REA Group (ASX:REA) Valuation Check After Google’s Property Search Test and Recent Share Price Weakness

Google’s experiment with homes for sale appearing directly in search results has unsettled investors in REA Group (ASX:REA). This has contributed to a decline in the company’s share price as the market reassesses its long term competitive position.

See our latest analysis for REA Group.

That Google trial has landed on a stock that was already under pressure, with a 1 month share price return of minus 8.1 percent and a year to date share price return of about minus 22 percent. Even though the 3 year total shareholder return is still up more than 70 percent, this suggests long term holders are nursing gains while shorter term momentum clearly fades.

If Google’s move has you rethinking your exposure to digital platforms, it could be a good moment to scout other opportunities and discover fast growing stocks with high insider ownership

With earnings still growing and the share price lagging, analysts see meaningful upside to their valuation. The key question is whether this pullback marks a rare entry point into a dominant franchise, or whether the market is correctly discounting future growth.

Most Popular Narrative: 24.7% Undervalued

With REA Group last closing at A$183.45 against a narrative fair value of A$243.58, the valuation story leans optimistic and sets up a key growth driver.

The acceleration of digital transformation in property search and transactions, as illustrated by record traffic to realestate.com.au and the successful rollout of personalized, AI-driven listing experiences (such as NextGen listings), is likely to increase user engagement and premium product adoption, driving both higher ARPU and sustainable revenue growth.

Want to see why steady revenue growth, fatter margins, and a rich future earnings multiple still add up to upside here? The narrative’s numbers may surprise you.

Result: Fair Value of $243.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained regulatory pressure or a misstep in international expansion could hit pricing power and margins, challenging expectations for smooth EPS outperformance.

Find out about the key risks to this REA Group narrative.

Another Lens on Valuation

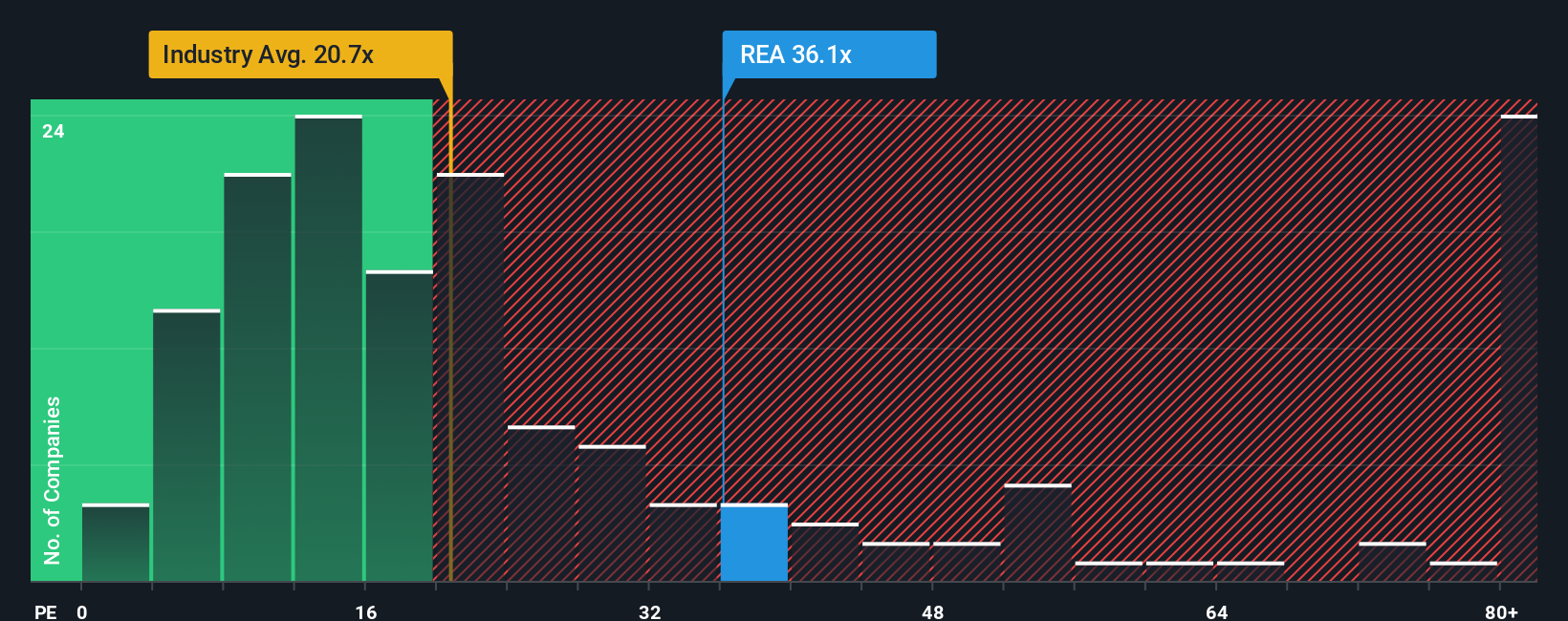

Step away from the narrative fair value and the numbers tell a tougher story. On a price to earnings basis, REA trades at 35.7 times, richer than the global sector on 20.4 times and not far below peers on 40.3 times, even though our fair ratio is 38.8 times.

That leaves a relatively narrow cushion between today’s valuation and where the market could reasonably move. This raises the risk that any disappointment on growth or regulatory outcomes hits the multiple before earnings can catch up. Are investors really being paid enough for that uncertainty?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own REA Group Narrative

If you want to dig into the numbers yourself and challenge the consensus view, you can build a fresh, personalized take in minutes, Do it your way

A great starting point for your REA Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next move?

Do not stop at one opportunity. Use the Simply Wall Street Screener to uncover fresh stocks and strategies that could sharpen your portfolio edge today.

- Boost your search for potential mispriced winners by screening for these 909 undervalued stocks based on cash flows where strong cash flow calculations suggest the market is still overlooking them.

- Explore the AI theme by targeting these 26 AI penny stocks that pair rapid innovation with scalable business models and accelerating revenue trends.

- Strengthen your income stream by focusing on these 13 dividend stocks with yields > 3% that combine solid balance sheets with reliable, above-market payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報