Unpleasant Surprises Could Be In Store For Shandong Weigao Group Medical Polymer Company Limited's (HKG:1066) Shares

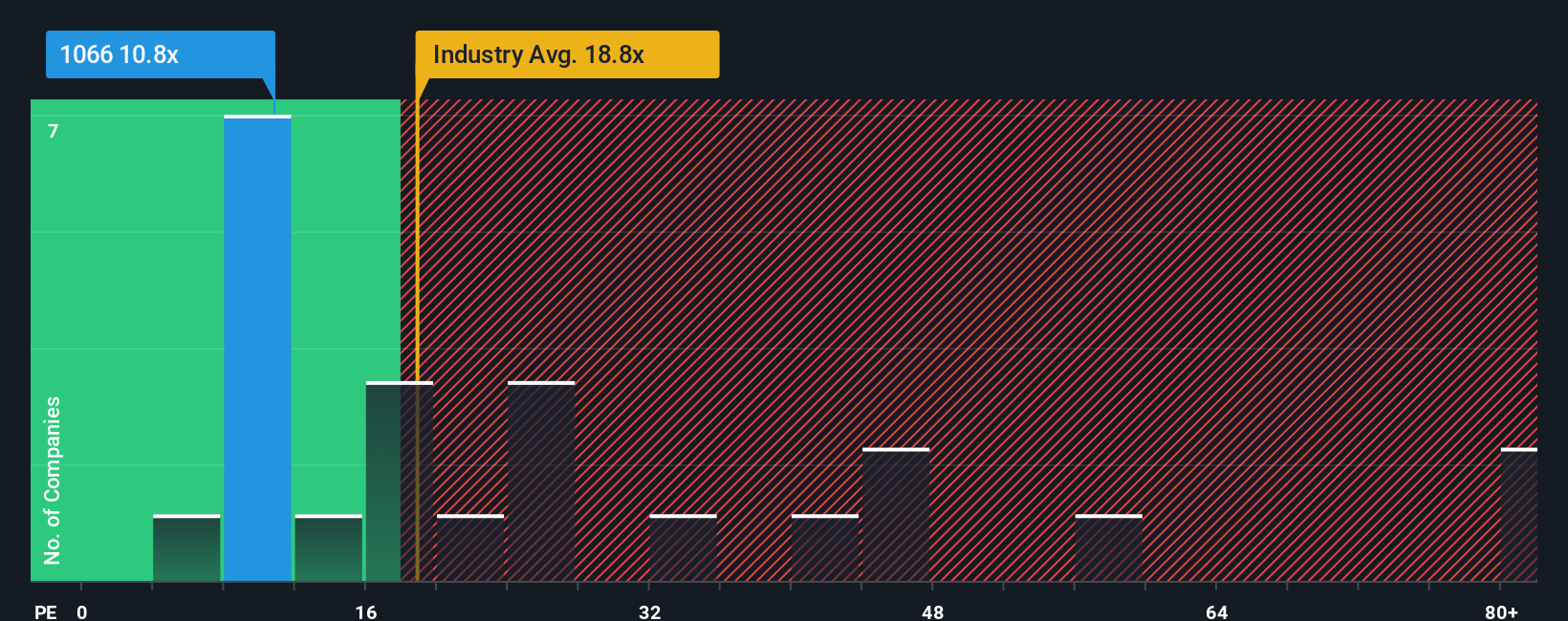

It's not a stretch to say that Shandong Weigao Group Medical Polymer Company Limited's (HKG:1066) price-to-earnings (or "P/E") ratio of 10.8x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 12x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

There hasn't been much to differentiate Shandong Weigao Group Medical Polymer's and the market's earnings growth lately. It seems that many are expecting the mediocre earnings performance to persist, which has held the P/E back. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

Check out our latest analysis for Shandong Weigao Group Medical Polymer

Does Growth Match The P/E?

In order to justify its P/E ratio, Shandong Weigao Group Medical Polymer would need to produce growth that's similar to the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 25% drop in EPS. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 8.4% per annum over the next three years. Meanwhile, the rest of the market is forecast to expand by 14% per year, which is noticeably more attractive.

With this information, we find it interesting that Shandong Weigao Group Medical Polymer is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Final Word

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Shandong Weigao Group Medical Polymer currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You always need to take note of risks, for example - Shandong Weigao Group Medical Polymer has 1 warning sign we think you should be aware of.

You might be able to find a better investment than Shandong Weigao Group Medical Polymer. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報