3 Asian Growth Companies With High Insider Ownership Expecting Up To 89% Earnings Growth

As global markets navigate the complexities of interest rate adjustments and economic uncertainties, Asian economies are also experiencing shifts, with China's deflationary pressures and Japan's potential rate hikes being notable developments. In this environment, growth companies in Asia with high insider ownership can offer unique insights into potential earnings expansion, as insiders' confidence often aligns with robust business prospects.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 29.8% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

We're going to check out a few of the best picks from our screener tool.

Guangzhou Goaland Energy Conservation Tech (SZSE:300499)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Goaland Energy Conservation Tech (ticker: SZSE:300499) specializes in energy conservation technologies and solutions, with a market cap of CN¥9.15 billion.

Operations: Guangzhou Goaland Energy Conservation Tech generates its revenue through various segments focused on energy conservation technologies and solutions.

Insider Ownership: 20.4%

Earnings Growth Forecast: 89.1% p.a.

Guangzhou Goaland Energy Conservation Tech has demonstrated robust growth, becoming profitable this year with net income reaching CNY 34.23 million from a previous loss. Its earnings are projected to grow significantly at 89.1% annually, outpacing the Chinese market average of 27.1%. Revenue is also expected to rise by 26.7% per year, surpassing market growth rates. Despite low forecasted return on equity, its inclusion in the S&P Global BMI Index highlights its growing prominence in the sector.

- Take a closer look at Guangzhou Goaland Energy Conservation Tech's potential here in our earnings growth report.

- Our valuation report here indicates Guangzhou Goaland Energy Conservation Tech may be overvalued.

Konfoong Materials International (SZSE:300666)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Konfoong Materials International Co., Ltd. (SZSE:300666) operates in the materials sector with a focus on producing and supplying advanced materials, and it has a market cap of CN¥24.28 billion.

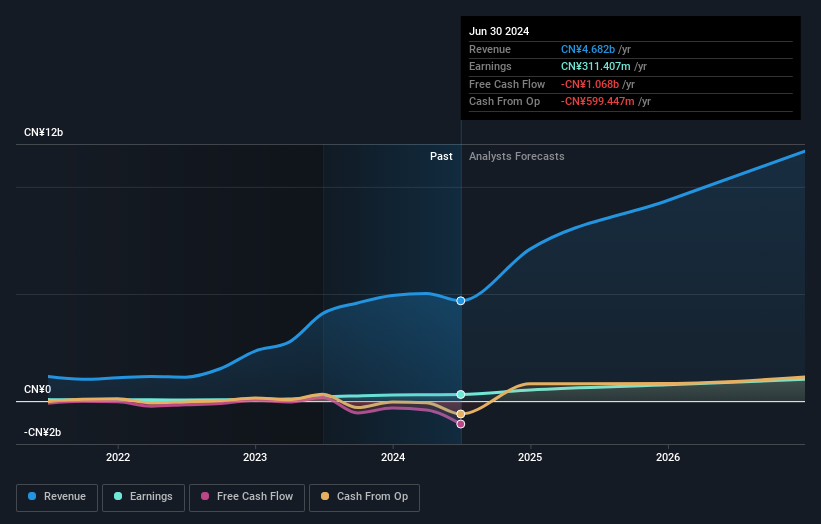

Operations: Konfoong Materials International generates revenue primarily from the Computer, Communications, and other Electronic Equipment Manufacturing segment, amounting to CN¥4.27 billion.

