Kumho Petro ChemicalLtd (KRX:011780) investors are up 3.3% in the past week, but earnings have declined over the last year

There's no doubt that investing in the stock market is a truly brilliant way to build wealth. But if when you choose to buy stocks, some of them will be below average performers. Over the last year the Kumho Petro Chemical Co.,Ltd (KRX:011780) share price is up 32%, but that's less than the broader market return. Zooming out, the stock is actually down 9.4% in the last three years.

Since the stock has added ₩104b to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year, Kumho Petro ChemicalLtd actually saw its earnings per share drop 19%.

This means it's unlikely the market is judging the company based on earnings growth. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

We are skeptical of the suggestion that the 1.8% dividend yield would entice buyers to the stock. However the year on year revenue growth of 3.9% would help. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

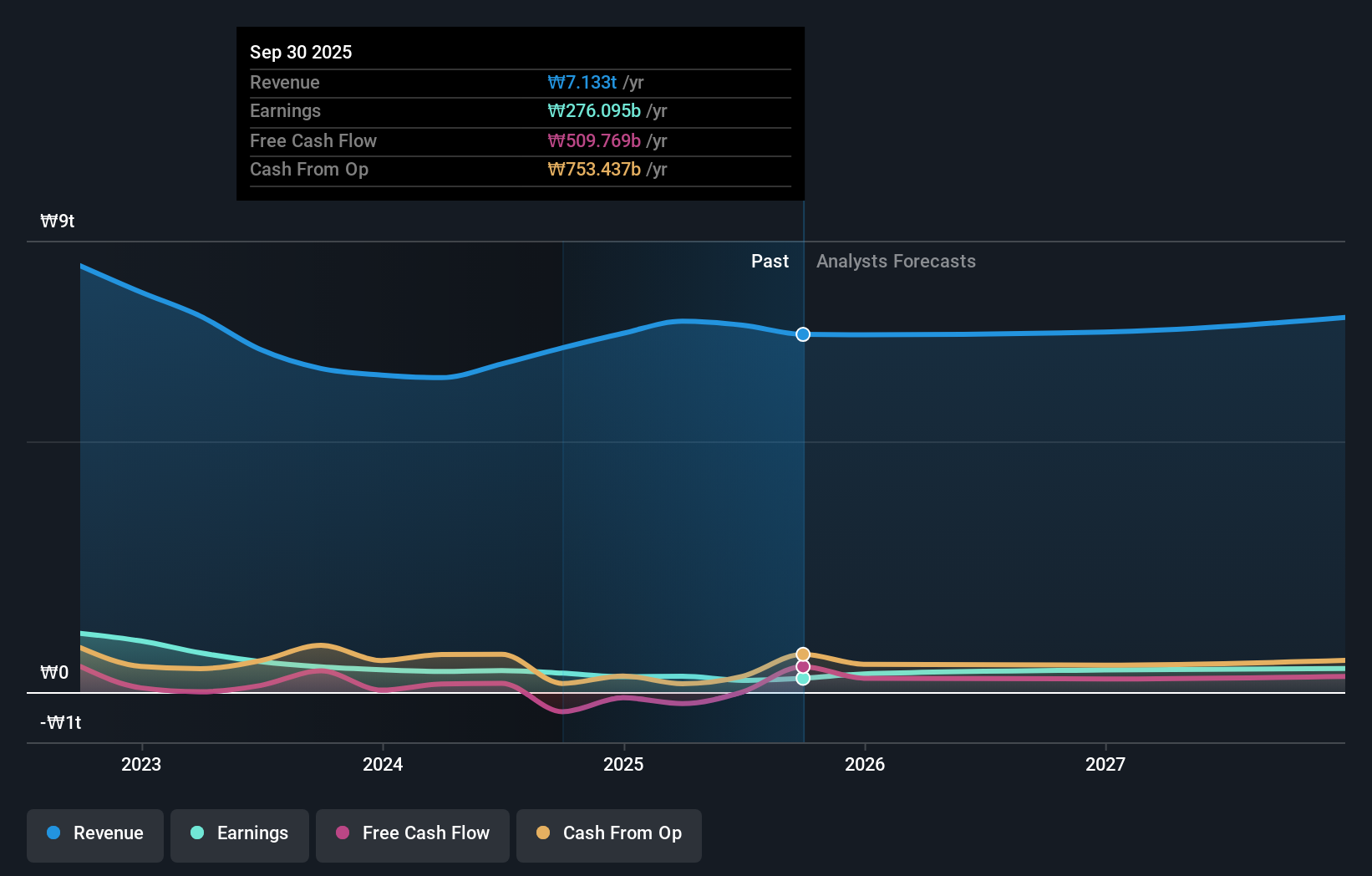

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Kumho Petro ChemicalLtd is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Kumho Petro ChemicalLtd stock, you should check out this free report showing analyst consensus estimates for future profits.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Kumho Petro ChemicalLtd, it has a TSR of 36% for the last 1 year. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Kumho Petro ChemicalLtd shareholders gained a total return of 36% during the year. But that return falls short of the market. The silver lining is that the gain was actually better than the average annual return of 1.5% per year over five year. This could indicate that the company is winning over new investors, as it pursues its strategy. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 1 warning sign for Kumho Petro ChemicalLtd that you should be aware of.

Of course Kumho Petro ChemicalLtd may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on South Korean exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報