Long-term holders continued to cash out, and Bitcoin once again fell below the $86,000 mark

The Zhitong Finance App learned that Bitcoin's most determined long-term holders are still continuing to cash out, and selling pressure is beginning to show clearly in the price trend. Since the Bitcoin price hit an all-time high of more than $126,000 more than two months ago, its price has fallen back nearly 30% and is struggling to find support within the current range. On Wednesday, Bitcoin once again fell below the $86,000 mark to $85,889.53.

An important reason why Bitcoin is under pressure is that long-term holders' sell-off has not stopped. According to the latest blockchain data, bitcoins that have been held for several years are re-entering the market at a rate rare in recent years, while at the same time, the market's ability to accept these chips is weakening.

According to K33 Research's report, since the beginning of 2023, the number of bitcoins that have not been transferred for at least two years has been reduced by about 1.6 million, worth about 140 billion dollars at current prices. This change is seen as a clear sign that long-term holders will continue to reap their gains.

In 2025 alone, close to $300 billion of Bitcoin, which had previously been dormant for more than a year, will be back in circulation. Blockchain analysis company CryptoQuant notes that in the past 30 days, the sell-off scale of long-term holders reached one of the highest levels in more than five years.

Chris Newhouse, head of research at the decentralized finance research institute Ergonia, said that the market is currently experiencing a process of “slow blood loss”, characterized by continuous selling of spot goods and relatively scarce buying liquidity. This downward trend, which is dominated by spot selling pressure, is more difficult to reverse than the rapid decline caused by high leverage bursts.

Over the past year, this type of sell-off was once digested by demand from newly launched Bitcoin ETFs and crypto investment institutions. Recently, however, the situation has changed markedly: ETF capital flows have changed to net outflows, derivatives trading volume has declined, and retail participation has declined markedly. Supply of the same scale now falls into a market with fewer buyers and less liquidity.

Market pressure has been particularly pronounced since October 10. On the same day, US President Trump made an unexpected statement about punitive tariffs, triggering sharp fluctuations in the crypto market. The single-day settlement scale reached 19 billion US dollars, making the biggest leveraged clearance in cryptocurrency history. Since then, traders have clearly withdrawn from the derivatives market, and there are still no clear signs of recovery.

Bitcoin's price briefly rebounded to $90,000 on Wednesday. Traders attributed this to concentrated short positions being closed, but the gains quickly subsided. Bitcoin then weakened again, falling back to the lower end of the trading range since the sharp fall in October. At one point, it fell 2.8% intraday to $85,278.

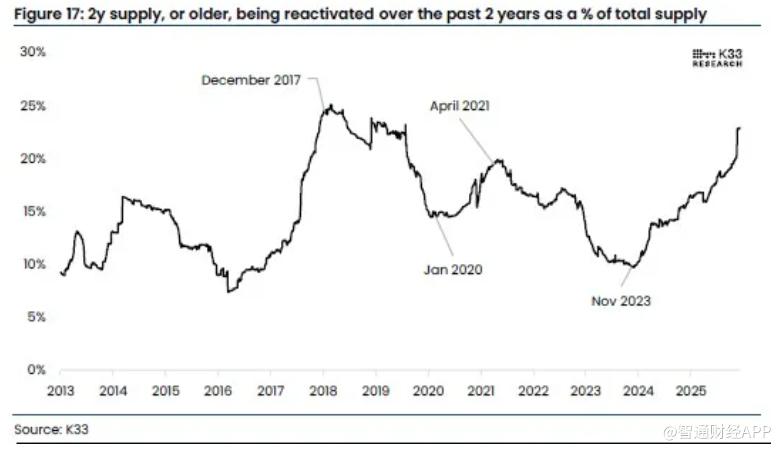

K33 senior analyst Vetle Lunde pointed out that unlike previous cycles, this round of “wake-up selling” for long-term holders was not driven by altcoin transactions or protocol incentives, but rather benefited from deep liquidity brought by US ETFs and corporate capital, which enabled early investors to achieve profits in the six-digit price range, thereby significantly reducing the concentration of Bitcoin positions. He said that the scale of recirculation of long-held chips observed this year and last year was the second and third largest in Bitcoin history, respectively, after 2017.

Meanwhile, according to Coinglass data, the number of open positions in Bitcoin options and perpetual contracts is still far below the level before the sharp drop in October. This shows that a large number of traders are still on the sidelines, and the derivatives market accounts for the majority of crypto trading volume. Furthermore, “base difference trading,” which was once widely used by hedge funds and arbitrage through spot and futures price differences, has also become unprofitable.

However, Lunde believes that the sell-off for long-term holders may be nearing its end. Based on historical on-chain data observations, he pointed out that currently about 20% of the Bitcoin supply has been reactivated in the past two years and is close to an important threshold.

Lunde wrote in the report that looking ahead, the selling pressure from long-term holders seems to be becoming saturated, and it is expected that by 2026, concentrated sell-off by early investors will significantly weaken. As Bitcoin is further integrated into the institutional investment system, the amount of coins held for more than two years is expected to pick up again, and the market structure may gradually shift to net buyer dominance.

Nasdaq

Nasdaq 華爾街日報

華爾街日報