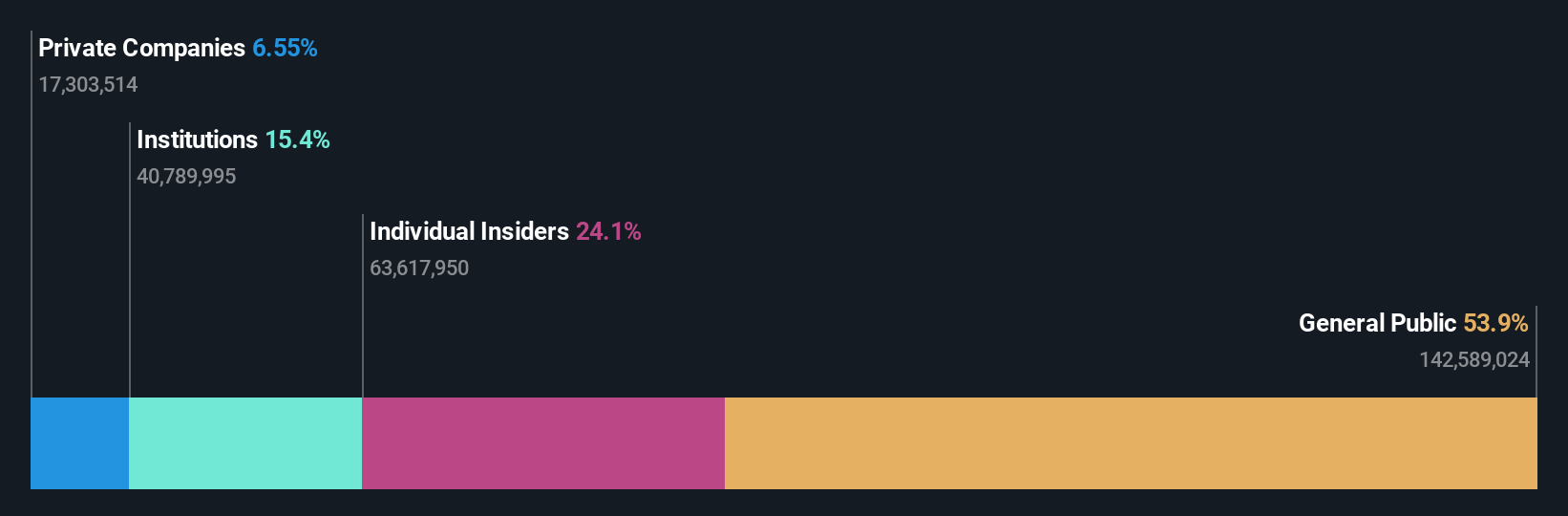

Insider Ownership: 24.1%

Earnings Growth Forecast: 26.8% p.a.

Konfoong Materials International has demonstrated strong growth, with earnings rising by 47.3% last year and revenue for the first nine months of 2025 reaching CNY 3.29 billion from CNY 2.63 billion a year prior. Despite high volatility in its share price, it maintains a favorable price-to-earnings ratio compared to the semiconductor industry average. While its earnings are expected to grow significantly at an annual rate of 26.83%, this is slightly below the broader Chinese market forecast of 27.1%.

- Unlock comprehensive insights into our analysis of Konfoong Materials International stock in this growth report.

- Our comprehensive valuation report raises the possibility that Konfoong Materials International is priced higher than what may be justified by its financials.

Sineng ElectricLtd (SZSE:300827)

Simply Wall St Growth Rating: ★★★★★★

Overview: Sineng Electric Co., Ltd. is involved in the research, development, production, and sale of power electronic equipment across China, Hong Kong, Macao, Taiwan, and international markets with a market cap of CN¥18.18 billion.

Operations: Sineng Electric Co., Ltd. generates revenue through its research, development, production, and sale of power electronic equipment in various regions including China and international markets.

Insider Ownership: 36%

Earnings Growth Forecast: 29.8% p.a.

Sineng Electric Ltd. is experiencing robust growth, with earnings up 12.8% over the past year and revenue for the first nine months of 2025 reaching CNY 3.56 billion from CNY 3.07 billion a year earlier. The company’s earnings are forecast to grow significantly at an annual rate of 29.85%, outpacing both its industry and market averages, despite a highly volatile share price recently and high non-cash earnings levels impacting perceived quality.

- Get an in-depth perspective on Sineng ElectricLtd's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Sineng ElectricLtd's current price could be inflated.

Where To Now?

- Click here to access our complete index of 640 Fast Growing Asian Companies With High Insider Ownership.

- Searching for a Fresh Perspective? Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報