Chorus (NZSE:CNU) Valuation After New Zealand’s Plan to Sell Its UFB-Era Stake

The New Zealand government’s plan to sell down its Chorus (NZSE:CNU) securities and debt is a big reset moment. It shifts attention from past Ultra Fast Broadband funding arrangements to future ownership dynamics and capital flows.

See our latest analysis for Chorus.

That backdrop helps explain why investors have been relatively steady on Chorus, with the share price at NZ$9.33 and a solid 1 year total shareholder return of 10.5 percent building on a 54.6 percent gain over five years.

If this kind of infrastructure story has you thinking about what else could quietly compound in your portfolio, it might be worth exploring fast growing stocks with high insider ownership as your next hunting ground.

With Chorus now a mature, regulated utility delivering steady growth, the real debate is whether today’s price still leaves room for upside or if the market is already baking in years of future expansion.

Most Popular Narrative: 2.6% Overvalued

With Chorus closing at NZ$9.33 against a narrative fair value of NZ$9.09, the pricing gap is narrow but hinges on bold profit and multiple assumptions.

The analysts have a consensus price target of NZ$9.093 for Chorus based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of NZ$9.95, and the most bearish reporting a price target of just NZ$8.0.

Want to see what justifies such a wide range of future earnings outcomes and still lands on a tight fair value band? The narrative leans on ambitious profit scaling, shifting margins and a punchy future valuation multiple that would usually be reserved for faster growing sectors. Curious how those moving parts combine to support the target price? Dive in to see the specific growth and profitability path that holds this valuation together.

Result: Fair Value of $9.09 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sluggish fiber uptake and tighter regulation could still choke Chorus's growth story, challenging those optimistic earnings forecasts and premium valuation multiples.

Find out about the key risks to this Chorus narrative.

Another Angle On Value

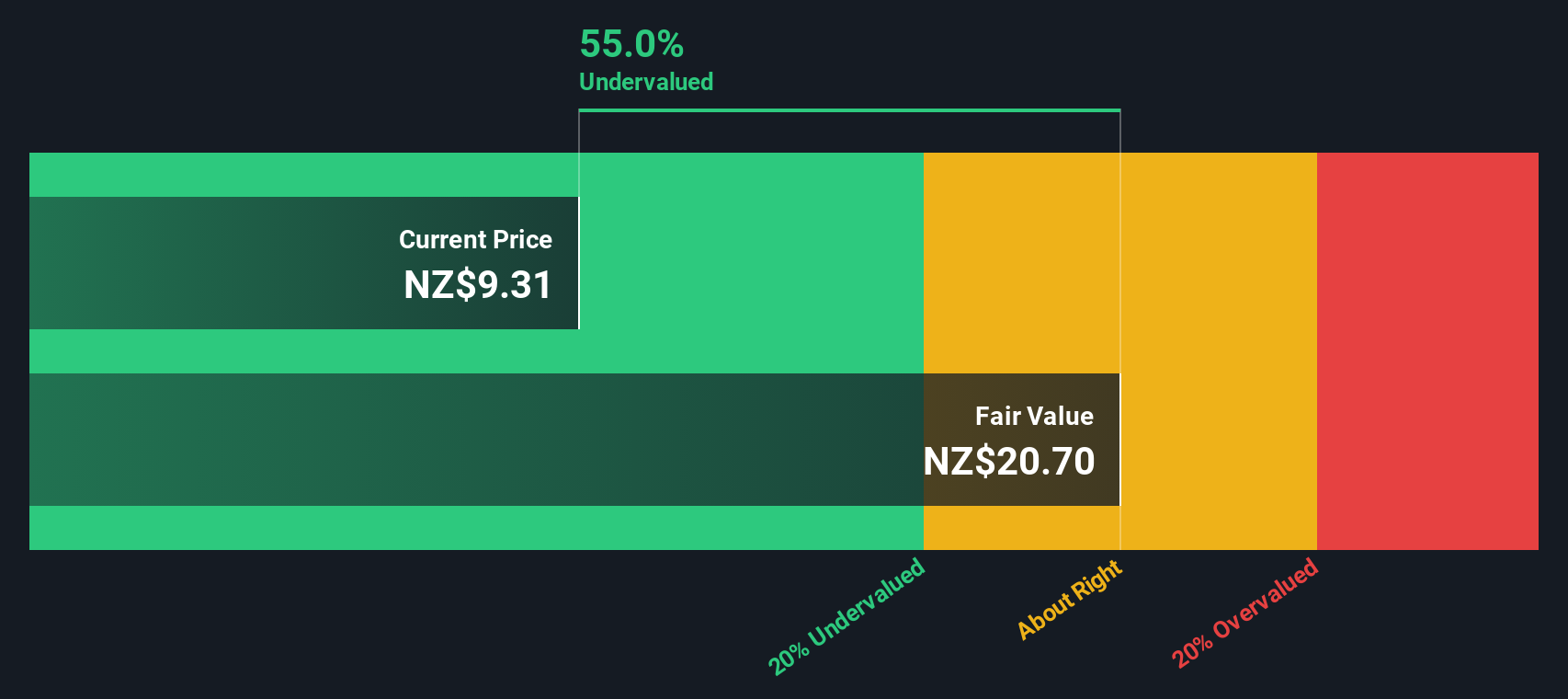

Analysts see Chorus as 2.6 percent overvalued at NZ$9.33 versus their NZ$9.09 fair value, but our DCF model presents a very different perspective, suggesting shares are trading at a 54.6 percent discount to a fair value of NZ$20.54. Which story do you consider more informative: sentiment or cash flows?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Chorus Narrative

If you see the story differently or prefer hands on research, you can craft a personalized Chorus view in under three minutes: Do it your way.

A great starting point for your Chorus research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop at Chorus, you could miss other powerful opportunities, so use the Simply Wall Street Screener to uncover complementary ideas that suit your strategy.

- Capitalize on emerging tech shifts by reviewing these 26 AI penny stocks that are turning AI innovation into real, scalable earnings potential.

- Lock in resilient cash flows with these 13 dividend stocks with yields > 3% that can support growing income while markets stay unpredictable.

- Ride structural change in digital finance through these 80 cryptocurrency and blockchain stocks positioned to benefit as blockchain adoption accelerates worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報