Strong Q3 Beat and Guidance Upside Might Change The Case For Investing In Collegium Pharmaceutical (COLL)

- In the past quarter, Collegium Pharmaceutical reported a strong Q3, with revenue rising 31.4% year on year and topping analyst expectations by 10.7%, driven by its differentiated pain management medicines.

- The company also exceeded its full-year revenue guidance, signaling operational strength that reinforces its focus on specialty products for chronic pain.

- With Q3 revenue surpassing expectations by 10.7%, we’ll now examine how this performance influences Collegium’s existing investment narrative and outlook.

We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Collegium Pharmaceutical Investment Narrative Recap

To own Collegium, you need to believe its differentiated pain and ADHD portfolio can offset looming patent cliffs and regulatory pressure on opioids. The latest Q3 beat and raised revenue guidance support the near term earnings catalyst by showing pricing and volume resilience, but they do not eliminate the longer term risk from generic competition and payer pressure.

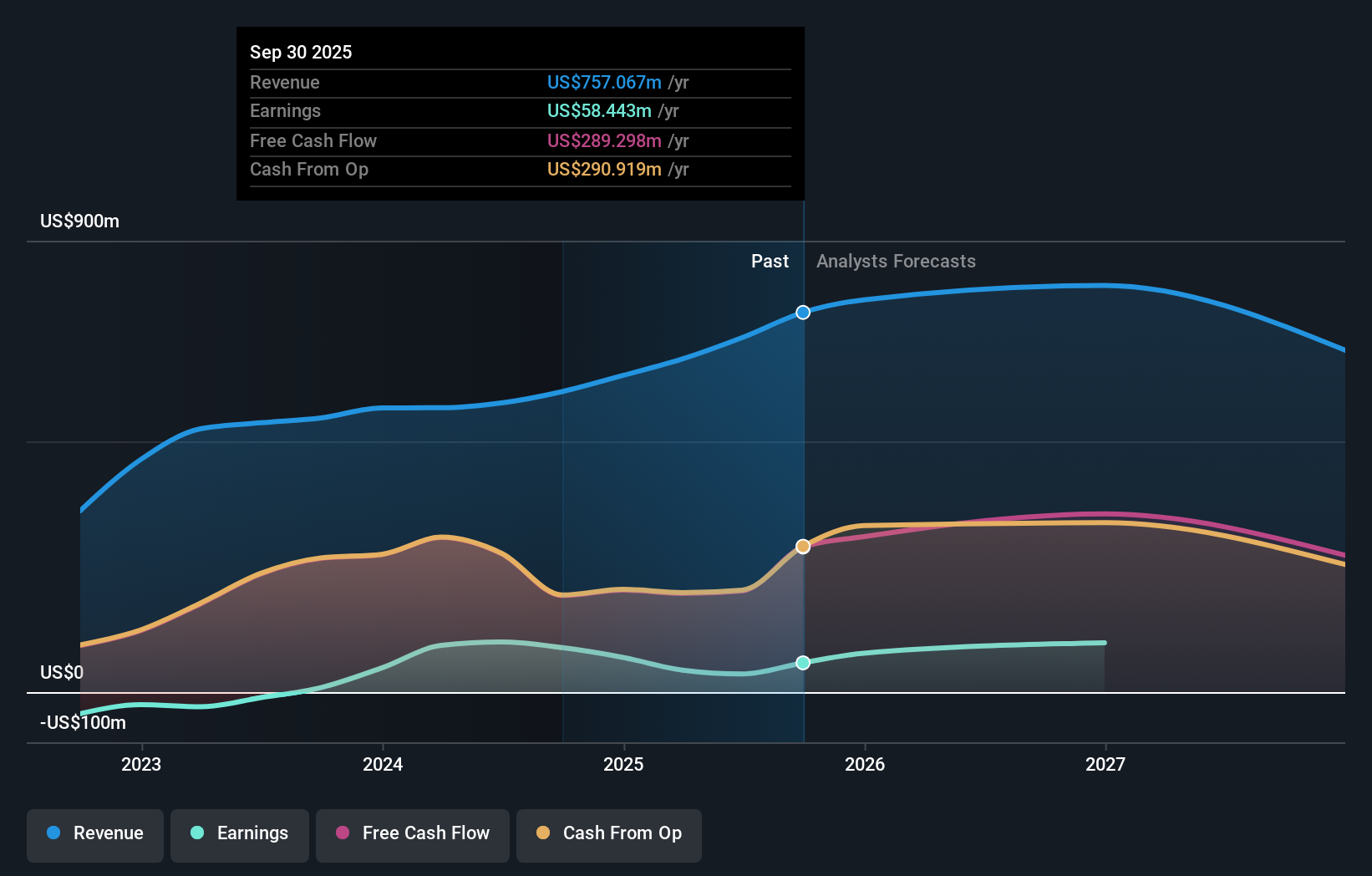

The most relevant recent announcement is Collegium’s decision to raise full year 2025 net product revenue guidance to US$775 million to US$785 million, following the strong Q3. This ties directly to the core catalyst of sustained earnings growth from its specialty pain and ADHD products, while putting a brighter spotlight on whether future operating expenses and patent expiries will allow that momentum to continue.

However, investors should also be aware of the risk that rising payer demands and future generic competition could...

Read the full narrative on Collegium Pharmaceutical (it's free!)

Collegium Pharmaceutical's narrative projects $695.3 million revenue and $131.4 million earnings by 2028.

Uncover how Collegium Pharmaceutical's forecasts yield a $46.80 fair value, a 4% downside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for Collegium span roughly US$47 to US$151 per share, showing just how far opinions can stretch. When you set that against the company’s dependence on a concentrated pain portfolio facing eventual patent expiry, it becomes even more important to weigh several different viewpoints before deciding what the recent Q3 beat really means for future performance.

Explore 3 other fair value estimates on Collegium Pharmaceutical - why the stock might be worth just $46.80!

Build Your Own Collegium Pharmaceutical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Collegium Pharmaceutical research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Collegium Pharmaceutical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Collegium Pharmaceutical's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報