PotlatchDeltic (PCH): Assessing Valuation as Shares Grind Higher and Timber REIT Sentiment Steadies

PotlatchDeltic (PCH) has been quietly grinding higher, with the stock up around 3 % over the past month as investors reassess timber REITs in a calmer interest rate backdrop.

See our latest analysis for PotlatchDeltic.

The recent 7 day share price return of 3.27 % has nudged PotlatchDeltic toward a steadier uptrend, while a 1 year total shareholder return of 1.96 % suggests momentum is only cautiously rebuilding from earlier softness.

If PotlatchDeltic has you rethinking where stable cash flows meet cyclical swings, it could be worth scouting fast growing stocks with high insider ownership as potential next wave candidates for your watchlist.

With PotlatchDeltic trading below analyst targets yet showing only modest long term returns, is the market overlooking upside from improving timber fundamentals, or already baking in most of the REIT's future growth?

Most Popular Narrative Narrative: 15.4% Undervalued

With PotlatchDeltic last closing at 40.42 dollars against a narrative fair value of 47.75 dollars, the valuation case leans on future earnings power and merger driven efficiencies.

Recent operational headwinds, onetime costs, and inventory impairments in the Wood Products segment are expected to reverse as lumber prices recover due to higher Canadian import duties/tariffs, improved mill utilization, and cost efficiencies, driving a significant rebound in net margins and segment earnings.

Curious how modest top line growth can still support a richer valuation multiple, stronger margins, and higher earnings per share over time, all under a single discount rate lens? The most followed narrative lays out a detailed path of rising profitability, shrinking share count, and a valuation multiple that assumes PotlatchDeltic earns a premium to many peers. Want to see which long run profit profile has to materialize for that upside case to hold together?

Result: Fair Value of $47.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent housing market softness or region specific disruptions like wildfires and stricter regulations could pressure timber demand and squeeze PotlatchDeltic's margin recovery story.

Find out about the key risks to this PotlatchDeltic narrative.

Another Angle on Valuation

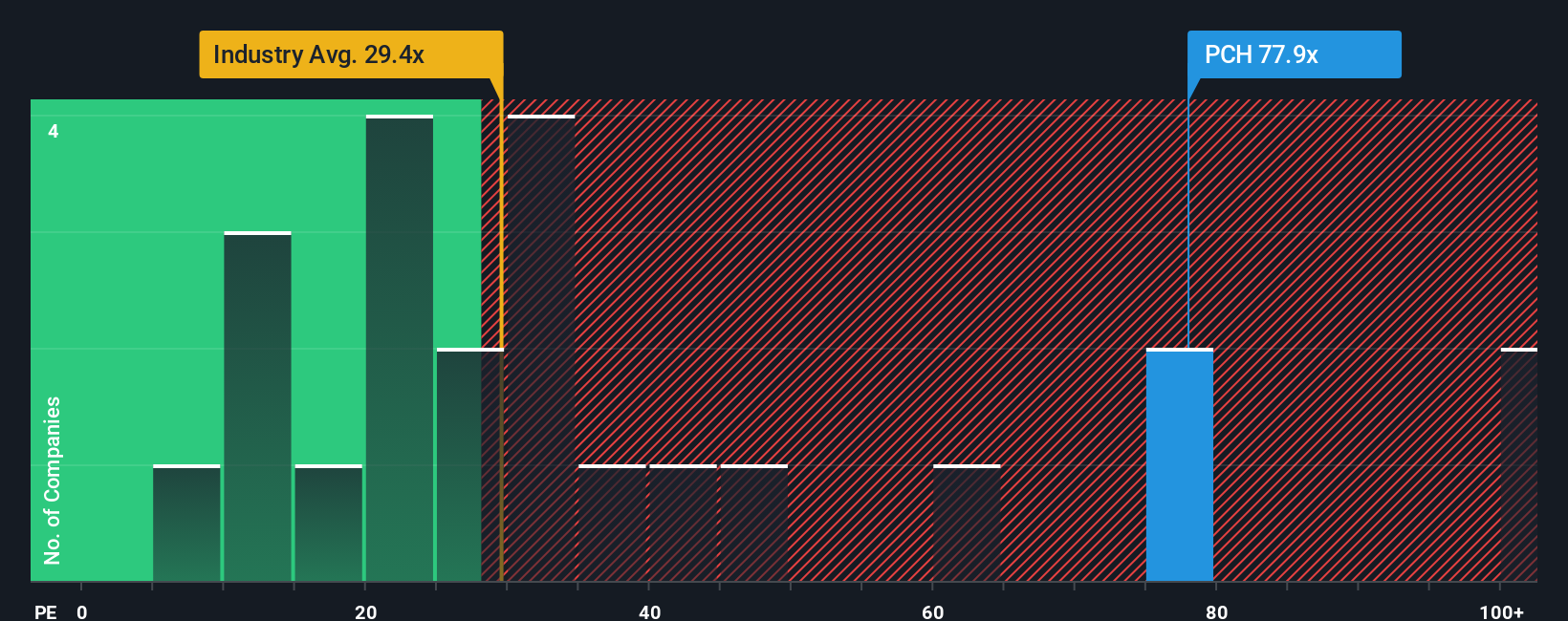

On earnings based metrics, PotlatchDeltic looks far less forgiving. Its price to earnings ratio of 48.6 times sits well above both the Specialized REITs industry at 28.5 times and peers at 31.9 times, as well as its own 38.7 times fair ratio marker. This raises real questions about downside if expectations slip.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own PotlatchDeltic Narrative

If you see the story differently or would rather test your own assumptions against the numbers, you can build a custom view in just a few minutes, Do it your way.

A great starting point for your PotlatchDeltic research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one opportunity when you can quickly scan fresh themes, compare fundamentals, and spot mispriced potential using the Simply Wall Street Screener.

- Target high potential value opportunities by scanning these 910 undervalued stocks based on cash flows that look mispriced relative to their future cash flows.

- Capitalize on powerful tech trends by zeroing in on these 26 AI penny stocks positioned to benefit from accelerating AI adoption.

- Strengthen your income strategy by reviewing these 13 dividend stocks with yields > 3% that offer attractive yields with room for steady payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報