Occidental Petroleum (OXY): Rethinking Valuation After Recent Share Price Weakness

Occidental Petroleum (OXY) has been grinding lower, with the stock down about 9% over the past month and roughly 18% over the past 3 months, inviting a closer look at valuation and expectations.

See our latest analysis for Occidental Petroleum.

That slide comes after a choppy year, where the share price has delivered a weak year to date return and a negative one year total shareholder return. This suggests momentum has faded as the market reassesses energy price risks and Occidental Petroleum’s growth outlook.

If you are rethinking your exposure to traditional energy, this could be a good moment to explore how other parts of the market are behaving, starting with aerospace and defense stocks.

With shares now trading at a steep discount to analyst targets and our intrinsic value estimate, but against a backdrop of falling revenue and weak momentum, is Occidental emerging as a contrarian buy or simply fairly priced for slower growth?

Most Popular Narrative: 22.3% Undervalued

With Occidental Petroleum closing at $38.92 versus a narrative fair value near $50.08, the valuation case leans positive but rests on specific long term assumptions.

The analysts have a consensus price target of $50.652 for Occidental Petroleum based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $64.0, and the most bearish reporting a price target of just $40.0.

Want to see what really sits behind that valuation gap? The story hinges on shifting margins, reshaped earnings power, and a bolder future profit multiple. Curious how those pieces fit together and why the discount rate still supports upside? Read on to unpack the assumptions driving this fair value call.

Result: Fair Value of $50.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside story could unravel if oil prices weaken faster than expected or if carbon capture projects fail to scale economically.

Find out about the key risks to this Occidental Petroleum narrative.

Another View: Multiples Paint a Tougher Picture

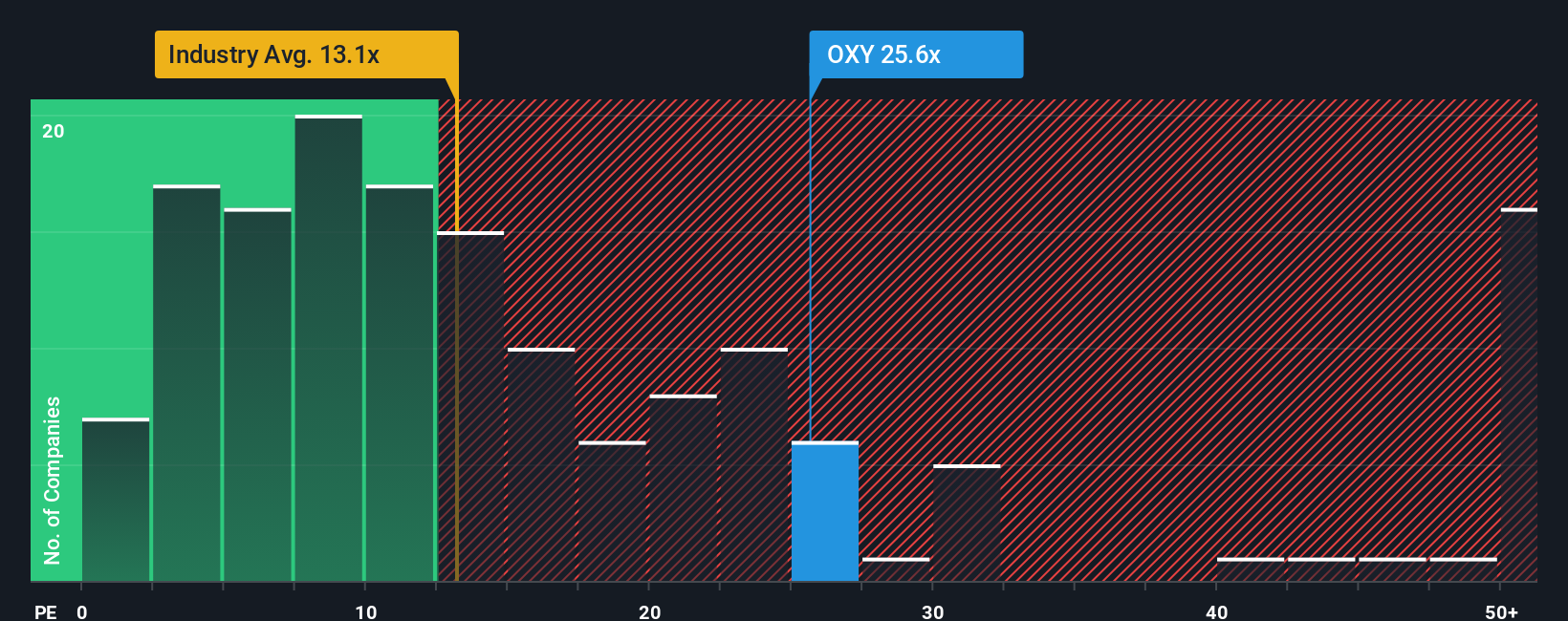

On earnings, Occidental screens far less generous. Its price to earnings ratio sits around 26.3 times, versus a fair ratio of 19.9 times, a 24 times peer average and roughly 12.8 times for the wider US oil and gas group. That premium challenges the simple undervalued story, or it may instead reflect confidence in Oxy’s transition plans.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Occidental Petroleum Narrative

If this perspective does not quite match your own, dive into the numbers yourself and build a fresh view in minutes: Do it your way.

A great starting point for your Occidental Petroleum research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, explore your next opportunity by scanning fresh stock ideas on Simply Wall Street that could complement or even outperform your Occidental position.

- Look for potential mispricings by targeting companies trading below their estimated cash flow value through these 909 undervalued stocks based on cash flows and position yourself ahead of any possible re rating.

- Focus on early stage companies in breakthrough technologies using these 3636 penny stocks with strong financials and consider how they might fit your view on innovation.

- Filter for companies with a history of regular dividend payments via these 13 dividend stocks with yields > 3% and assess whether their income profiles align with your portfolio goals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報