Constellation Energy (CEG): Assessing Valuation After a Strong Multi‑Year Shareholder Return Run

Constellation Energy (CEG) has quietly been rewarding patient shareholders, with the stock up about 51% year to date and roughly 57% over the past year, handily beating the broader utilities space.

See our latest analysis for Constellation Energy.

That strength has not come out of nowhere, with a steady 30 day share price return of about 8 percent and a three year total shareholder return of roughly 328 percent pointing to investors repricing Constellation as a higher growth, lower risk utility play.

If this kind of momentum has your attention, it could be a good moment to see what else is moving by exploring fast growing stocks with high insider ownership.

With Constellation now trading near record highs yet still showing a double digit discount to analyst targets and our intrinsic value, investors face a crucial question: is there still upside left or is future growth already priced in?

Most Popular Narrative: 8.6% Undervalued

With the narrative fair value sitting meaningfully above the last close, the current share price implies investors still are not fully paying for Constellation Energy's projected cash flow power.

Strategic investments and progress in nuclear plant restarts (Crane Clean Energy Center), upgrades (900MW in engineering), and selective M&A (Calpine acquisition) provide visible avenues for substantial capacity additions and operational synergies, enhancing EBITDA and free cash flow over the medium to long term.

Curious how moderate top line growth, rising margins, and a richer future earnings multiple combine to support that higher value target? The full narrative breaks down the exact growth runway, profitability lift, and valuation bridge that underpin this pricing blueprint.

Result: Fair Value of $399.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors still need to watch for regulatory uncertainty around aging nuclear assets, as well as potential execution hiccups on large data center and M&A driven projects.

Find out about the key risks to this Constellation Energy narrative.

Another View: Market Multiple Sends a Caution Flag

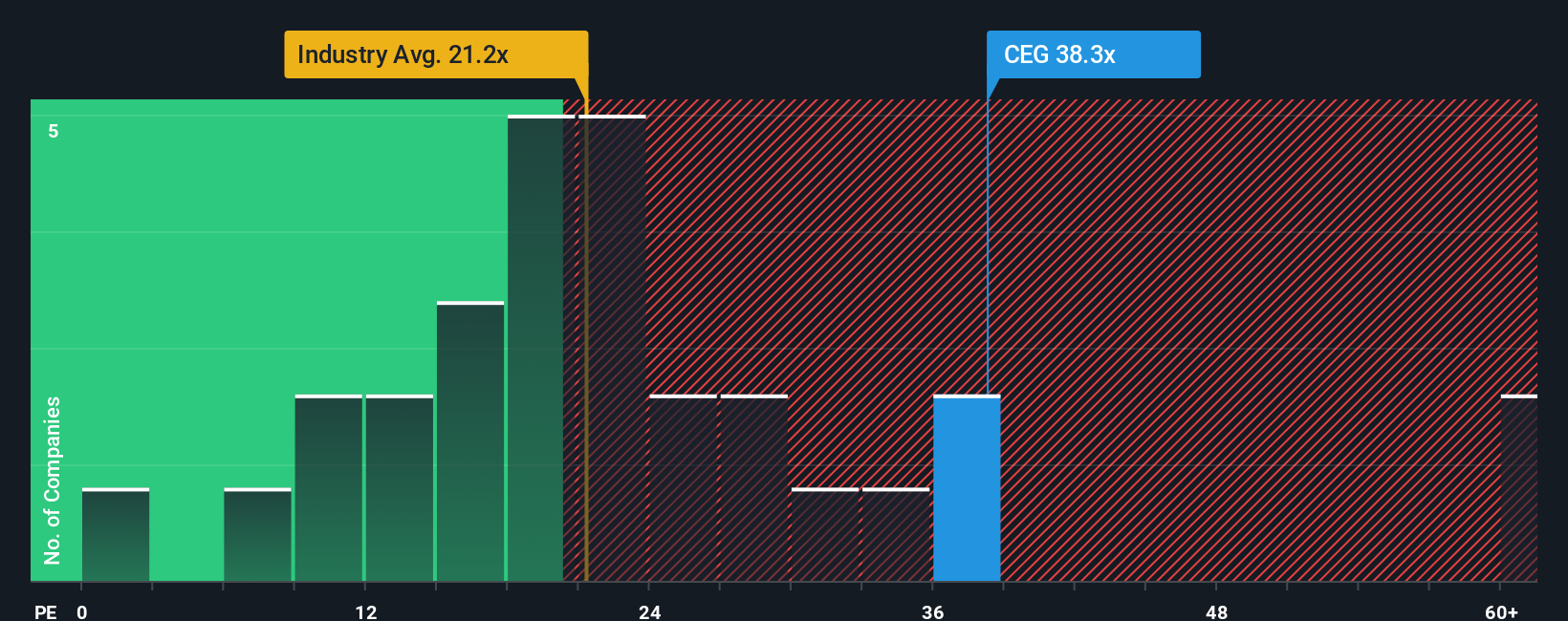

Market based clues tell a different story. Constellation trades on a steep 41.7 times earnings, roughly double the US electric utilities sector at 19.5 times and well above its 38.5 times fair ratio. This hints that enthusiasm could be outrunning fundamentals for now.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Constellation Energy Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a fully custom view in minutes: Do it your way.

A great starting point for your Constellation Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at a single opportunity when you can quickly scan robust ideas across sectors using the Simply Wall Street Screener tailored to your investing style.

- Capture powerful secular growth by reviewing these 26 AI penny stocks positioned to benefit from the accelerating adoption of automation, machine learning, and intelligent software.

- Lock in potential income streams by assessing these 13 dividend stocks with yields > 3% that combine attractive yields with the balance sheets needed to keep payments flowing.

- Strengthen your value hunt by scanning these 909 undervalued stocks based on cash flows where current prices may underestimate long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報