Quanta Services (PWR): Assessing Valuation After Strong Recent Share Price Gains

Quanta Services (PWR) has quietly turned into a steady compounder. With the stock up roughly 17% over the past 3 months and about 39% year to date, investors are asking what comes next.

See our latest analysis for Quanta Services.

That recent 2.1% 1 month share price return, alongside a strong 16.6% 3 month share price return and a hefty 5 year total shareholder return of more than 500%, suggests momentum is still very much on Quanta’s side as investors lean into its long term infrastructure growth story.

If Quanta’s run has you thinking about what else might quietly compound over time, it could be worth exploring fast growing stocks with high insider ownership for more ideas with similar long term potential.

Yet with Quanta trading near record highs, supported by double digit revenue and profit growth but a negative intrinsic value discount, investors now face a key question: is there still a buying opportunity, or is future growth already priced in?

Most Popular Narrative Narrative: 7.6% Undervalued

With the most followed narrative placing Quanta’s fair value near $474 versus a $438.49 close, the story leans toward upside supported by durable growth assumptions.

The accelerating demand for transmission and distribution infrastructure driven by rising electric loads from AI/data center proliferation, grid modernization needs, and the broader energy transition positions Quanta to benefit from a major, long term investment cycle in power grid expansion and resilience, this is likely to support sustained revenue and backlog growth in future years.

Want to see the math behind that upside call? The narrative leans on ambitious revenue compounding, wider margins, and a bold future earnings multiple. This helps clarify which levers really move that valuation.

Result: Fair Value of $474 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, several factors, including complex project execution risks and potential slowdowns in utility and data center capital spending, could still derail this upbeat narrative.

Find out about the key risks to this Quanta Services narrative.

Another View: Rich on Traditional Valuation

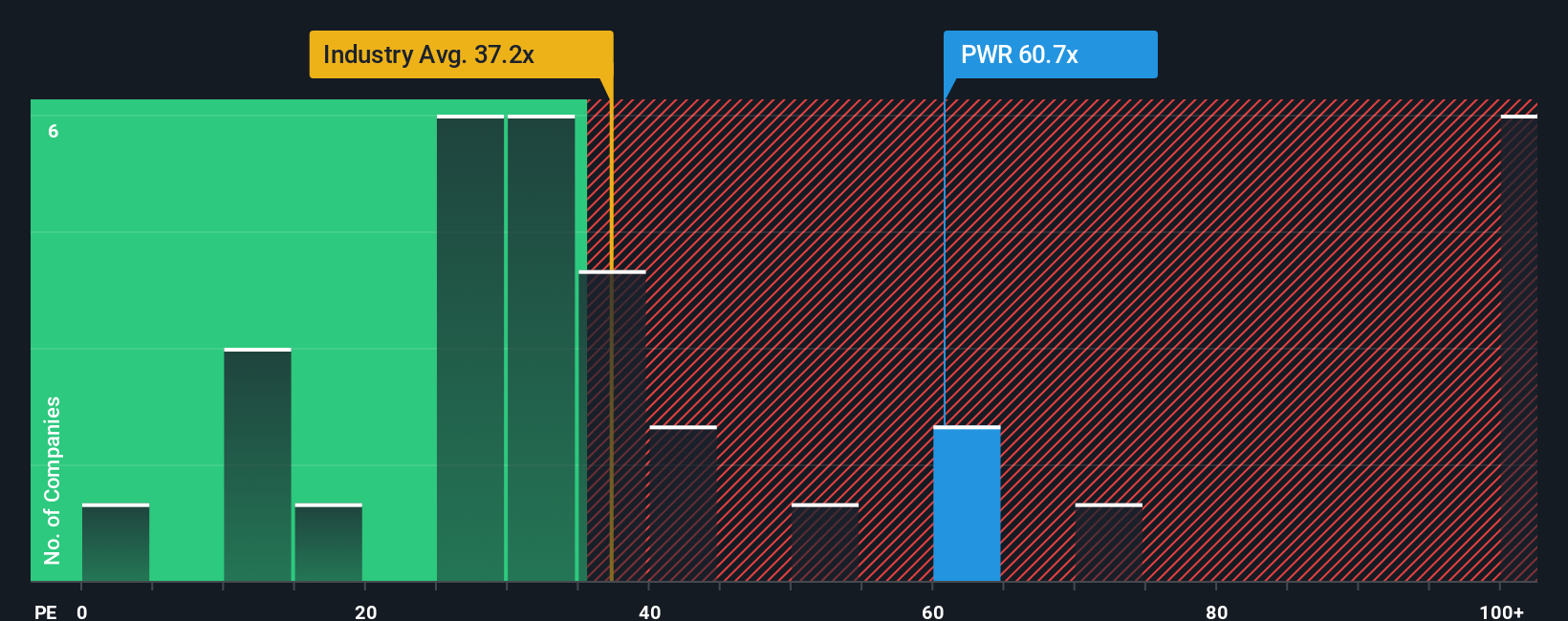

While the narrative suggests Quanta is about 7.6% undervalued, the price tag tells a tougher story. At 64.2 times earnings, versus 32.4 times for the US Construction industry, 55.3 times for peers, and a 39.7 times fair ratio, the stock looks stretched and leaves little room for disappointment.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Quanta Services Narrative

If this perspective does not quite match your own, or you prefer to dig into the numbers yourself, you can quickly build a personalized view in under three minutes, Do it your way.

A great starting point for your Quanta Services research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop your research at Quanta, use the Simply Wall Street Screener to uncover more stocks that could quietly transform your portfolio’s long term returns.

- Capitalize on market mispricing by targeting companies trading below their estimated worth through these 910 undervalued stocks based on cash flows and sharpen your focus on value opportunities others might overlook.

- Catch sector trends early by using these 30 healthcare AI stocks to spot businesses using AI to develop treatments, diagnostics, and healthcare efficiency.

- Explore potential upside by filtering digital asset plays via these 80 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報