Is Healthcare Services Group (HCSG) Still Undervalued After a 67% Year-to-Date Rally?

Healthcare Services Group (HCSG) has been quietly turning in stronger numbers, with revenue and net income both climbing, and the stock up about 67% this year after a tough few years.

See our latest analysis for Healthcare Services Group.

That 66.6% year to date share price return, alongside a 61.8% one year total shareholder return, suggests momentum is building as investors start to reassess both growth prospects and execution risk at HCSG.

If HCSG’s rebound has you rethinking the healthcare space, it could be worth scanning other potential ideas across healthcare stocks and seeing which names show similar improving trends.

Yet with earnings recovering, shares still below analyst targets and valuation screens flagging limited intrinsic discount, investors face a key question: Is Healthcare Services Group still a buying opportunity, or is the market already pricing in future growth?

Most Popular Narrative: 11.2% Undervalued

With Healthcare Services Group closing at $19.09 versus a narrative fair value of $21.50, the current setup leans toward upside if assumptions hold.

The company is positioned to benefit from a multi decade increase in demand for long term and post acute care services as the demographic shift of the aging U.S. population accelerates, supporting continued sequential revenue growth and a larger addressable market.

Curious how steady contract wins, margin rebuild, and a surprisingly modest future earnings multiple can still justify a premium valuation? The full narrative lays out the playbook.

Result: Fair Value of $21.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent client concentration and rising labor and reimbursement pressures could quickly undermine today’s bullish margin and growth expectations if conditions deteriorate.

Find out about the key risks to this Healthcare Services Group narrative.

Another View: Valuation Signals Mixed Messages

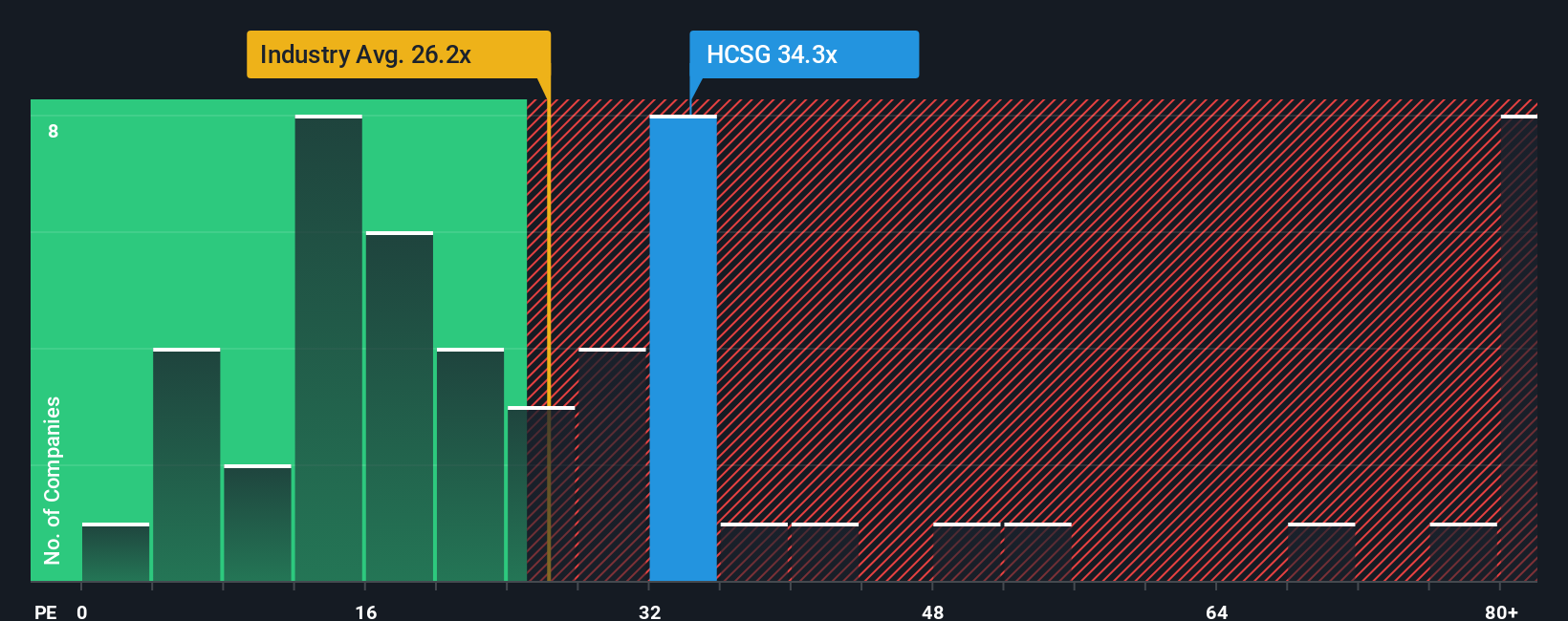

While the narrative fair value suggests upside, the current price implies a price to earnings ratio of 33.8x, well above both peers at 25.1x and a fair ratio of 25.4x. That premium hints at valuation risk if growth or margins slip. The key question is whether the recent momentum is already fully priced in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Healthcare Services Group Narrative

If you see things differently or want to dig into the numbers yourself, you can build a custom narrative in just minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Healthcare Services Group.

Ready for more investment ideas?

Do not stop with one opportunity. Use the Simply Wall St screener to uncover fresh stocks that match your strategy before the market catches on.

- Capture potential bargains early by targeting these 910 undervalued stocks based on cash flows that combine attractive prices with solid cash flow profiles.

- Ride powerful innovation trends by focusing on these 26 AI penny stocks positioned at the heart of real world artificial intelligence adoption.

- Strengthen your income stream by selecting these 13 dividend stocks with yields > 3% that may support reliable payouts in different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報