Asian Dividend Stocks To Watch In 2023

In recent weeks, Asian markets have experienced a mix of profit-taking and cautious optimism as investors navigate the complexities of global economic shifts and regional policy adjustments. Amidst these dynamics, dividend stocks in Asia offer an intriguing opportunity for investors seeking stability and income potential in uncertain times.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.83% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.07% | ★★★★★★ |

| Torigoe (TSE:2009) | 3.96% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.67% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.02% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.24% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.49% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.59% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.89% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.76% | ★★★★★★ |

Click here to see the full list of 1039 stocks from our Top Asian Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

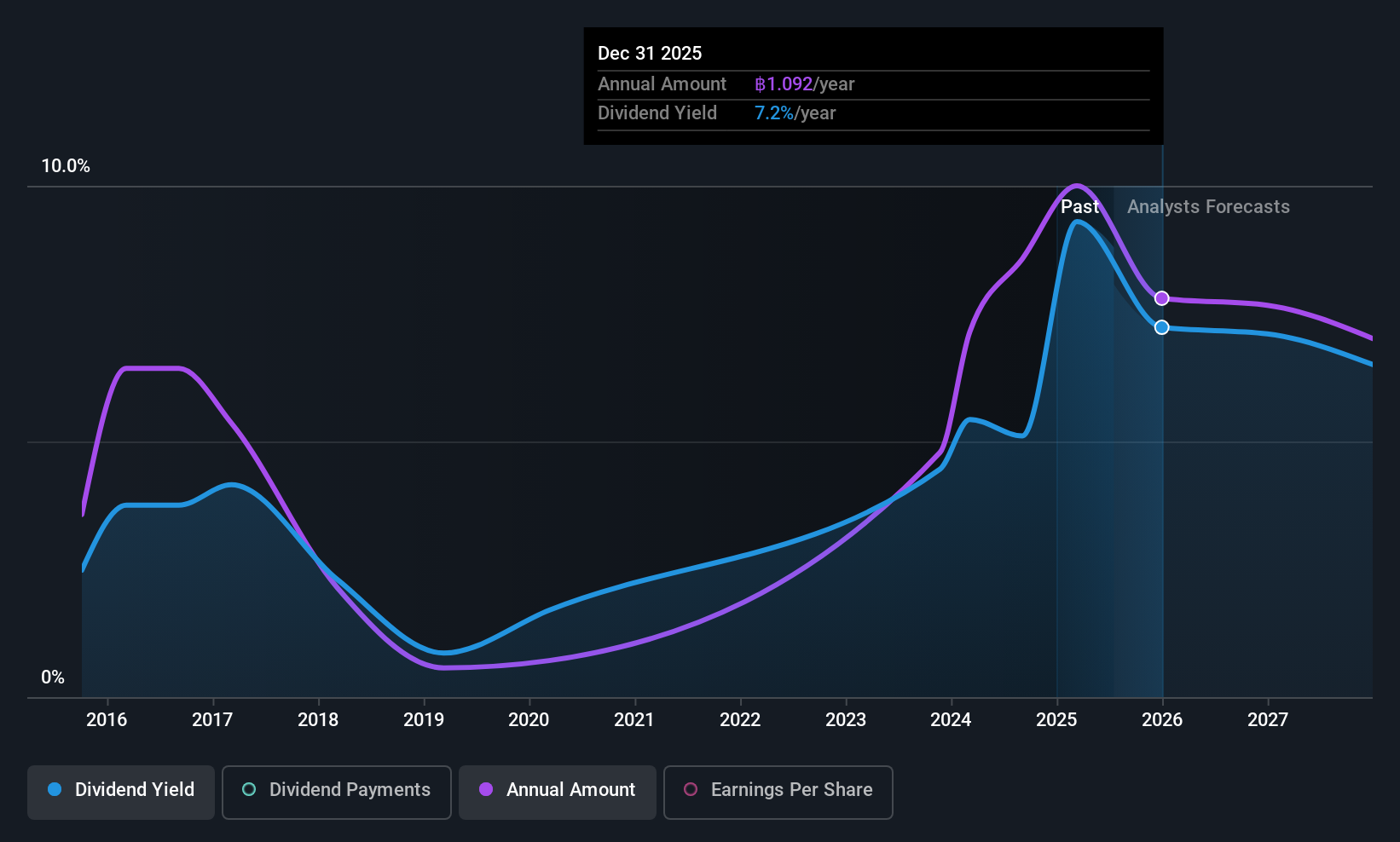

Bangkok Airways (SET:BA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bangkok Airways Public Company Limited, along with its subsidiaries, offers air transportation and airport services, with a market capitalization of approximately THB31.33 billion.

Operations: Bangkok Airways generates revenue primarily from its Airlines segment at THB17.80 billion and Supporting Airlines Business at THB5.66 billion, with additional income from Airports amounting to THB670 million.

Dividend Yield: 9.3%

Bangkok Airways offers a compelling dividend profile with its 9.27% yield, ranking in the top 25% of Thai market payers. Despite an unstable dividend track record over the past decade, recent earnings growth of 25.3% and a payout ratio of 69.1% suggest dividends are currently well-covered by earnings and cash flow. Trading at significant value below fair estimates, recent financials show improved net income for Q3, indicating potential stability in future payouts amidst past volatility.

- Take a closer look at Bangkok Airways' potential here in our dividend report.

- The valuation report we've compiled suggests that Bangkok Airways' current price could be quite moderate.

