Progyny (PGNY): Evaluating Whether Recent Share Price Momentum Still Leaves Upside in Its Valuation

Progyny (PGNY) has quietly outperformed the broader market over the past year, and that steady climb has investors revisiting what they are paying for this fertility benefits specialist at roughly 26 dollars a share.

See our latest analysis for Progyny.

The stock’s recent 7 day and 90 day share price returns of 5.22 percent and 20.25 percent respectively show momentum building behind Progyny’s growth story, even as the 3 year total shareholder return remains negative.

If Progyny’s run has you rethinking your healthcare exposure, it could be a good time to explore other specialized healthcare stocks that might be catching similar tailwinds.

With shares up more than 75 percent over the past year yet still trading below Wall Street’s target and some estimates of intrinsic value, investors now face a key question: is Progyny still attractively valued or is its future growth already fully reflected in the share price?

Most Popular Narrative Narrative: 11.5% Undervalued

With Progyny last closing at 26.01 dollars versus a narrative fair value of 29.40 dollars, the current price implies the market is still cautious about how much of its long term growth is already priced in.

Investment in an integrated women's health platform (including new services such as pelvic floor therapy, leave navigation, and enhanced digital engagement) positions Progyny to cross sell adjacent products, resulting in higher share of wallet with current clients and additional revenue streams, supporting both topline and margin expansion.

Want to see what kind of future profitability and growth engine could justify this premium style valuation in a benefits business, and exactly how far margins and earnings are projected to climb from here, step by step.

Result: Fair Value of $29.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained employer cost cutting and intensifying competition for fertility benefits could weaken utilization growth and challenge the upbeat assumptions behind Progyny’s valuation narrative.

Find out about the key risks to this Progyny narrative.

Another Lens on Valuation

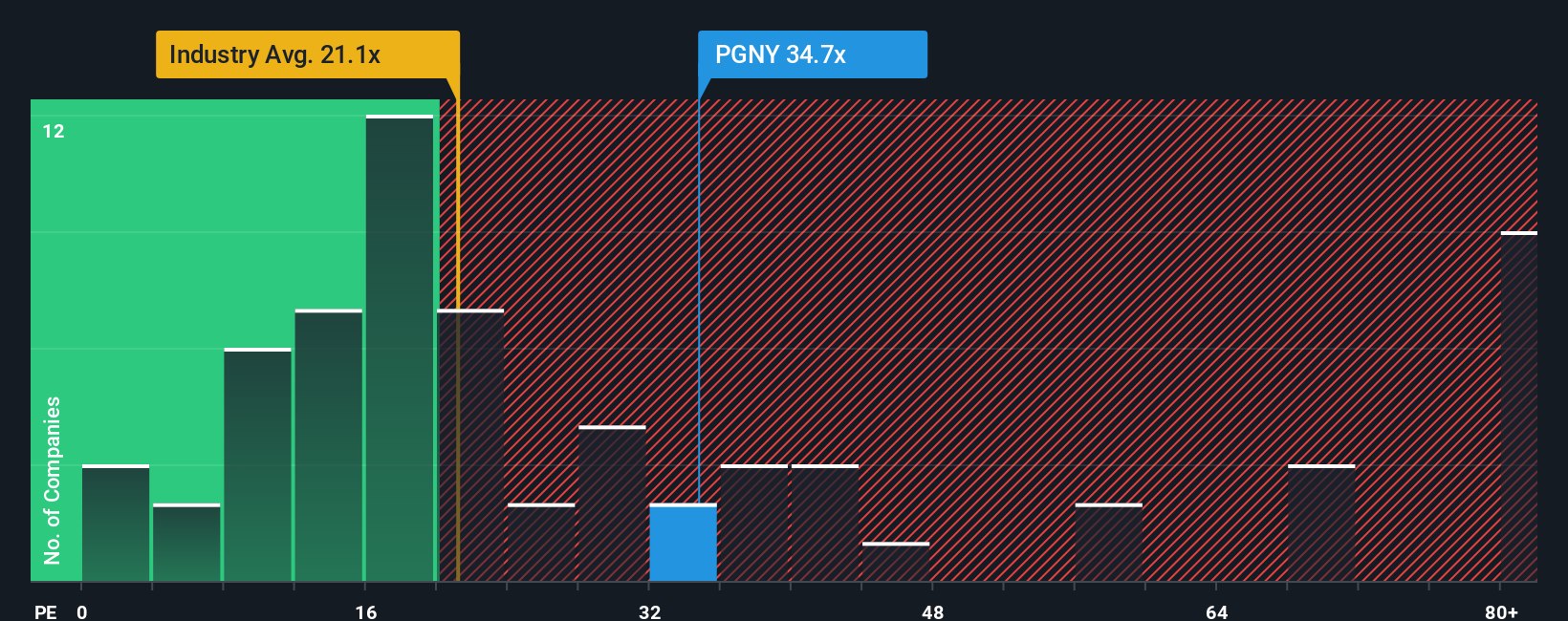

While the narrative fair value points to upside, the earnings multiple tells a tougher story. Progyny trades on a rich 39.6 times earnings versus 23.9 times for the US healthcare sector and 22.6 times for peers, far above its 26.3 times fair ratio. That premium leaves less room for error if growth wobbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Progyny Narrative

If you see the numbers differently, or prefer digging into the details yourself, you can build a personalized view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Progyny.

Ready for your next investing move?

Use the Simply Wall Street Screener to quickly surface fresh opportunities so you are not stuck watching others capture gains you never even considered.

- Capitalize on mispriced potential by targeting companies that look cheap on future cash flows using these 910 undervalued stocks based on cash flows, which is tailored to value focused investors.

- Ride powerful secular trends in automation and machine learning by zeroing in on these 26 AI penny stocks, which are positioned to benefit from accelerating adoption.

- Strengthen your income stream with companies offering attractive payouts and resilient fundamentals through these 13 dividend stocks with yields > 3%, which is built for yield conscious portfolios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報