Southwest Airlines (LUV): Assessing Valuation After a Sharp 3-Month Share Price Rebound

Southwest Airlines (LUV) has quietly staged a sharp rebound, with the stock up about 31% over the past 3 months and 28% this month, far outpacing broader airline peers.

See our latest analysis for Southwest Airlines.

That surge comes after a tough few years, but with the share price now at $42.17 and a roughly 26% year to date share price return, momentum looks to be rebuilding as investors reassess Southwest’s recovery prospects and risk profile.

If Southwest’s rebound has your attention, this could be a good moment to compare it with other carriers and related names using aerospace and defense stocks for fresh ideas.

With shares now trading above the average analyst target yet still screening as undervalued on some intrinsic metrics, investors face a key question: Is Southwest a momentum story to chase, or is future growth already priced in?

Most Popular Narrative Narrative: 20.6% Overvalued

With Southwest Airlines closing at $42.17 versus a narrative fair value near $34.97, the dominant storyline suggests investors are paying ahead of fundamentals.

The analysts have a consensus price target of $32.06 for Southwest Airlines based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $46.0, and the most bearish reporting a price target of just $19.0.

Want to see why a modest growth outlook still leads to such a tight valuation band? The real twist is how profit margins and future earnings multiples intersect. Curious which assumptions really drive that gap between fair value and today’s price?

Result: Fair Value of $34.97 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering macro uncertainty and potential Boeing delivery delays could quickly pressure Southwest’s revenue outlook and undermine the optimistic margin recovery narrative.

Find out about the key risks to this Southwest Airlines narrative.

Another View, Rich Multiples Signal Less Cushion

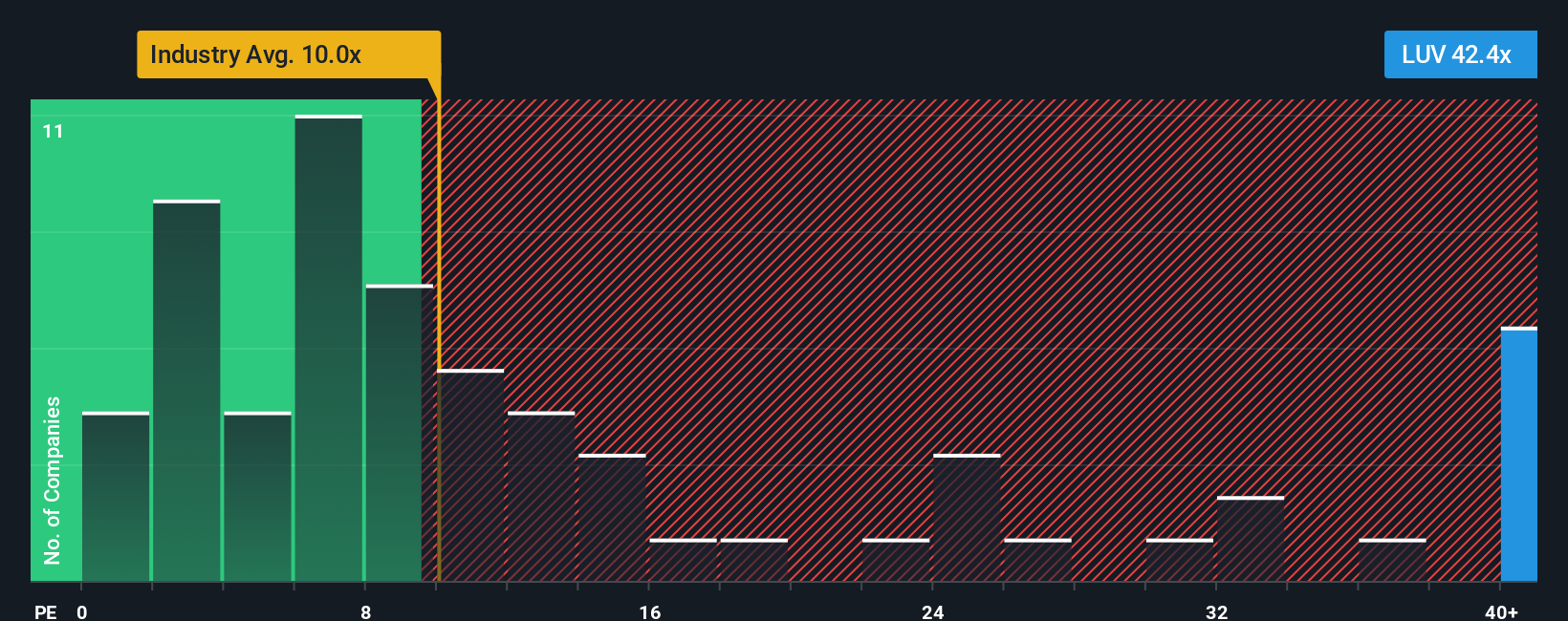

While the narrative fair value suggests Southwest is about 20% overvalued, its current price to earnings ratio of 57.5 times versus a 9.3 times global airline average and a 29.7 times fair ratio implies investors are paying a steep premium with limited margin for error.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Southwest Airlines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 910 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Southwest Airlines Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a tailored view in just minutes, starting with Do it your way.

A great starting point for your Southwest Airlines research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Next, sharpen your edge by using Simply Wall Street’s powerful Screener to uncover opportunities other investors might miss and position your portfolio ahead of the crowd.

- Capture early-stage potential by scanning these 3636 penny stocks with strong financials that pair smaller market caps with stronger financial backbones than typical high-risk names.

- Ride structural growth trends by targeting these 30 healthcare AI stocks at the intersection of data, diagnostics and scalable medical innovation.

- Strengthen your income stream by focusing on these 13 dividend stocks with yields > 3% that aim to balance yield with sustainable business quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報