Undiscovered Gems in Asia to Explore This December 2025

As December 2025 unfolds, the Asian markets are navigating a complex landscape shaped by global economic shifts and regional dynamics. With the Federal Reserve's recent interest rate cuts influencing market sentiment, small-cap stocks in Asia present intriguing opportunities for investors seeking potential growth amid fluctuating conditions. In this context, identifying promising stocks involves assessing their resilience to economic changes and their capacity to leverage emerging trends effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Toho | 64.50% | 7.33% | 58.64% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 32.67% | 9.30% | 4.58% | ★★★★★★ |

| FALCO HOLDINGS | 4.59% | -1.20% | -5.35% | ★★★★★★ |

| Thai Steel Cable | NA | 3.35% | 17.89% | ★★★★★★ |

| Camelot Electronics TechnologyLtd | 10.07% | 11.02% | -5.75% | ★★★★★★ |

| Nextronics Engineering | 20.23% | 11.39% | 24.54% | ★★★★★★ |

| Guangdong Green Precision Components | NA | -8.91% | -38.16% | ★★★★★★ |

| LanZhou Foci PharmaceuticalLtd | 1.63% | 7.07% | -12.27% | ★★★★★★ |

| Hyakugo Bank | 131.34% | 6.52% | 7.51% | ★★★★★☆ |

| Zhejiang Risun Intelligent TechnologyLtd | 51.85% | 20.80% | -5.94% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Hong Leong Asia (SGX:H22)

Simply Wall St Value Rating: ★★★★★★

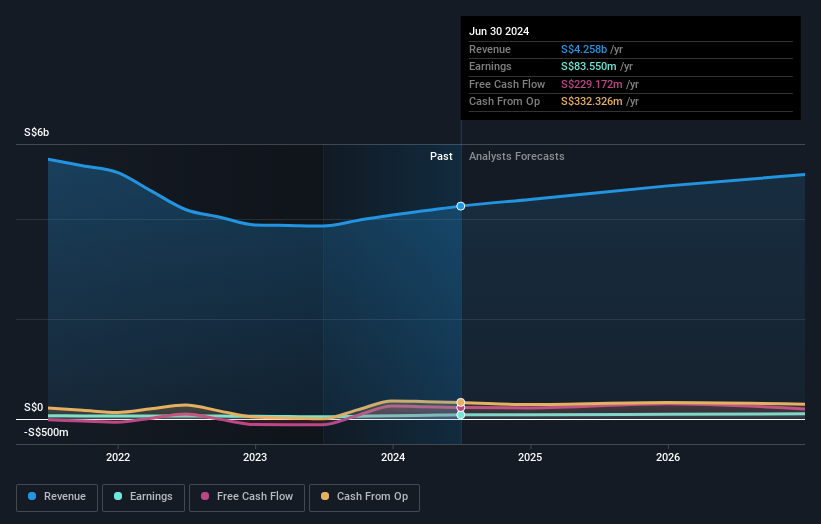

Overview: Hong Leong Asia Ltd. is an investment holding company that manufactures and distributes powertrain solutions, building materials, and rigid packaging products across China, Singapore, Malaysia, and internationally with a market capitalization of approximately SGD1.66 billion.

Operations: The company's primary revenue stream comes from Powertrain Solutions, generating approximately SGD4.14 billion, followed by Building Materials at SGD671.05 million. The net profit margin reflects the efficiency of its operations and profitability relative to total revenue.

Hong Leong Asia, a notable player in the machinery sector, has been making strides with high-quality earnings and a debt-to-equity ratio reduction from 40% to 32.6% over the past five years. Trading at 28.2% below its estimated fair value, it presents an attractive valuation for potential investors. The company is free cash flow positive and boasts well-covered interest payments with EBIT covering them 3.6 times over. Recent inclusion in the S&P Global BMI Index highlights its growing prominence, while earnings have outpaced industry growth at 12.5%. Future projections suggest further annual earnings growth of around 15%.

