Dollar General (DG): Reassessing Valuation After Q3 Beat, Raised Guidance, Dividend Boost and Analyst Upgrades

Dollar General (DG) just delivered a cleaner story for investors, pairing a third quarter earnings beat and higher full year guidance with a fresh dividend declaration and a well timed wave of analyst upgrades.

See our latest analysis for Dollar General.

The market has clearly noticed, with Dollar General’s share price up about 29% over the past month and a 1 year total shareholder return above 80%. However, the 3 year total shareholder return remains sharply negative, suggesting momentum is rebuilding from a low base as investors reassess the turnaround story.

If this rebound has you rethinking your watchlist, it could be a good moment to look beyond retail and explore fast growing stocks with high insider ownership as potential next ideas.

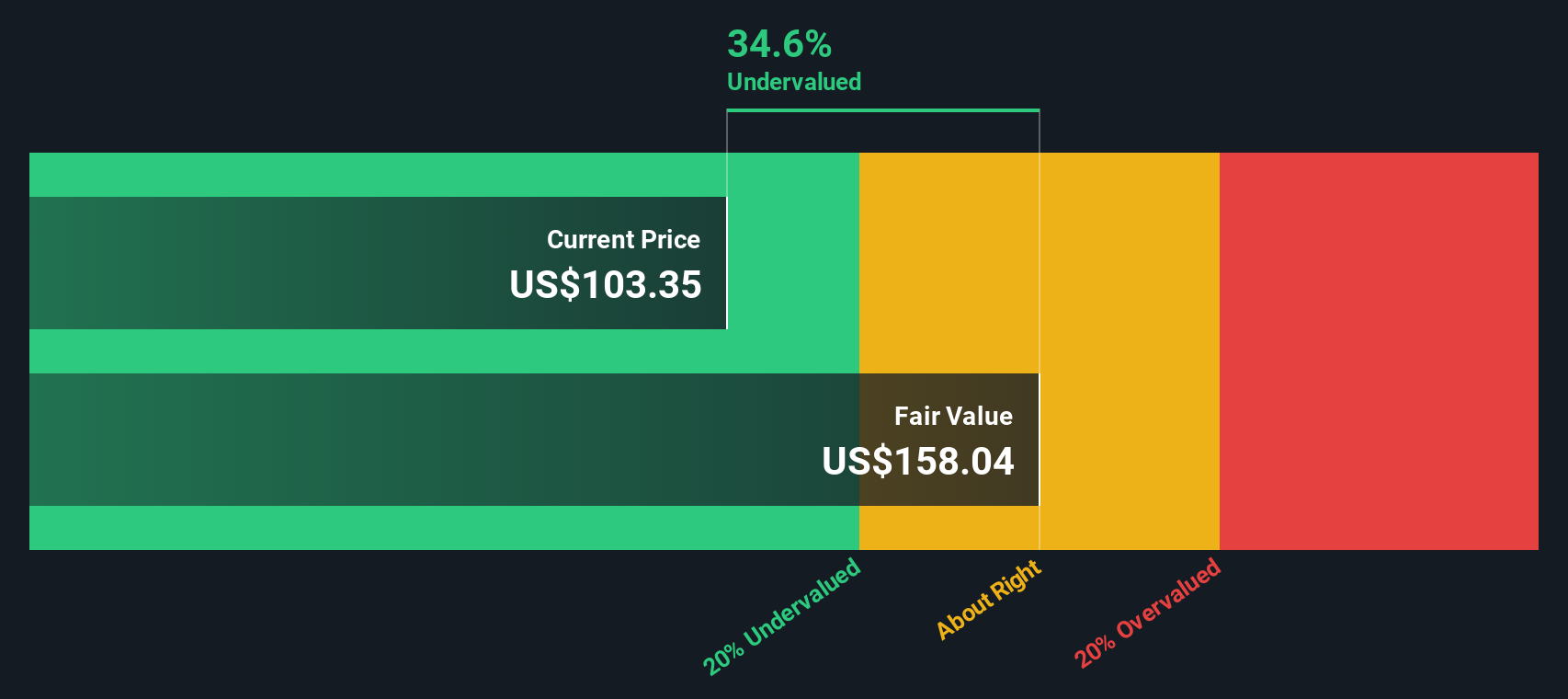

With earnings surging, guidance raised and analysts turning bullish, Dollar General now trades near some price targets but still at a discount to intrinsic value. Is this rebound a renewed buying opportunity, or is future growth already priced in?

Most Popular Narrative: 9.6% Overvalued

Compared with Dollar General’s last close at $134.51, the most followed narrative points to a lower fair value, suggesting that recent optimism may be running ahead of fundamentals.

Remodeling efforts (Project Renovate and Project Elevate), along with expansion of higher margin nonconsumables and continued development of private label brands, are improving store productivity and encouraging higher basket sizes, supporting gross margin expansion and profitable earnings growth.

Want to see how modest growth assumptions and a disciplined profit margin rebuild can still produce a richer future earnings multiple than many retailers currently exhibit? Discover the projections, the time horizon, and the valuation change they are designed to support.

Result: Fair Value of $122.68 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition and persistent labor cost pressures could undercut margin gains and challenge both the store expansion strategy and the improved earnings outlook.

Find out about the key risks to this Dollar General narrative.

Another View: SWS DCF Suggests Undervaluation

While the popular narrative sees Dollar General as roughly 9.6% overvalued, our DCF model points the other way and indicates shares could be worth about $172.96, roughly 23% above the current price. If cash flows recover as expected, is the market underestimating the turnaround?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dollar General for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 910 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dollar General Narrative

If you would rather question these conclusions and dig into the numbers yourself, you can craft a personalized story in just minutes: Do it your way.

A great starting point for your Dollar General research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more smart investment ideas?

Now is the moment to act. Use the Simply Wall St Screener to uncover fresh opportunities before the crowd catches on and prices move without you.

- Capitalize on mispriced potential by scanning these 910 undervalued stocks based on cash flows that the market has not fully recognized yet.

- Ride structural growth trends by filtering for these 30 healthcare AI stocks transforming medicine, diagnostics, and patient outcomes.

- Tap into early stage innovation by targeting these 3636 penny stocks with strong financials where strong financials support outsized upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報