Shima Seiki Mfg.Ltd (TSE:6222) Has Announced A Dividend Of ¥10.00

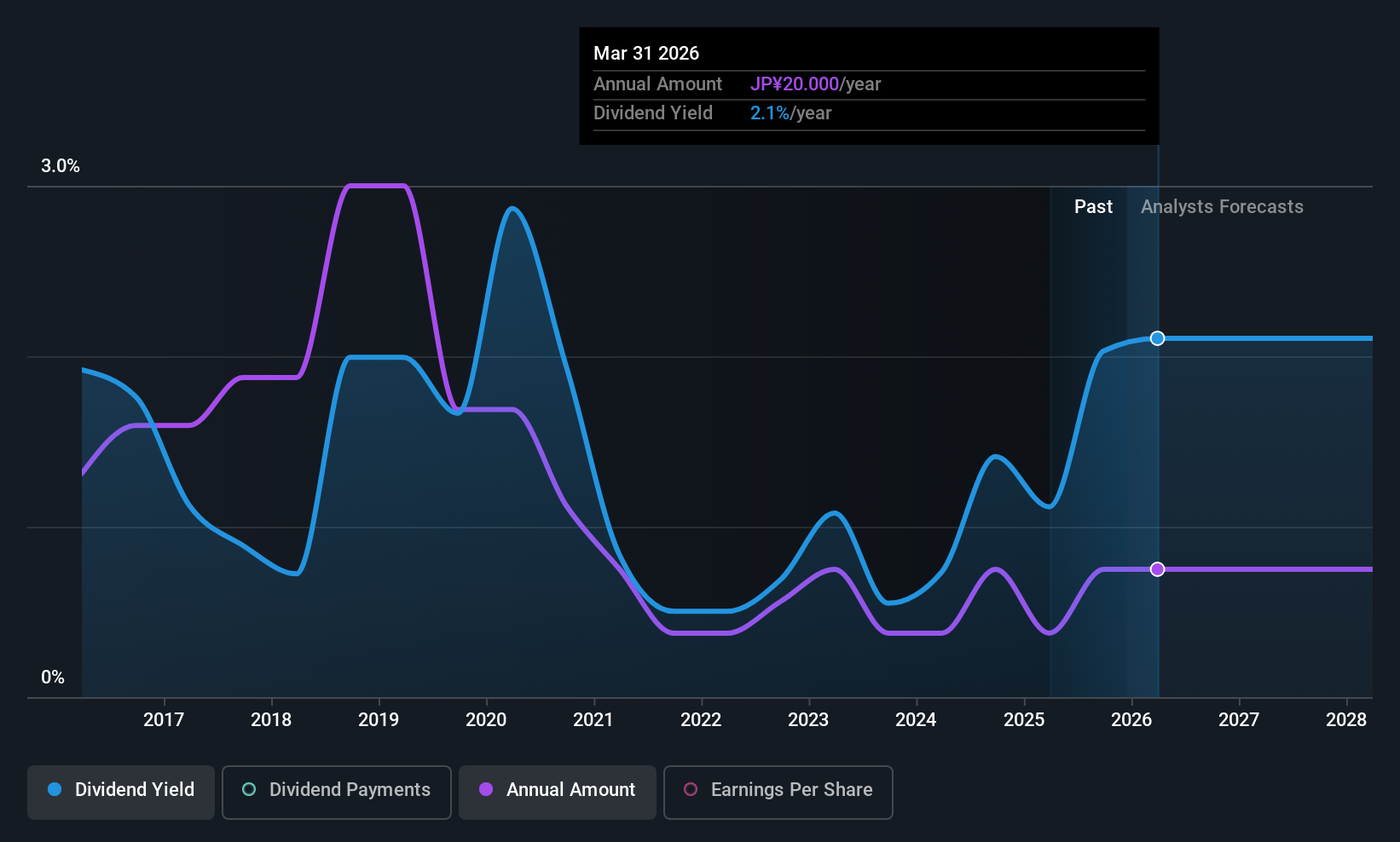

The board of Shima Seiki Mfg.,Ltd. (TSE:6222) has announced that it will pay a dividend on the 29th of June, with investors receiving ¥10.00 per share. The payment will take the dividend yield to 2.1%, which is in line with the average for the industry.

Estimates Indicate Shima Seiki Mfg.Ltd's Dividend Coverage Likely To Improve

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. Even though Shima Seiki Mfg.Ltd is not generating a profit, it is still paying a dividend. Along with this, it is also not generating free cash flows, which raises concerns about the sustainability of the dividend.

Earnings per share is forecast to rise by 106.6% over the next year. If the dividend continues along recent trends, we estimate the payout ratio could reach 77%, which is on the higher side, but certainly still feasible.

View our latest analysis for Shima Seiki Mfg.Ltd

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2015, the annual payment back then was ¥32.50, compared to the most recent full-year payment of ¥20.00. The dividend has shrunk at around 4.7% a year during that period. A company that decreases its dividend over time generally isn't what we are looking for.

The Company Could Face Some Challenges Growing The Dividend

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Shima Seiki Mfg.Ltd has seen EPS rising for the last five years, at 13% per annum. Unprofitable companies aren't normally our pick for a dividend stock, but we like the growth that we have been seeing. Assuming the company can post positive net income numbers soon, it could has the potential to be a decent dividend payer.

The Dividend Could Prove To Be Unreliable

Overall, we always like to see the dividend being raised, but we don't think Shima Seiki Mfg.Ltd will make a great income stock. While we generally think the level of distributions are a bit high, we wouldn't rule it out as becoming a good dividend payer in the future as its earnings are growing healthily. We would probably look elsewhere for an income investment.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 1 warning sign for Shima Seiki Mfg.Ltd that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報