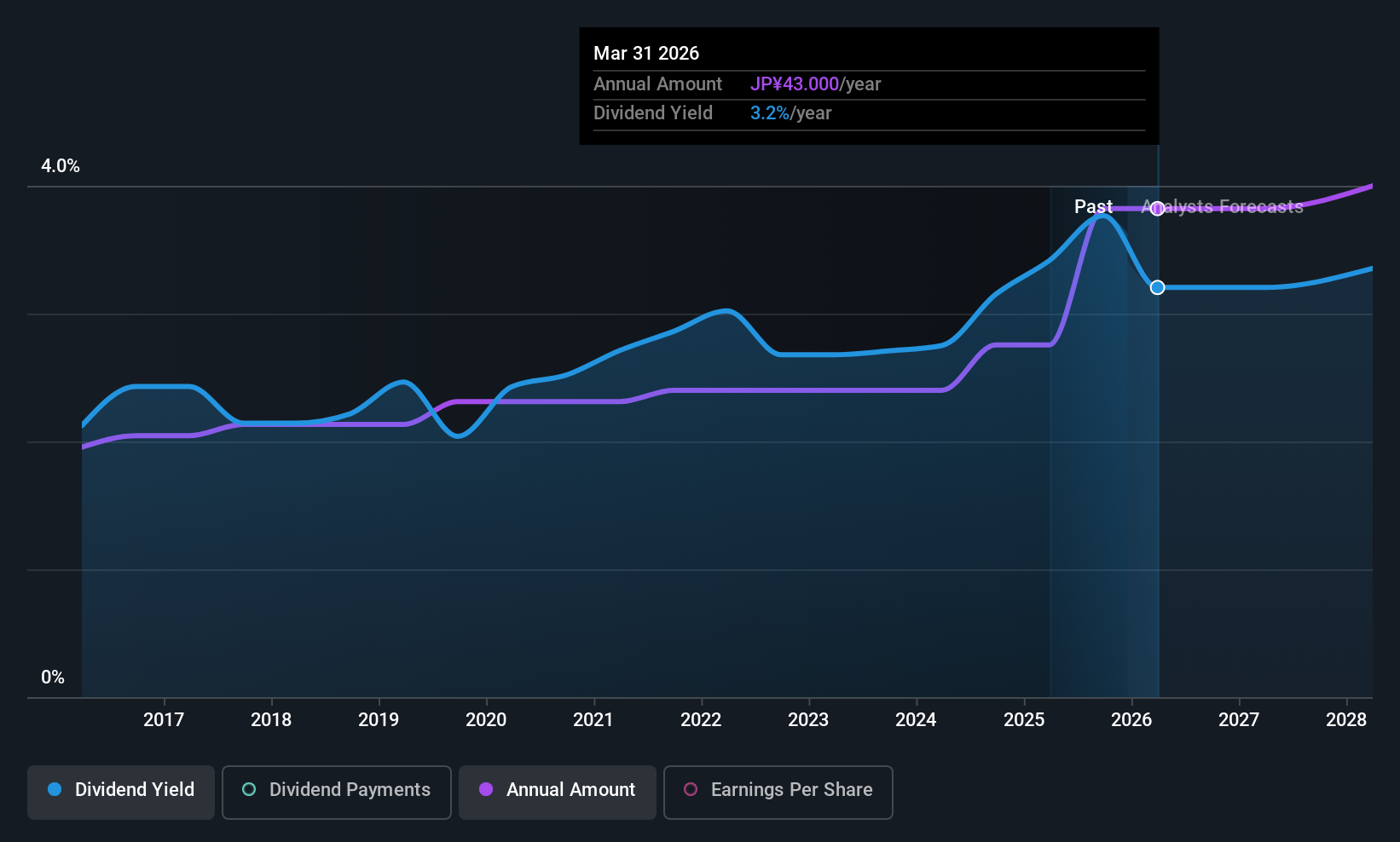

Nippon Signal (TSE:6741)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nippon Signal Co., Ltd., with a market cap of ¥83.14 billion, operates in the manufacture and sale of railway and road traffic signal solutions through its subsidiaries.

Operations: Nippon Signal Co., Ltd. generates revenue from its ICT Solution Business, which accounts for ¥50.57 billion, and its Transportation Infrastructure Business, contributing ¥60.04 billion.

Dividend Yield: 3.2%

Nippon Signal's recent dividend increase to JPY 13.00 per share reflects a commitment to rewarding shareholders, with dividends well-covered by earnings (payout ratio: 34.7%) and cash flows (cash payout ratio: 28.6%). The company maintains stable dividends over the past decade, supported by a reliable yield of 3.23%. Despite being lower than top-tier JP payers, its valuation is attractive with a P/E ratio of 10.1x compared to the market's 14.2x, enhancing its investment appeal in Asia's dividend landscape.

- Delve into the full analysis dividend report here for a deeper understanding of Nippon Signal.

- Upon reviewing our latest valuation report, Nippon Signal's share price might be too pessimistic.