Kexin DevelopmentLtdShanxi (SHSE:600234)

Simply Wall St Value Rating: ★★★★★☆

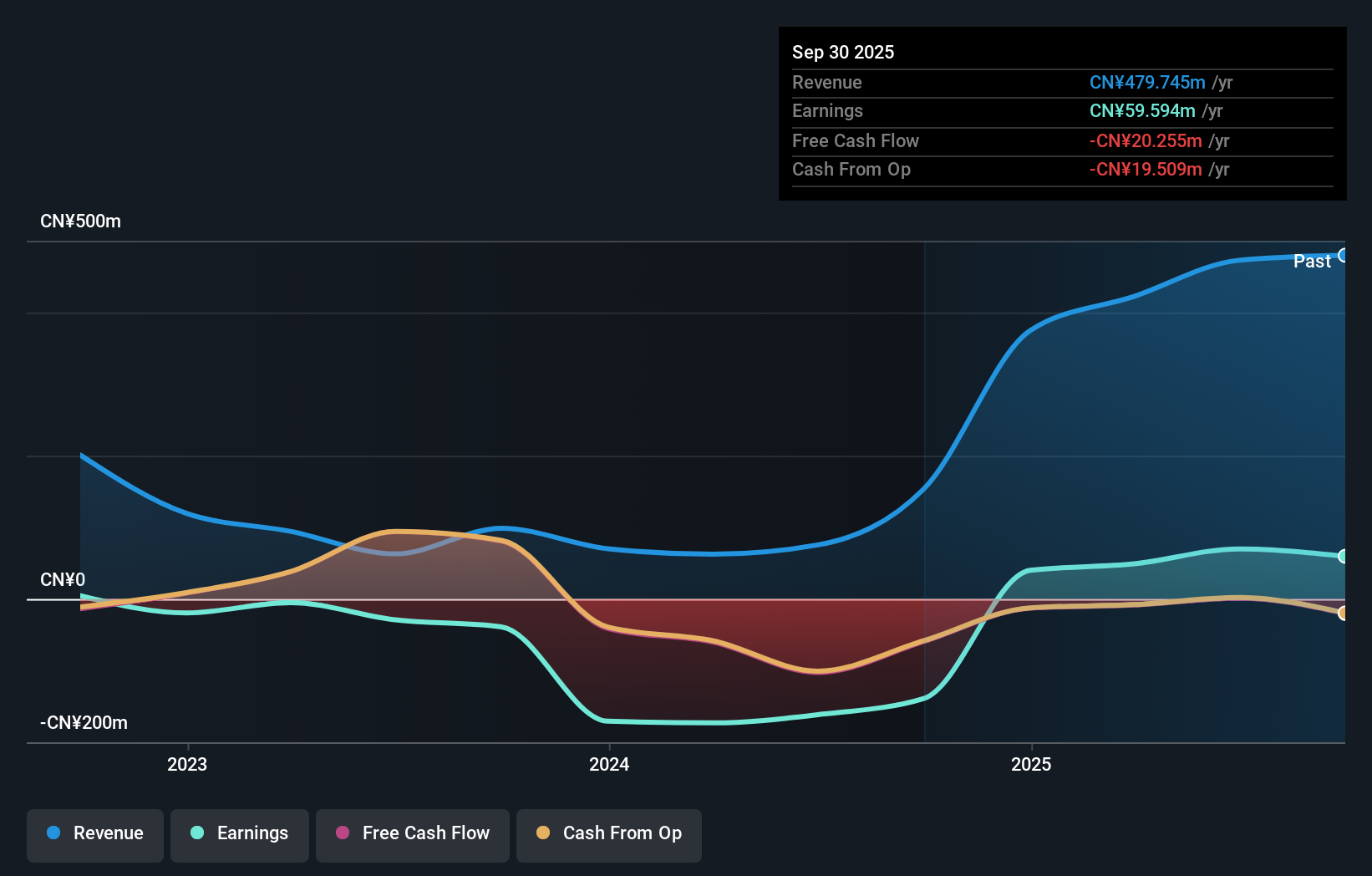

Overview: Kexin Development Co., Ltd, Shanxi operates in media advertising, self-owned housing leasing, and architectural decoration engineering services with a market capitalization of CN¥3.63 billion.

Operations: Kexin Development generates revenue primarily through media advertising, self-owned housing leasing, and architectural decoration engineering services. The company has a market capitalization of CN¥3.63 billion.

Kexin Development Ltd, Shanxi has shown notable growth with sales reaching CNY 262.42 million for the nine months ending September 2025, a significant increase from CNY 157.22 million the previous year. Net income also rose to CNY 31.09 million compared to last year's CNY 11.48 million, reflecting improved profitability and a debt-to-equity ratio drop from 24.4% to just 1.5% over five years, indicating strong financial management. Despite this progress and high-quality earnings, its share price has been highly volatile recently, which could be a concern for potential investors looking at stability in their investments.

