Is Flowers Foods Now an Opportunity After a 43.6% Share Price Decline?

- If you have been wondering whether Flowers Foods is starting to look like a bargain or a value trap, you are not alone. This breakdown will give you the context you need before making a move.

- Despite a rough longer term stretch, with the stock down 43.6% over the last year and 46.4% year to date, the recent 4.1% gain over the past week after a 3.2% dip in the last month hints that sentiment may be trying to find a floor.

- Recent coverage has focused on Flowers Foods as a defensive consumer staple facing shifting demand patterns and cost pressures, while management continues to lean on its strong brand portfolio and distribution network to navigate a tougher operating backdrop. Investors are watching how strategy updates around pricing, product mix, and efficiency can support margins and justify a re-rating from these depressed levels.

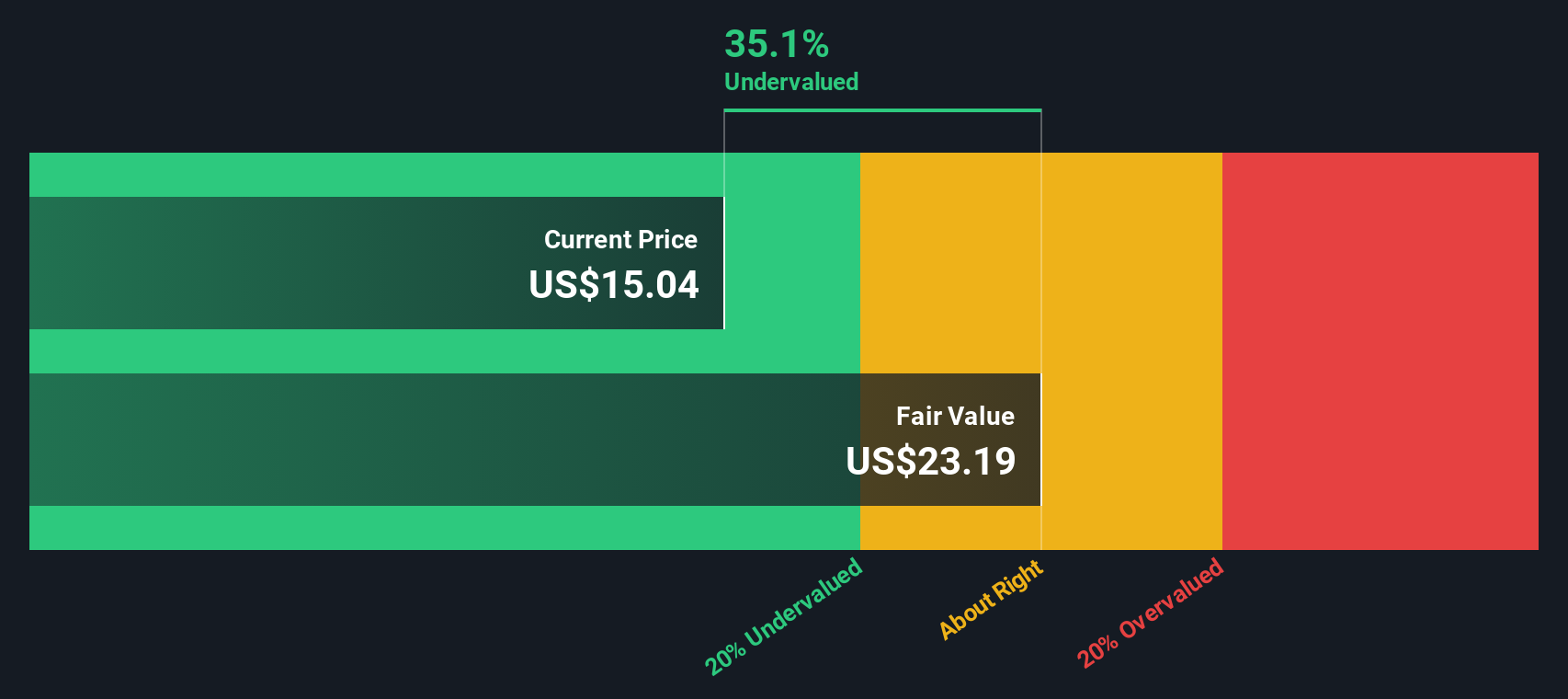

- On our checklist-based valuation framework, Flowers Foods scores a solid 5 out of 6 for being undervalued. This sets the stage for a closer look at discounted cash flow, multiples, and other methods, and then an even more intuitive way to think about valuation that we will get to at the end of this article.

Find out why Flowers Foods's -43.6% return over the last year is lagging behind its peers.

Approach 1: Flowers Foods Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and discounting them back to today in dollar terms. For Flowers Foods, the model starts with last twelve month Free Cash Flow of about $314 million and then uses analyst forecasts for the next few years. Simply Wall St then extrapolates further out to build a 2 Stage Free Cash Flow to Equity profile.

On this basis, Flowers Foods is expected to generate around $210 million in annual Free Cash Flow by 2035, with the interim years showing a modestly declining then stabilizing cash flow path rather than aggressive growth. Aggregating and discounting these future cash flows results in an intrinsic value estimate of roughly $20.71 per share.