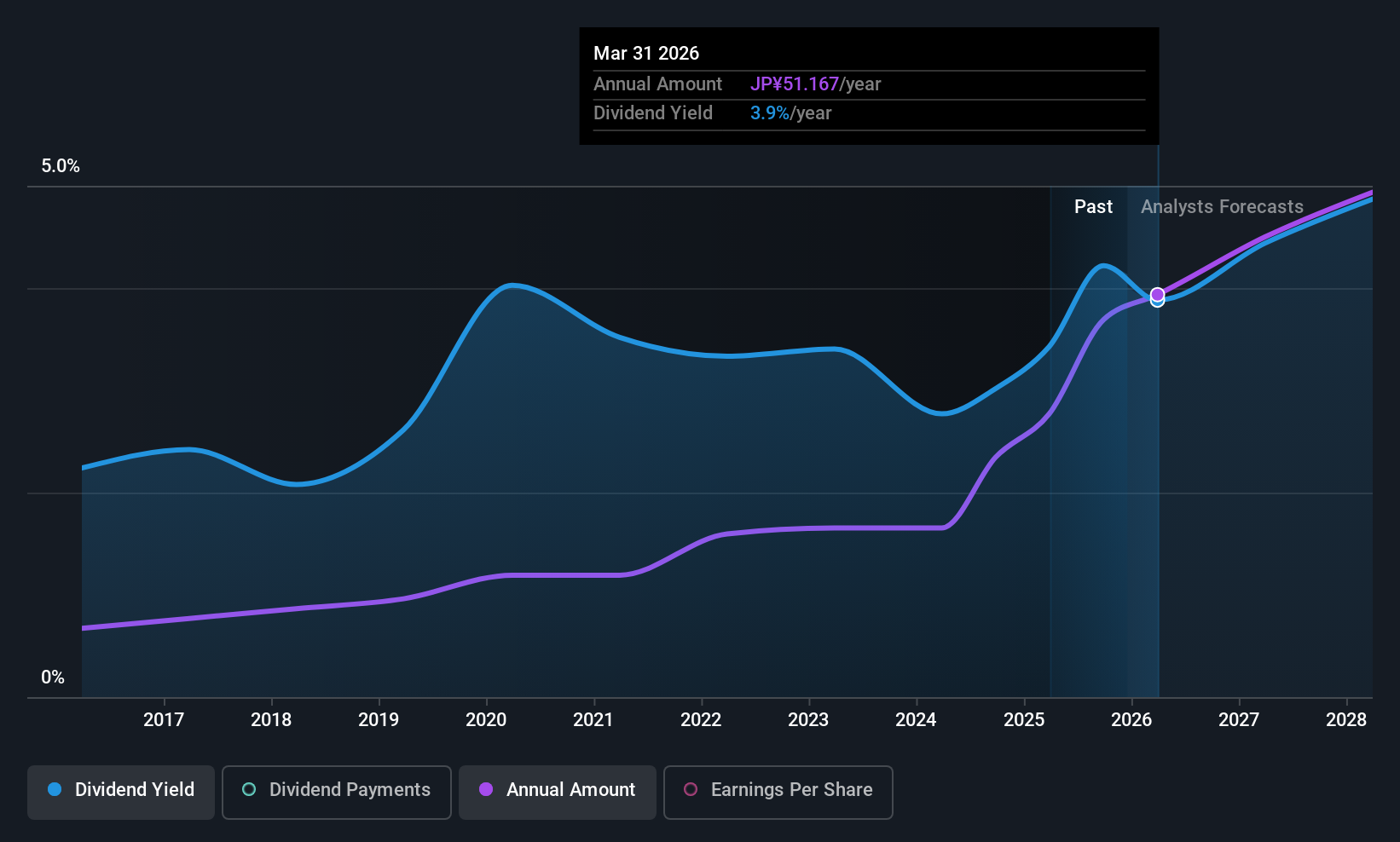

Dai-ichi Life Holdings (TSE:8750)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Dai-ichi Life Holdings, Inc. operates through its subsidiaries to offer insurance products in Japan, the United States, and internationally, with a market cap of ¥4.73 trillion.

Operations: Dai-ichi Life Holdings, Inc. generates revenue through its subsidiaries by offering a range of insurance products across Japan, the United States, and various international markets.

Dividend Yield: 4.2%

Dai-ichi Life Holdings offers a compelling dividend profile, with a payout ratio of 17.2% ensuring dividends are well-covered by earnings and cash flows. The dividend yield stands at 4.15%, placing it in the top quartile among Japanese payers. Despite recent reductions in per-share dividends, strategic investments and raised earnings forecasts highlight growth potential, supported by robust financial performance and capital efficiency improvements through acquisitions and asset management initiatives across Asia.

- Unlock comprehensive insights into our analysis of Dai-ichi Life Holdings stock in this dividend report.

- Our expertly prepared valuation report Dai-ichi Life Holdings implies its share price may be lower than expected.

Taking Advantage

- Click this link to deep-dive into the 1039 companies within our Top Asian Dividend Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報