Digital Realty (DLR) Valuation Check After Power Infrastructure Veteran Stephen Bolze Joins Board

Digital Realty Trust (DLR) just added infrastructure veteran Stephen Bolze to its board, a move that lines up squarely with the data center landlord’s growing focus on power reliability and large scale expansion.

See our latest analysis for Digital Realty Trust.

Despite bringing in Bolze to help steer expansion and power strategy, momentum has cooled recently, with a roughly mid teens year to date share price decline, but a strong three year total shareholder return still signaling long term conviction.

If Bolze’s appointment has you thinking about other infrastructure heavy growth stories, it could be a good moment to explore fast growing stocks with high insider ownership for fresh ideas beyond data centers.

With shares down double digits this year but still boasting a hefty multiyear run and a sizable gap to analyst targets, is Digital Realty quietly slipping into value territory, or is the market already discounting its next leg of growth?

Most Popular Narrative Narrative: 24.6% Undervalued

With Digital Realty Trust closing at $150.28 versus a narrative fair value near $199, the current setup frames a sizable potential upside driven by growth and capital deployment assumptions.

The successful formation of Digital Realty's first U.S. hyperscale fund is expected to fuel future growth with up to $10 billion in investments, leading to enhanced revenue and returns through fees, highlighting its significant potential impact on long-term earnings sustainability.

Want to see what kind of revenue runway and margin profile could support that valuation gap? The narrative leans on powerful growth, scale, and premium multiples. Curious how those forces connect into a single fair value number? Dive in to unpack the full playbook behind this upside case.

Result: Fair Value of $199.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained power bottlenecks and a potential oversupply in key U.S. markets could quickly undercut the bullish growth and valuation narrative.

Find out about the key risks to this Digital Realty Trust narrative.

Another View: Market Ratios Flash Caution

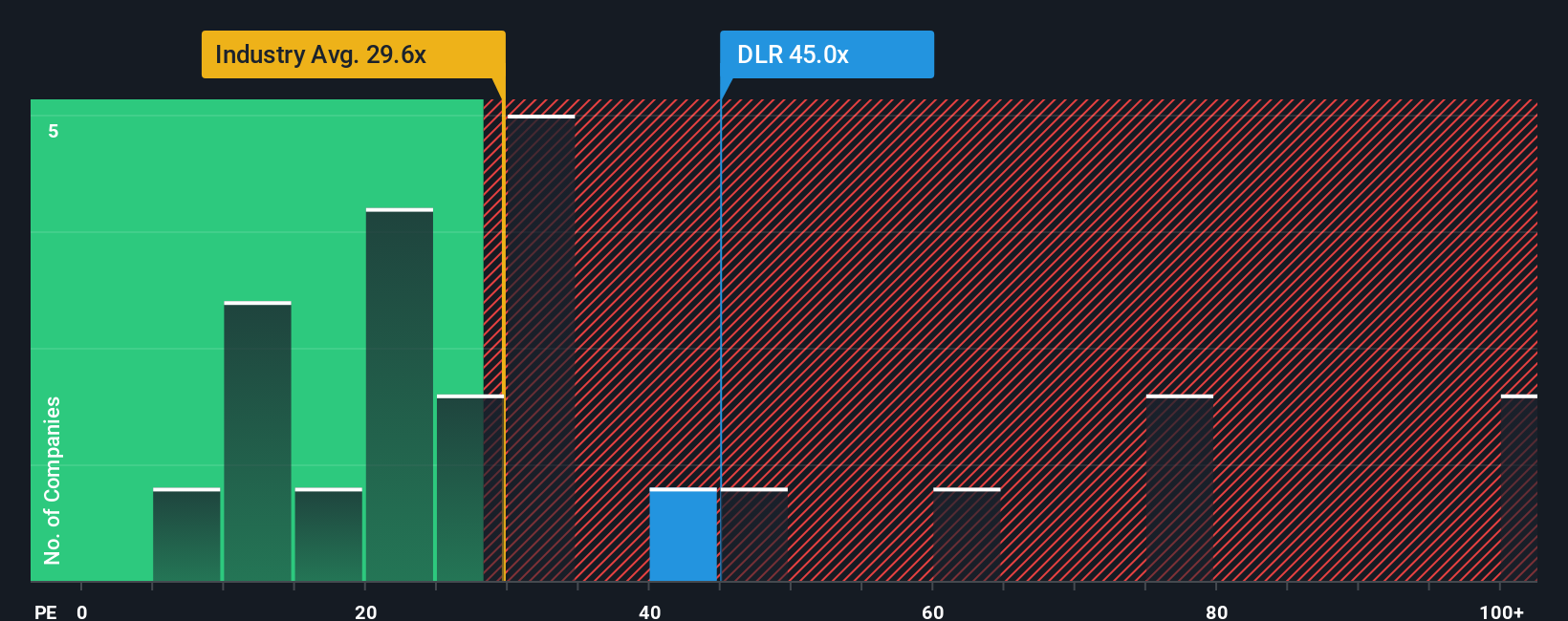

While the narrative fair value points to upside, the price to earnings ratio tells a different story. Digital Realty trades on 38 times earnings versus 28.1 times for the US Specialized REITs industry and a fair ratio of 28.8, suggesting investors are already paying up for growth that may not fully arrive.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Digital Realty Trust Narrative

If you see the story differently or want to test your own assumptions against the data, craft a custom narrative in minutes, Do it your way.

A great starting point for your Digital Realty Trust research is our analysis highlighting 5 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you log off, consider using the Simply Wall Street Screener to explore opportunities that could help diversify or refine your portfolio.

- Look for potential mispricings by targeting companies that appear attractively valued on cash flows using these 909 undervalued stocks based on cash flows.

- Explore structural trends in automation and machine learning by scanning these 26 AI penny stocks for businesses developing intelligent products and platforms.

- Support an income-focused approach by searching for dividend payers through these 13 dividend stocks with yields > 3%, including companies offering yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報