3 Asian Stocks Estimated To Be Undervalued By Up To 43.5%

As global markets react to central bank decisions and economic indicators, Asia's stock markets have shown mixed performance amid concerns about deflationary pressures in China and anticipated interest rate changes in Japan. In this environment, identifying undervalued stocks can offer potential opportunities for investors seeking value, as these stocks might be trading below their intrinsic worth due to broader market uncertainties or sector-specific challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥153.67 | CN¥303.69 | 49.4% |

| Wuhan Guide Infrared (SZSE:002414) | CN¥12.86 | CN¥25.28 | 49.1% |

| Sany Heavy Equipment International Holdings (SEHK:631) | HK$8.24 | HK$16.21 | 49.2% |

| Mobvista (SEHK:1860) | HK$15.47 | HK$30.70 | 49.6% |

| KoMiCo (KOSDAQ:A183300) | ₩84300.00 | ₩166235.75 | 49.3% |

| JINS HOLDINGS (TSE:3046) | ¥5480.00 | ¥10936.95 | 49.9% |

| Global Security Experts (TSE:4417) | ¥2896.00 | ¥5752.68 | 49.7% |

| FIT Hon Teng (SEHK:6088) | HK$5.65 | HK$11.25 | 49.8% |

| Beijing HyperStrong Technology (SHSE:688411) | CN¥259.34 | CN¥517.30 | 49.9% |

| ActRO (KOSDAQ:A290740) | ₩12750.00 | ₩25049.37 | 49.1% |

Let's review some notable picks from our screened stocks.

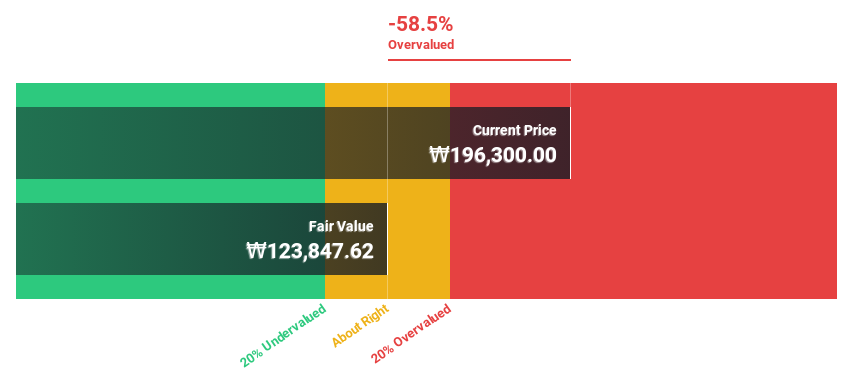

LIG Nex1 (KOSE:A079550)

Overview: LIG Nex1 Co., Ltd. is a defense company that develops and manufactures weapon systems globally, with a market cap of ₩8.41 trillion.

Operations: The company's revenue is primarily derived from its Aerospace & Defense segment, which generated approximately ₩4.07 billion.

Estimated Discount To Fair Value: 35.6%

LIG Nex1 is trading at ₩385,000, significantly below its estimated fair value of ₩598,053.87, indicating it may be undervalued based on cash flows. Despite high non-cash earnings and strong profit growth forecasts of 22.97% annually over three years, revenue growth lags behind market expectations at 13.8%. The company's debt coverage by operating cash flow is weak; however, analysts agree the stock price could rise by 55.8%, reflecting potential upside in valuation.

- Our expertly prepared growth report on LIG Nex1 implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in LIG Nex1's balance sheet health report.

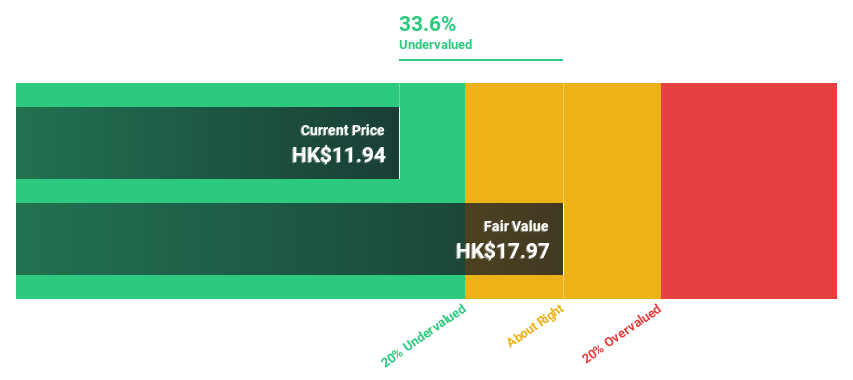

Smoore International Holdings (SEHK:6969)

Overview: Smoore International Holdings Limited is an investment holding company that provides vaping technology solutions, with a market capitalization of HK$74.70 billion.

Operations: Smoore International Holdings Limited generates its revenue from providing vaping technology solutions.