Mercuries Life Insurance (TWSE:2867)

Simply Wall St Value Rating: ★★★★☆☆

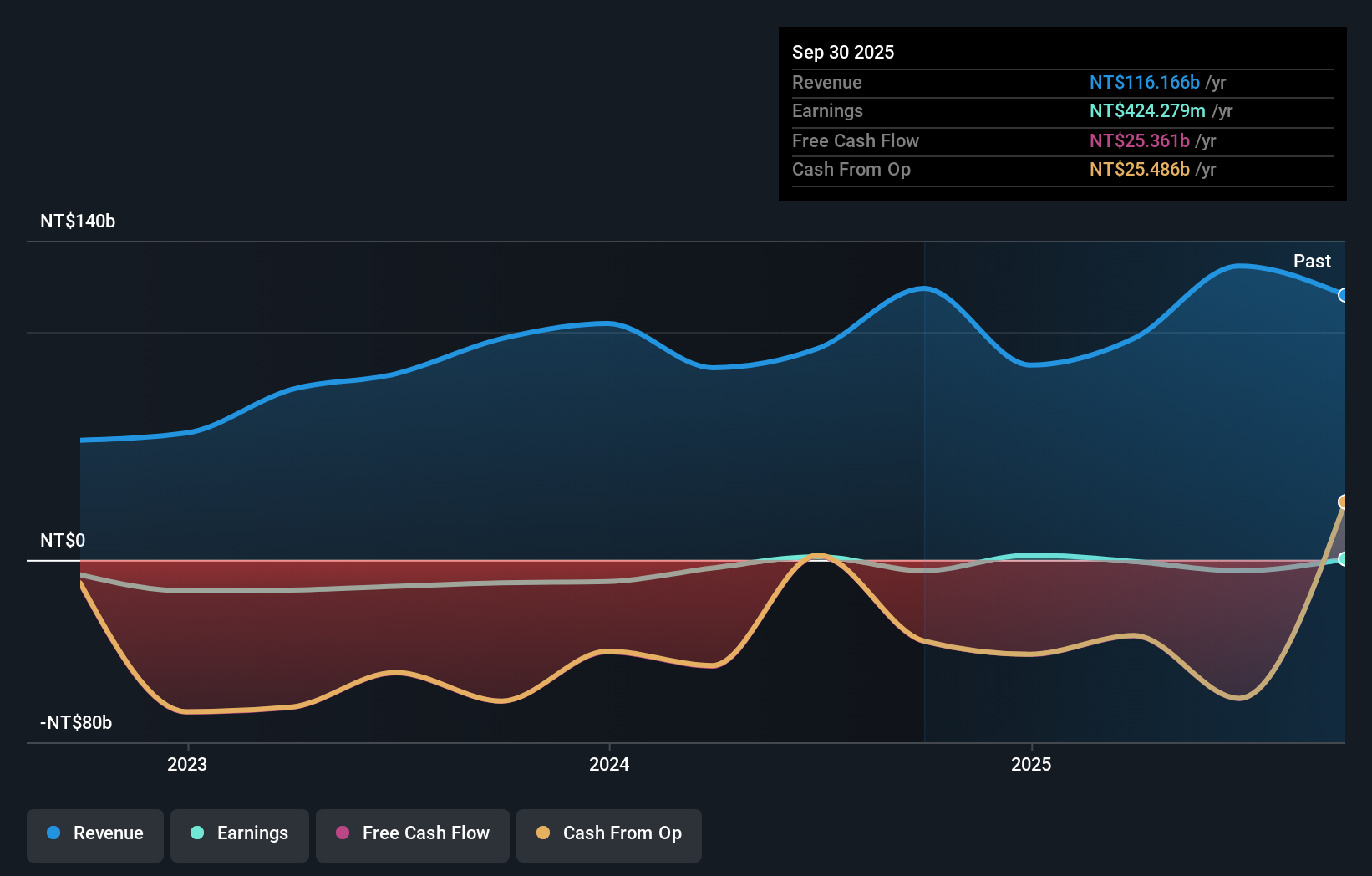

Overview: Mercuries Life Insurance Company Ltd. offers life insurance products in Taiwan and has a market capitalization of approximately NT$47.02 billion.

Operations: The company generates revenue from its life insurance business, amounting to NT$116.17 billion.

Mercuries Life Insurance, a smaller player in the insurance sector, recently turned profitable, with net income for Q3 2025 hitting TWD 1.60 billion from a loss of TWD 3.63 billion the previous year. Basic earnings per share improved to TWD 0.28 from a loss of TWD 0.7 last year, highlighting its financial rebound despite industry challenges like the -5.8% growth rate in insurance earnings. The company's debt-to-equity ratio climbed to 38% over five years but remains manageable with interest payments well covered by EBIT at an impressive 82x coverage level, indicating robust financial health amidst ongoing acquisition talks by E.SUN Financial Holding Company for TWD 42.9 billion.

Turning Ideas Into Actions

- Access the full spectrum of 2496 Asian Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報