Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990): Valuation Check After Landmark Crescent Oncology Partnership

Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990) just locked in a wide ranging oncology partnership with Crescent Biopharma, featuring exclusive regional rights along with substantial upfront and milestone payments that could significantly influence its long term growth profile.

See our latest analysis for Sichuan Kelun-Biotech Biopharmaceutical.

The Crescent tie up lands after a powerful run, with a year to date share price return of 142.75 percent and a 1 year total shareholder return of 131.95 percent, even though the 3 month share price return of minus 20.27 percent shows momentum has cooled near HK$406.6.

If this oncology deal has you rethinking healthcare exposure, it could be a good moment to explore other potential compounders across healthcare stocks.

With shares still trading at a sizable discount to analyst targets despite rapid revenue growth and fresh partnership cash flows, investors now face a key question: is this a buying opportunity, or is future growth already priced in?

Price-to-Book of 17.1x: Is it justified?

On a price-to-book basis, Sichuan Kelun-Biotech Biopharmaceutical looks richly valued at HK$406.6 per share, trading well ahead of the broader Hong Kong biotechs pack.

The price-to-book ratio compares a company’s market value with its net assets, a common yardstick for asset heavy, early stage or loss making biopharmaceutical businesses where earnings are not yet a reliable guide.

For Kelun-Biotech, a 17.1x multiple indicates that investors are willing to pay a large premium to the company’s current book value, effectively front loading expectations for strong future growth and eventual profitability rather than current financial performance.

That premium stands out sharply against the Hong Kong biotechs industry average of 4.7x, suggesting the market is assigning Kelun-Biotech a leadership style valuation multiple that reflects significantly higher growth and commercial success than is assumed for its peers.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 17.1x (OVERVALUED)

However, clinical setbacks or slower than expected commercialization of its oncology pipeline could quickly deflate sentiment and challenge today’s premium valuation.

Find out about the key risks to this Sichuan Kelun-Biotech Biopharmaceutical narrative.

Another Take on Value

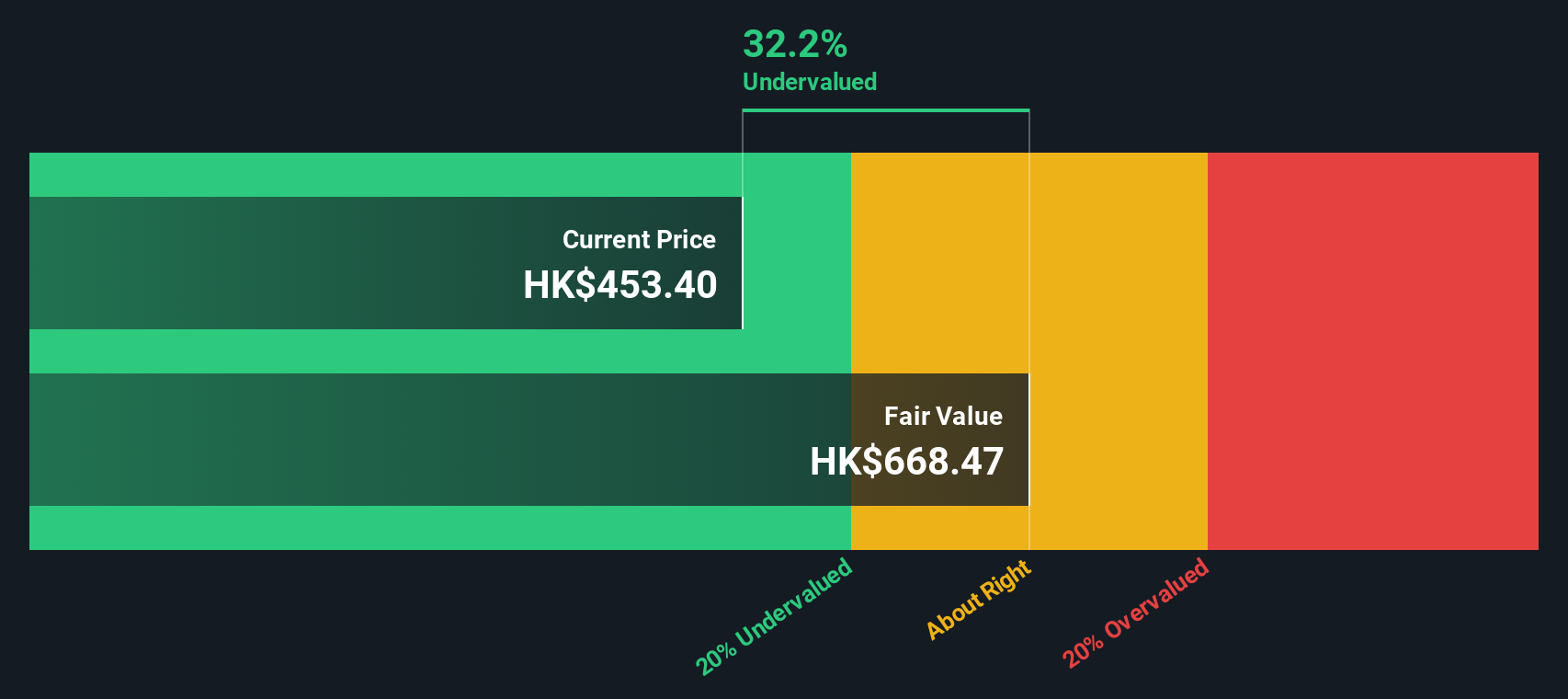

Our DCF model paints a very different picture, suggesting fair value around HK$656.65, roughly 38 percent above the current HK$406.6. If cash flows ultimately justify that gap, today’s steep book premium could still be an entry point. However, how much execution risk are you comfortable with?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sichuan Kelun-Biotech Biopharmaceutical for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sichuan Kelun-Biotech Biopharmaceutical Narrative

If you are not fully convinced by this view, or simply prefer hands on research, you can build a personalized narrative in just a few minutes at Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Sichuan Kelun-Biotech Biopharmaceutical.

Ready for more high conviction ideas?

Before you move on, consider locking in your next watchlist upgrades using focused stock screens that surface quality opportunities most investors overlook until it is too late.

- Identify potential multi baggers early by scanning these 3636 penny stocks with strong financials that already show stronger financial foundations than the typical speculative small cap.

- Explore the AI theme by targeting these 26 AI penny stocks positioned at the center of real world automation, data infrastructure, and intelligent software demand.

- Find value opportunities by filtering for these 909 undervalued stocks based on cash flows where prices still lag behind the strength of their underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報