Estimated Discount To Fair Value: 43.5%

Smoore International Holdings is trading at HK$12.06, considerably below its estimated fair value of HK$21.33, highlighting potential undervaluation based on cash flows. Despite a decline in profit margins from 13.1% to 7.7%, the company's earnings are expected to grow significantly at 37.6% annually over three years, outpacing the Hong Kong market's growth rate of 12.1%. However, revenue growth is projected at a slower pace than earnings expansion but still exceeds market averages.

- Upon reviewing our latest growth report, Smoore International Holdings' projected financial performance appears quite optimistic.

- Take a closer look at Smoore International Holdings' balance sheet health here in our report.

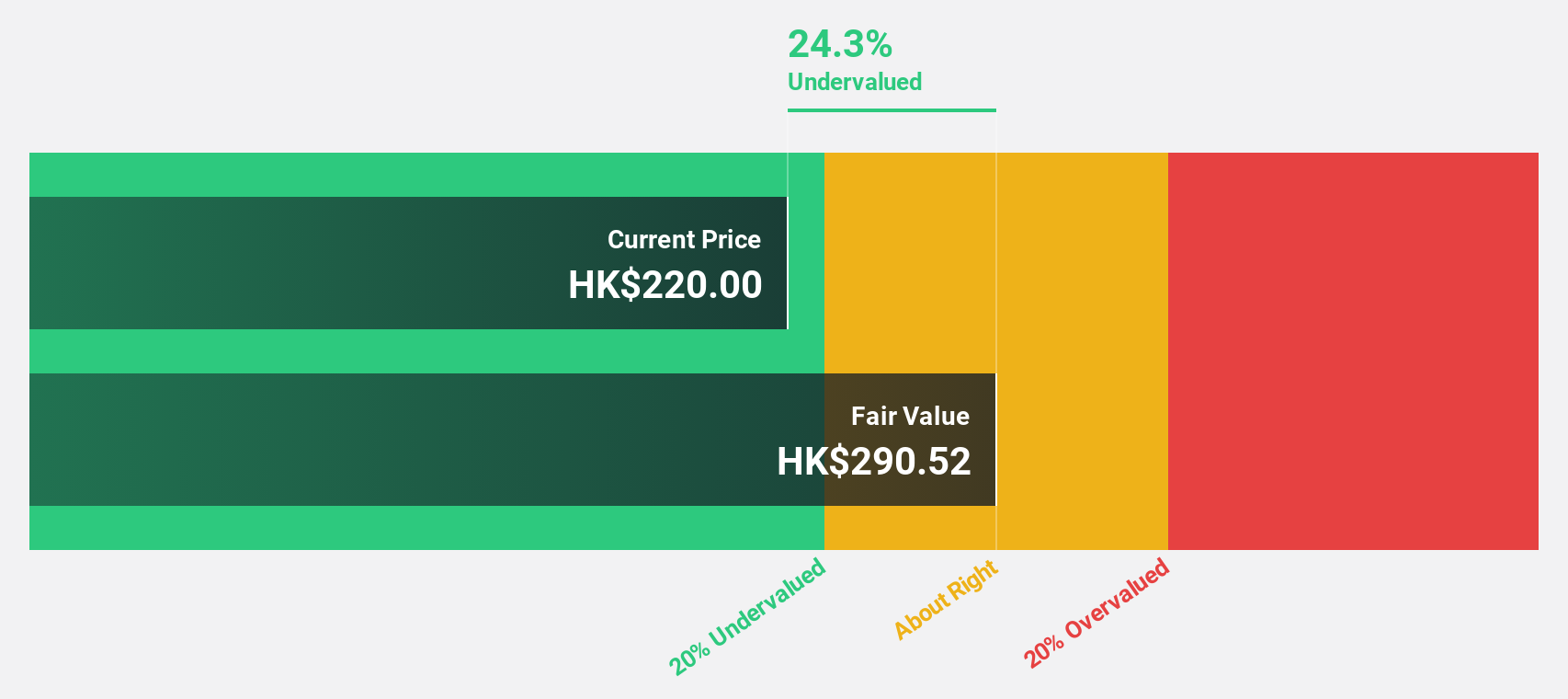

Pop Mart International Group (SEHK:9992)

Overview: Pop Mart International Group Limited is an investment holding company focused on the design, development, and sale of pop toys across the People’s Republic of China, Hong Kong, Macao, Taiwan, and internationally with a market cap of approximately HK$259.92 billion.

Operations: The company's revenue primarily comes from its brand development, design, and sales of toys segment, which generated CN¥22.36 billion.

Estimated Discount To Fair Value: 30.8%

Pop Mart International Group is trading at HK$195.7, significantly below its estimated fair value of HK$282.78, indicating potential undervaluation based on cash flows. Recent unaudited revenue showed a substantial increase of 245%-250% year-on-year for Q3 2025, with overseas operations surging by 365%-370%. Earnings are forecast to grow annually by 25.7%, surpassing the Hong Kong market average of 12.1%, while return on equity is projected to reach a high level of 42.7% in three years.

- Our earnings growth report unveils the potential for significant increases in Pop Mart International Group's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Pop Mart International Group.

Next Steps

- Get an in-depth perspective on all 282 Undervalued Asian Stocks Based On Cash Flows by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報