly offering upside, or is the market already banking on that future growth?

Most Popular Narrative: 2.7% Overvalued

With FedEx closing at $282.46 against a narrative fair value near $275, the story hinges on whether cost discipline can keep powering earnings ahead.

The analysts have a consensus price target of $264.25 for FedEx based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $320.0, and the most bearish reporting a price target of just $200.0.

Want to see what kind of steady, compounding earnings path could justify paying above today’s price, and what profit margins this narrative quietly bakes in?

Result: Fair Value of $275.14 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this narrative could unravel if freight volumes stay weaker for longer or if the Freight spin off and restructuring prove more disruptive than planned.

Find out about the key risks to this FedEx narrative.

Another Take: Cash Flows Point To Upside

While the narrative fair value suggests FedEx is slightly overvalued, our DCF model tells a different story, indicating the stock is trading about 19.6 percent below its estimated fair value of roughly $351 per share. Is the market underpricing FedEx’s long term cash generation potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out FedEx for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 912 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own FedEx Narrative

If you see the story differently or would rather lean on your own work, you can quickly build a personalised view in under three minutes using Do it your way.

A great starting point for your FedEx research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing edge?

FedEx might be in focus today, but the real advantage comes from lining up your next opportunities now, before everyone else starts paying attention.

- Target powerful potential turnarounds by scanning these 912 undervalued stocks based on cash flows that the market has not fully appreciated yet, before sentiment and prices catch up.

- Ride structural growth trends by pinpointing these 30 healthcare AI stocks that could transform patient care and healthcare economics over the next decade.

- Tap into innovation at the frontier of money and infrastructure with these 80 cryptocurrency and blockchain stocks that are building real businesses around blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報