Compared with the current share price, this implies the stock is about 46.8% undervalued, suggesting a wide margin of safety if the cash flow assumptions prove broadly accurate and the business maintains its underlying economics.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Flowers Foods is undervalued by 46.8%. Track this in your watchlist or portfolio, or discover 909 more undervalued stocks based on cash flows.

Approach 2: Flowers Foods Price vs Earnings

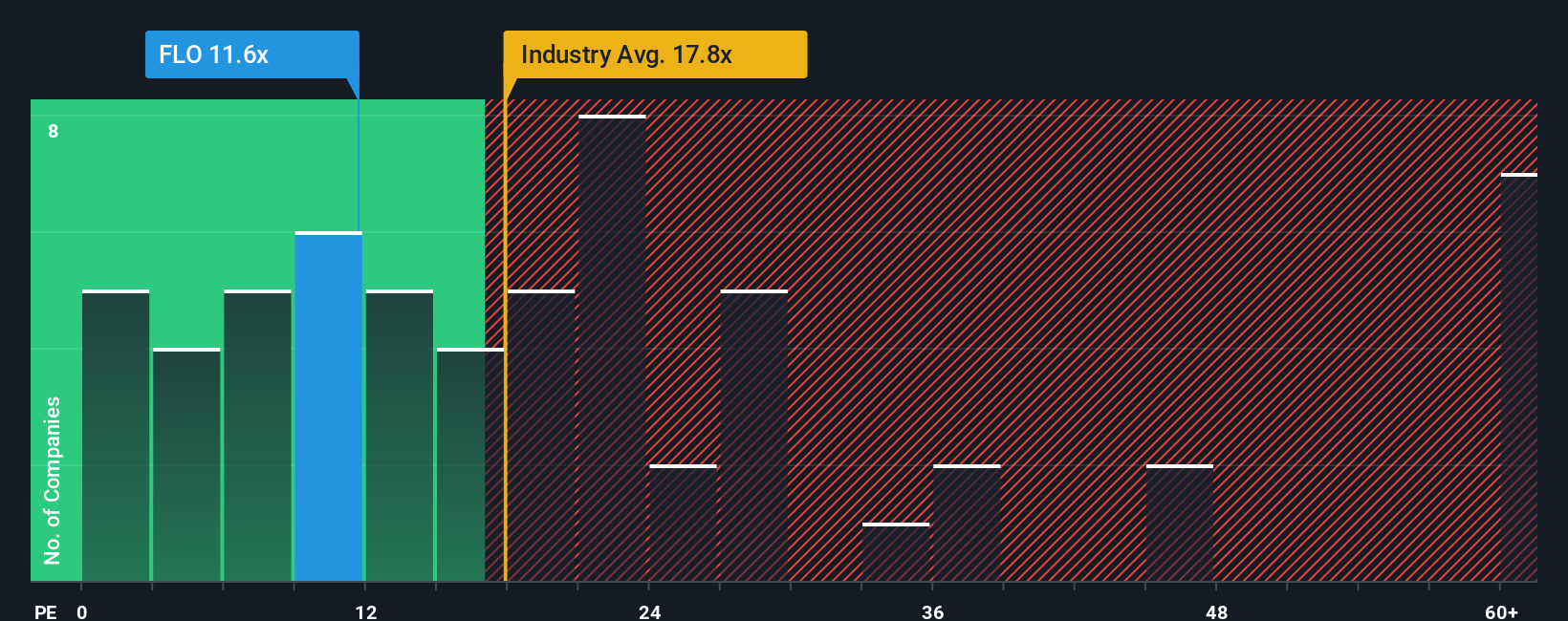

For consistently profitable companies like Flowers Foods, the price to earnings, or PE, ratio is a useful way to gauge how much investors are paying for each dollar of current earnings. In general, businesses with stronger growth prospects and lower perceived risk tend to justify higher PE ratios, while slower growth and higher uncertainty usually warrant a lower multiple.

Flowers Foods currently trades at about 12.0x earnings, which sits well below the broader Food industry average of around 19.9x and also under the peer group average of roughly 16.9x. Simply Wall St’s proprietary Fair Ratio model goes a step further by estimating what a more suitable PE might be, based on the company’s earnings growth outlook, profitability, size, risk profile, and industry context. For Flowers Foods, this Fair Ratio comes out at about 13.3x.

Because this Fair Ratio is tailored to Flowers Foods’ specific characteristics rather than broad peer comparisons, it offers a more nuanced anchor for valuation. With the current 12.0x PE sitting below the 13.3x Fair Ratio, the stock screens as modestly undervalued on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Flowers Foods Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which are simple, story driven explanations of why you think a company like Flowers Foods should be worth a certain amount in the future, based on your assumptions for revenue, earnings and margins, and how those translate into a fair value per share. On Simply Wall St’s Community page, millions of investors use Narratives to connect a company’s story to a concrete financial forecast and then to a fair value, making it easier to compare that fair value to the current share price and decide whether they see Flowers Foods as a buy, hold or sell. Because Narratives update dynamically when new information such as earnings, guidance or news is released, they stay relevant and reflect changing views. For example, one Flowers Foods Narrative might see fair value at about $12.71 with modest growth and margin pressure, while another more optimistic view might see fair value closer to $16.12 based on stronger growth, better margins and a higher future PE multiple.

Do you think there's more to the story for Flowers Foods? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報